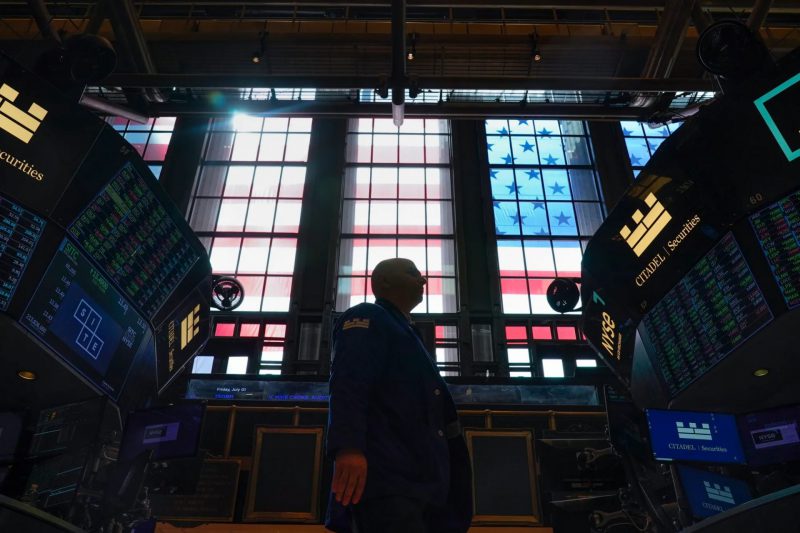

There is no shortage of uncertainty facing the United States economy. President Donald Trump has engaged in a rather concerning economic policy that has the world preparing for a trade war. Yet, with the US stock market facing increased pressure, which was hit the hardest by Trump’s incoming tariff plan?

The cryptocurrency market was pummeled after the import tax was levied Saturday. Overall, the sector saw $2.3 billion in liquidations take place. For much of January, Wall Street was increasingly volatile due to the unknowns of the incoming administration’s economic policy. Yet, experts weigh in on who may have had the toughest time.

Also Read: Apple (AAPL) Stock in Tariff Trouble? Here’s What Bank of America Says

US Stock Market Reeling From Trump Tariff Plan: Who Was Most Affected?

On the campaign trail last year, Donald Trump was clear about his goals for tariffs. He was targeting BRICS nations, who had sought to threaten the US dollar’s position as the world’s currency. In the early days of his presidency, he has expanded those threats. Now, the 47th president has imposed an increased importer tax on Mexico, Canada, and China. Moreover, all of them have issued retaliatory economic policies.

Early Monday, Mexican President Claudia Sheinbaum announced those tariffs would be delayed. Now set back by a month, there is hopefully time for resolution. However, the US stock market may be set to struggle, with experts discussing who was impacted the most by Trump’s tariff plan.

Also Read: Nvidia’s $600B Stock Crash: How DeepSeek’s AI Breakthrough Shook the Market

Monday morning, board indexes fell, with the S&P 500 plummeting 1.5%, according to Forbes. Moreover, the Dow Jones and Nasdaq had fallen 1.1% and 1.9%, respectively. Among American powerhouse stocks, Apple (AAPL), Nvidia (NVDA), and Tesla (TSLA) fell the most, dropping 7%, 4%, and 2%, respectively.

Experts believe that American car companies are set to be the hardest hit. Ford dropped 5% and fell alongside General Motors and Jeep’s parent company, Stellantis, on Monday. These companies rely on Canadian and Mexican imports for their operations. Therefore, when the tariff returns, they should be hit the hardest.

Additionally, crypto-related platforms stumbled on Monday. MicroStrategy began by losing 8% but rebounded when the tariff was delayed. Additionally, Coinbase, Robinhood, and Marathon Digital were all down Monday.