Warren Buffet, the king of investment and finance, is an idolized figure for many investment folks in trading and finance.

Buffett’s trading moves are closely documented, with traders doing their best to imitate and follow his trading trail. In a recent move, Berkshire Hathaway’s CEO was noted for dumping Apple shares and exploring a new oil stock. Here’s more detail on this new precious US stock.

Also Read: Ripple: Bitwise Filing Ignites XRP’s Bullish Potential, Data Shows

Warren Buffet Dumps Apple

Buffett has dumped Apple stocks in a new move, sending ripples of surprise across the investment market. Buffett’s new filing indicates how Hathaway Berkshire’s CEO has sold nearly half of HB’s Apple stock, raising nearly $80 billion in cash.

There were many speculations about Buffett’s stark move to dump Apple stocks. Apple has always been labeled a robust company, with its share price rising as the company fosters innovation and keeps unveiling new products, including the iPhone and tablets.

However, the firm’s revenue status, on the contrary, has been quite bearish and stagnant, compelling investors to pivot and seek out other lucrative stocks. Apple is noting stiff smartphone competition, with elements like saturation and stagnation gnawing at its core. The company struggles to bring innovations, pushing its revenue to fall flat on investors’ expectations.

Per The Motley Fool, Apple’s P/E ratio currently stands at 35, labeled as “wildly expensive for a low-growth stock.”

Also Read: JP Morgan Alert: Gold & Bitcoin Surge as Debasement Trade Heats Up

Buffett’s New Oil Stock Fund

In the middle of this, Buffett has found a new oil asset, promising lucrative returns. Dubbed Occidental Petroleum, Berkshire Hathaway has shown significant interest in the particular stock by owning a staggering 27% of Occidental’s shares.

One of the primary reasons for Buffett’s huge interest in the stock would be its categorization. Oil and gas stocks are a “redundant” category, making them a worthy find in the long haul. At the same time, Occidental’s P/E ratio stands at 12.5. This metric makes OXY an undervalued stock to explore and keep an eye on.

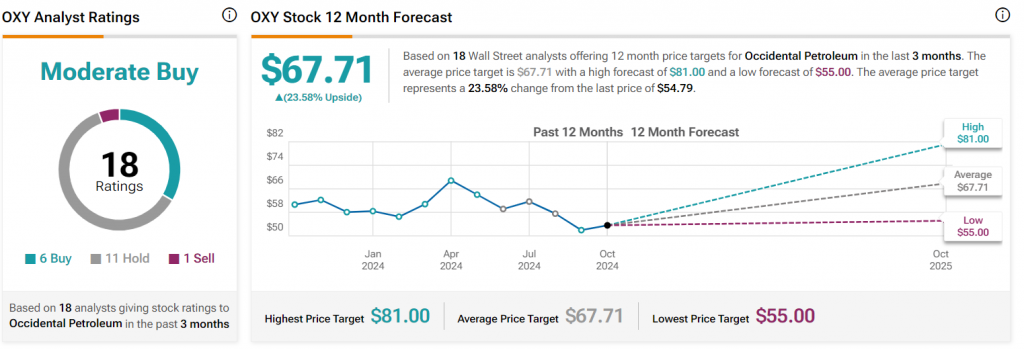

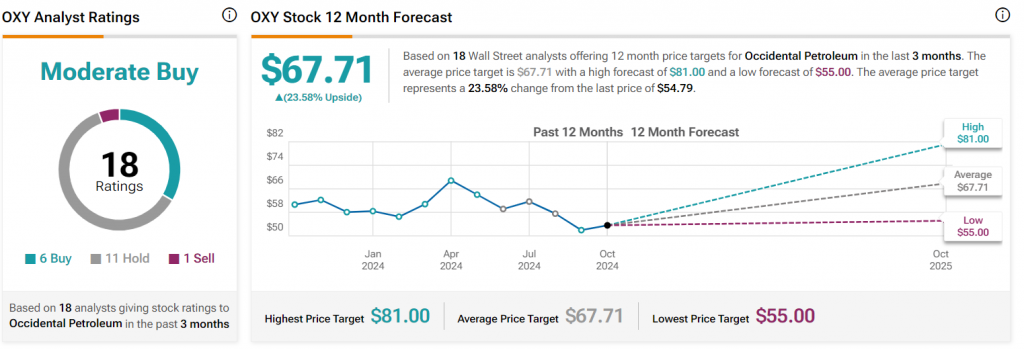

Per TipRanks, Occidental stocks can spike to hit $80 in the next 12 months. Six Wall Street analysts are issuing a buy call, while 11 analysts suggest holding the stock for the long haul.

“Based on 18 Wall Street analysts offering 12-month price targets for Occidental Petroleum in the last 3 months. The average price target is $67.71 with a high prediction of $81.00 and a low forecast of $55.00.

Also Read: Shiba Inu: Here’s How To Be A Millionaire With SHIB By 2028