As we finally approach the last chapter of 2025, the month of December, investors cannot seem to help but wonder whether the closing chapter of 2025 will help them deliver worthwhile gains. As markets have now started to show a downward trajectory, will historic December highs apply to this year as well?

Also Read: Markets in Panic: Is This the Long-Awaited Crypto Winter or Just a Dip Now?

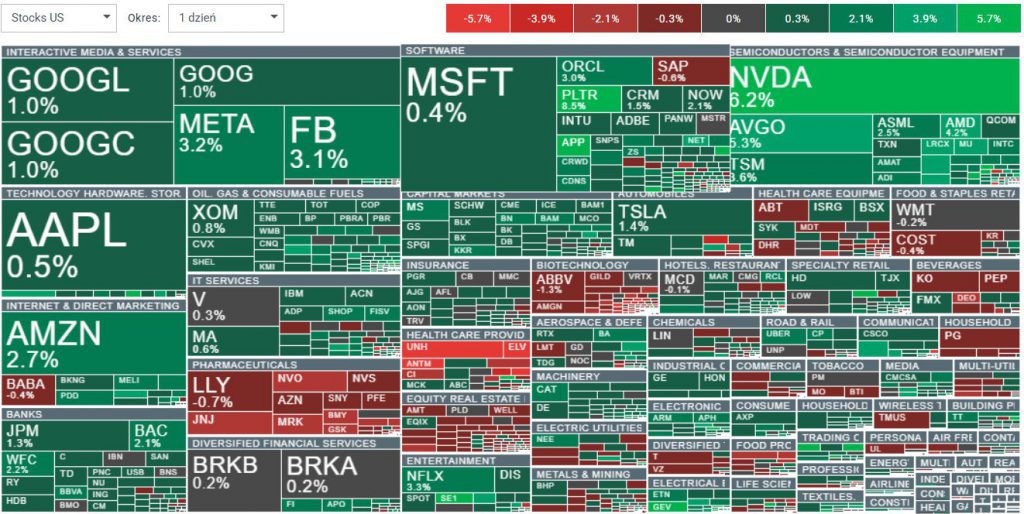

US Markets: Bullish December Calls Gain Momentum

According to a latest post by the Kobeissi Letter, US markets are now hoping to have a stellar December, as historic data often signals December to be the best month for the stock market rallies. Per the KL post, December has been a strong month for stock markets in general. The KL post adds how the S&P 500 has delivered nearly 73% gains in December since 1928. Moreover, only 26 out of 97 years have faced negative returns. The markets are now once again anticipating a bullish December, resulting in stunning gains for their investors.

“December is a historically strong month for stocks. Since 1928, the S&P 500 has risen 73.2% of the time in December, the highest win rate of any month. In other words, only 26 of the last 97 years have seen negative returns. Over this period, the index has returned an average gain of +1.28%. Since 1945, the S&P 500 has gained +1.50% in December on average. Record highs may be on the horizon.”

Risk Trading Is At An All-Time High

According to another leading post by the Kobeissi letter, investors’ appetite for exploring risk assets has been incredibly strong. Per the KL post, options trading is volume in loss-making; Russell 2000 stocks have risen to 6 million contracts a day, signaling new interest.

“Appetite for risk is incredibly strong. Options trading volumes in loss-making Russell 2000 stocks have risen to ~6 million contracts per day, an all-time high. Volumes have more than doubled since April and surpassed the previous record set during the 2021 meme-stock mania. By comparison, options activity in profitable stocks is only 33% as large. Market activity is also becoming more concentrated, with the top 20% of small-cap stocks by options volume now reflecting 75% of small-cap options trading.”

Also Read: US Markets: Americans Haven’t Feared Job Loss This Much Since 1980