The US stock domain has always been quite energetic and electrifying to tinker with. While most traders often pivot to robust stocks like Nvidia or the Magnificent Seven in general, one new stock is catching people’s eyes and has the potential to outpace the aforementioned market dominators.

Also Read: Ripple: XRP May Replicate Its 2017-18 Bullish Run, Analyst Says

New Stock Alert: GoDaddy

Per investors, GoDaddy has emerged as the latest stock scion, reporting stellar earnings metrics in the past 12 months. These earnings have reportedly outpaced the magnificent seven’s revenue and are on the verge of printing another bullish breakout of the year.

The outlet shared how GoDaddy has steadily been rising high on the stock radar and recently topped the list of new buys by the best mutual funds. The portal streamlined another milestone, claiming 120 funds now own GoDaddy with an impressive A+ rating.

GoDaddy has noted stellar straight quarters and rising fund ownership per the IBD Stock Checkup. The firm’s earnings have soared incredibly since November 2023, as it delivered gains of up to 123%.

With a positive entry point of $164, GoDaddy stocks are playing high ground, with chances of hitting a bull run soon.

Also Read: Bitcoin’s Meteoric Rise: EU Central Bank Issues Urgent Warning

TipRanks Forecast

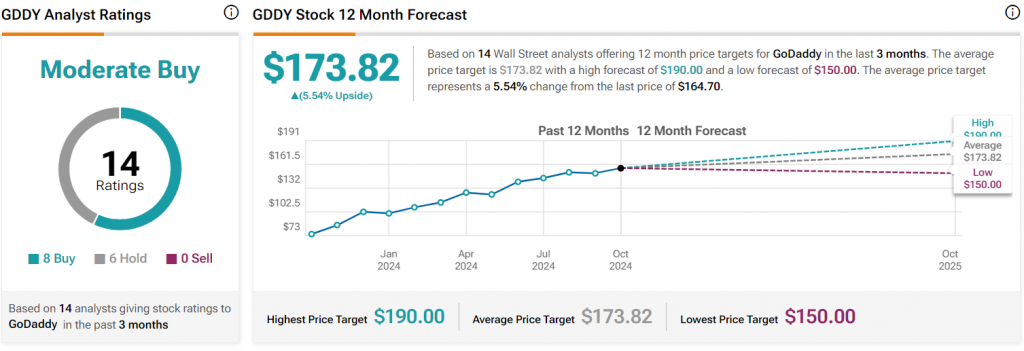

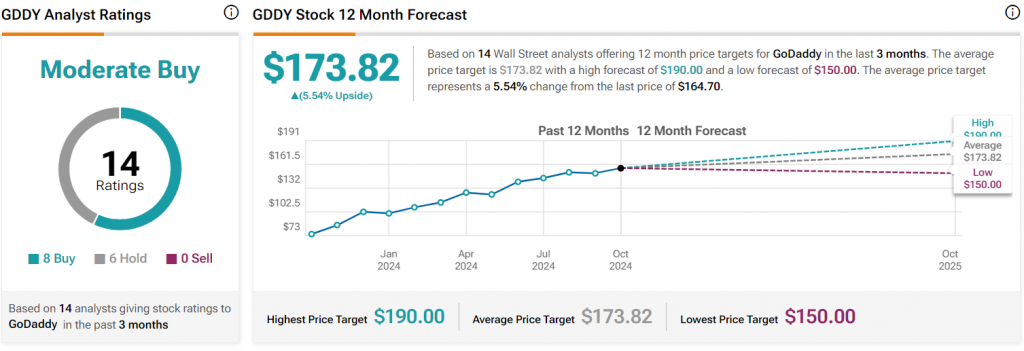

Per TipRanks, GoDaddy can reach a high of $190 in the next 12 months. Wall Street analysts have issued a moderate buy call to encourage its price momentum.

“Based on 14 Wall Street analysts offering 12-month price targets for GoDaddy in the last 3 months. The average price target is $173.82 with a high forecast of $190.00 and a low forecast of $150.00. The average price target represents a 5.54% change from the last price of $164.70. GoDaddy’s analyst rating consensus is a moderate buy. This is based on the ratings of 14 Wall Street analysts.”

Also Read: Solana Outperforms Bitcoin & Ethereum: Will SOL Hit $200?