There is no denying that the United States is enveloped in a concerning reality from an economic standpoint. Despite America-first policies, the country has seen its financial markets struggle to start the year. Among them are digital assets, as US President Trump’s first 100 days have seen the crypto market value plummet by $520 billion.

Trump has sought to enact a total reversal of the nation’s cryptocurrency policy. However, that has yet to impact prices. Although it has increased the potential of the asset class, the favorable regulation trends have yet to manifest into significant gains. To this point, the macroeconomic realities have only driven value from the industry.

Also Read: Trump’s Tariff Shock: How Brazil, Argentina & Uruguay May Cash In

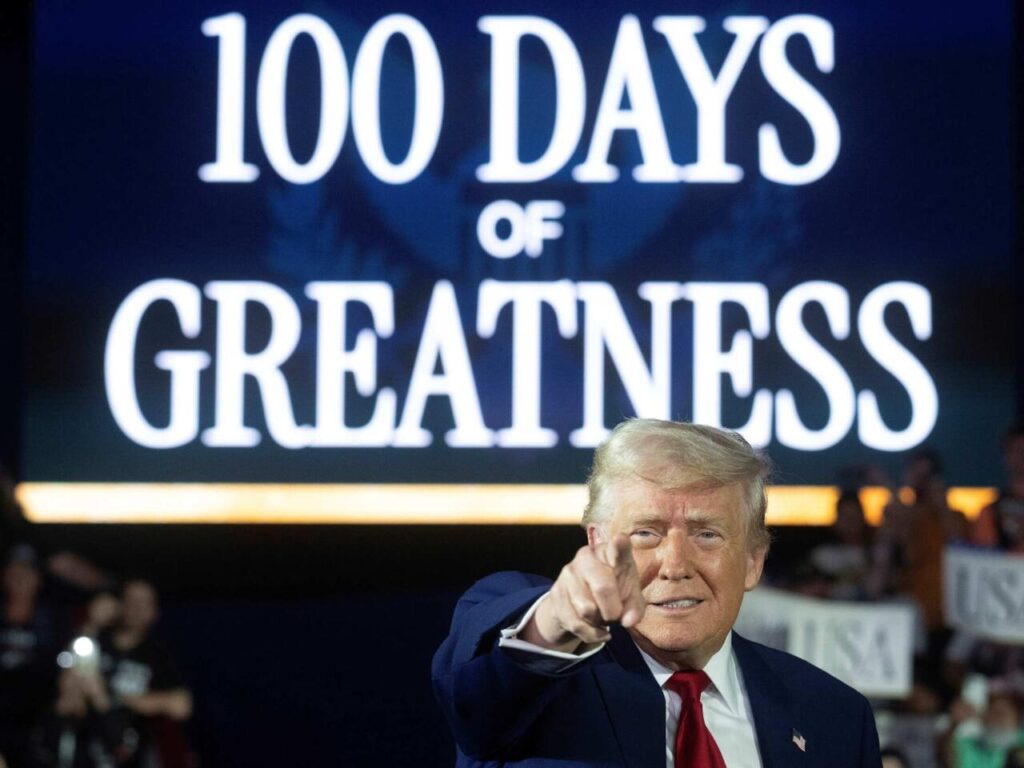

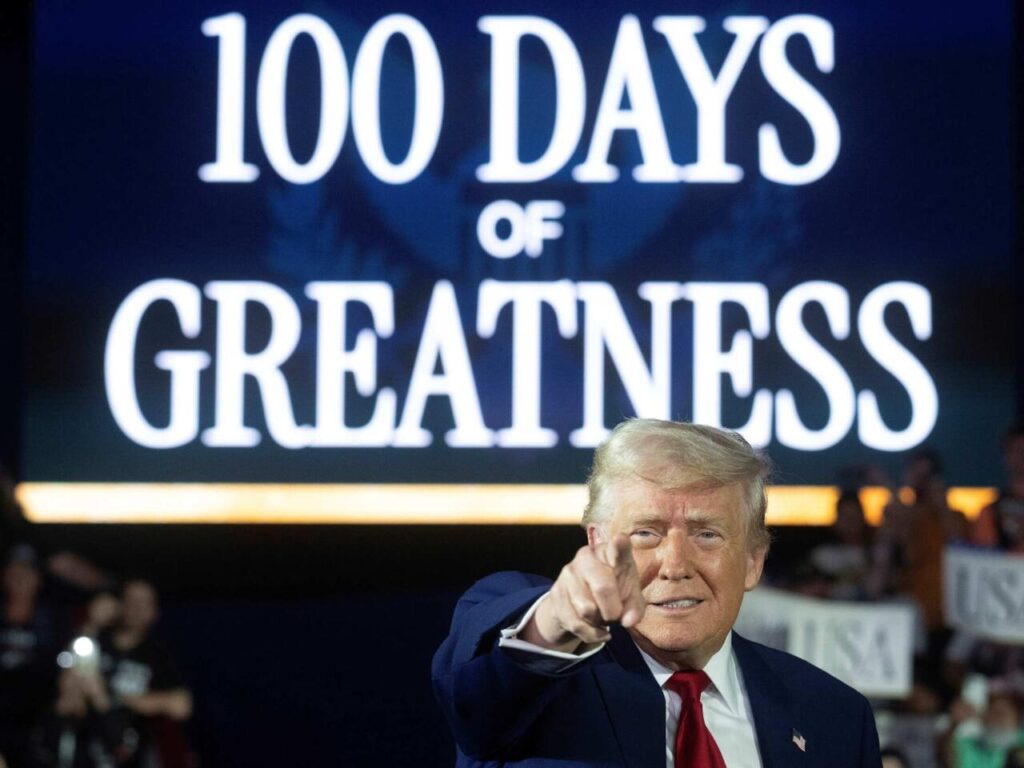

President Trump’s 100 Days Wreak Havoc on Crypto Market

The return of US President Donald Trump has brought with it tremendous optimism for the country’s financial standing. The US stock market and cryptocurrency sector were expected to shift upward. Moreover, with an unprecedented 140 executive orders, he wielded near-unprecedented power to tackle any issue he deemed necessary.

Yet, that has not been able to propel the digital asset industry to this point. Indeed, US President Trump’s first 100 days have seen the crypto market value drop by an astounding $520 billion. Although he is seeking to reshape policy, it has not equated to upward price momentum for the sector.

Also Read: 12 States Sue Trump Over ‘Illegal’ Tariff Chaos: What’s at Stake

According to a report from Finbold, the crypto market had a total value of $3.49 trillion on January 20th. As of April 29th, the 100-day mark, that figure dropped to $2.97 trillion. Since then, that figure has returned above the $3 trillion mark, although concerns persist

The country is in an increasingly vulnerable economic position. With its first contraction taking place in three years, there are justified worries. Moreover, the country is positioning itself in a brewing trade war with China and increasing tariff conflicts with a host of nations. To this point, cryptocurrencies are just one of the sectors affected.