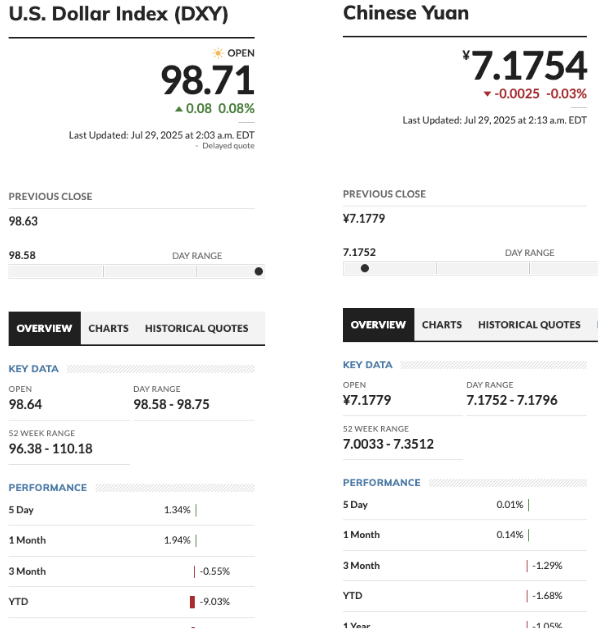

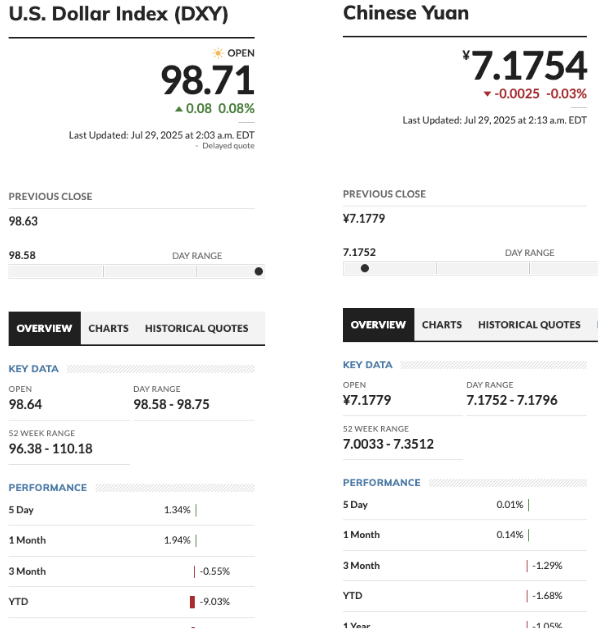

According to US dollar data from Market Watch, it has fallen 9.03% year-to-date. The Chinese yuan, on the other hand, has dipped by 1.68% year-to-date. The rapid decline of the dollar’s value has led to much concern among traders, investors, and economists. The USD’s lackluster performance has also reignited de-dollarization dreams.

Yuan Gains On The USD As De-Dollarization Advances

According to a report cited by the South China Morning Post, the yuan internationalization index rose by 11% in 2024 to 6.06. The US dollar, on the other hand, got a score of 51.13 in 2024, down from 51.52 the previous year. Meanwhile, the euro fell 3.8% to 24.07 on the same index. The internationalization index measures a currency’s global use. The data alligns with the growing position of the Chinese yuan.

According to the report, “Promoting the yuan’s internationalisation and leveraging it to push for reform of the global monetary system is a key strategy to mitigate geoeconomic risks.“

The move away from the US dollar is being increasingly explored as a risk-deterent by many central banks. According to BlackRock, central banks are moving to other assets to diversify beyond the dollar.

One of the most significant threats to the US dollar’s dominance in global trade is the growing US debt. Many experts have called for immediate caution around the US debt. In a letter to shareholders, BlackRock CEO Larry Fink also shed light on the US debt. Fink believes that the dollar’s position as the global reserve currency may not last forever. The dollar could be eclipsed by other currencies, or even by digital currencies like Bitcoin (BTC).

Stablecoins To The Rescue?

Stablecoins have seen a massive surge in adoption over the last few years. The US recently passed legislation to bring more clarity to the stablecoin arena. USD-pegged stablecoins could be the answer to de-dollarization. According to former Chinese central bank chief Zhou Xiaochuan, stablecoins could lead to rapid “dollarization.”

Also Read: $400B China Fund Launches First Yuan Token in De-Dollarization Push

USD-backed stablecoins may lead to more confidence in the US dollar. While other nations are exploring blockchain-based currencies, a dollar-based stablecoin system could be the way forward.