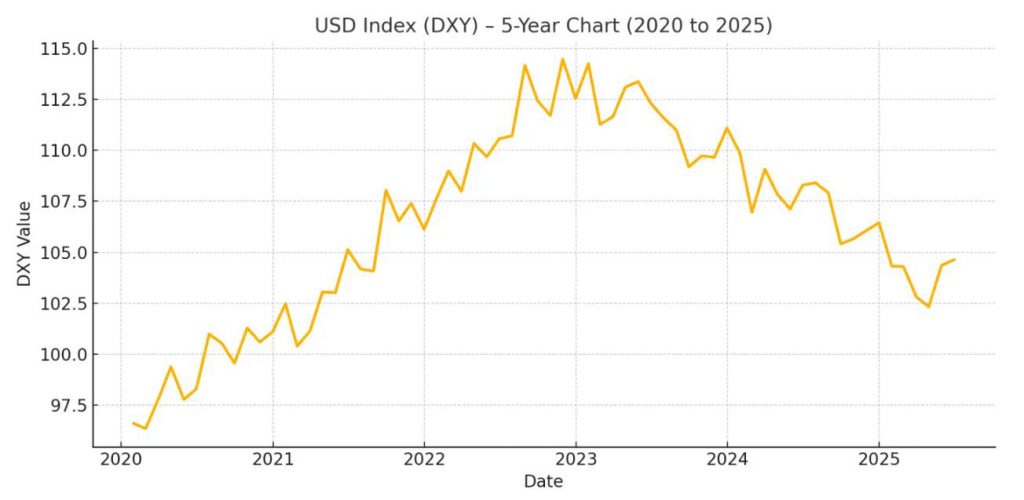

The USD prediction for 2025 has become one of the most watched topics in currency markets right now, and for good reason. The greenback is down roughly 10% year-to-date, trading near 98.0 on the DXY index after falling from highs above 114 in previous years. The dollar forecast for the next 6 months points to continued pressure from Federal Reserve rate cuts and also capital outflows, with most analysts projecting a range between 95-98 through year-end. At the time of writing, the US dollar forecast today reflects mixed signals—technical support is holding around 96.60 but fundamental headwinds from policy uncertainty and investor rotation into alternative assets are creating downward pressure on the currency.

Also Read: US Markets: What’s Next for US Dollar, Gold, Silver, and Platinum?

Dollar Forecast, Market Trends, Fed Moves, and Investment Insights

The Dollar’s Steepest Decline in Years

The US dollar index has posted its sharpest drop in over three years, and the numbers tell a pretty stark story. Against a basket of major currencies, the greenback fell approximately 10.7% in just the first half of the year alone. Right now, investors are pulling capital out of dollar assets at the fastest pace since 2005, according to Bank of America survey data that the firm recently released. Investors are moving money into gold, eurozone equities, the Swiss franc, and also emerging market bonds.

Barry Eichengreen, economist at UC Berkeley, had this to say:

“Uncertainty is kryptonite for currencies.”

Policy inconsistencies and regulatory reversals have rattled investor confidence, and the dollar forecast for the next 6 months reflects this ongoing volatility that’s been building. The Fed expects to deliver somewhere between 2 and 3 rate cuts by year-end, though recent GDP revisions and inflation that’s proven stickier than anticipated have reduced the probability of aggressive easing measures.

Source: Federal Reserve Economic Data

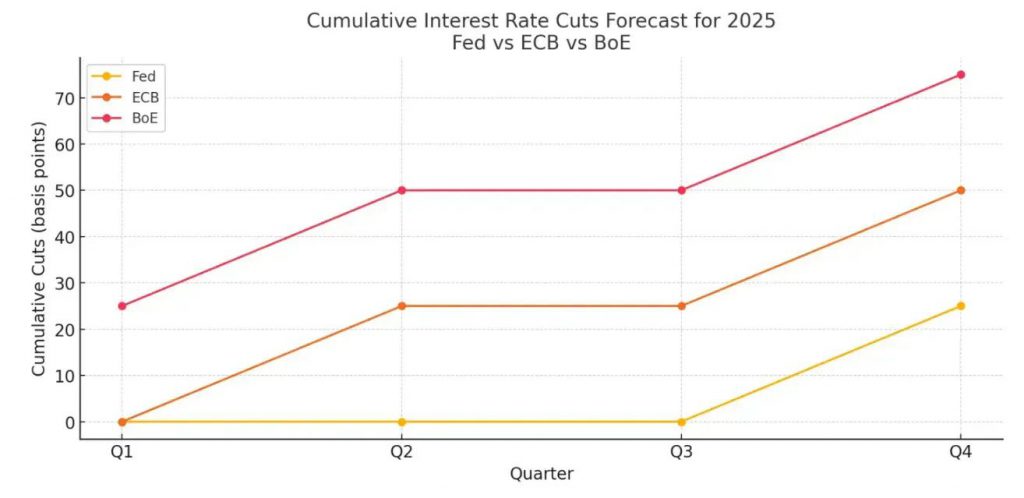

The USD prediction for 2025 from most major banks suggests that short-term softness will continue, especially if the Fed follows through with multiple cuts. Interest rate divergence is playing a role here too—the ECB projects to cut rates by 0.50% total, while the Bank of England may implement 0.75% in total cuts. Meanwhile, the Bank of Japan is moving in the opposite direction entirely, with potential rate hikes of roughly 47 basis points on the horizon.

Source: Goldman Sachs Global Banking & Markets

Goldman Sachs Reveals Unprecedented Market Setup

The US dollar outlook from Goldman Sachs has identified something remarkable happening right now—bearish dollar sentiment is running alongside bullish equity views, which is an unusual combination.

Oscar Ostlund, global head of content strategy, market analytics & data science for Marquee in Goldman Sachs Global Banking & Markets, stated:

“One of the most important paradigm shifts over the last couple of months has been the decoupling of the dollar and US equities.”

The firm’s QuickPoll survey, which polled 800 institutional investors in early July, found that dollar bears outnumber bulls at a ratio greater than 7:1—the highest level of one-sidedness seen in almost a decade of running these surveys. Yet at the same time, 51% of respondents remained bullish on the S&P 500, which creates an interesting dynamic.

Brian Garrett, who oversees equity execution for the cross-asset sales desk in Goldman Sachs Global Banking & Markets, pointed out the disconnect:

“When you look at the returns of the equity market, the biggest driver is economic growth. And if the US economy is growing at a fast pace, you’d think the dollar would get stronger.”

This unusual setup is being driven by expectations of a more dovish Fed, optimism about artificial intelligence, and also normalized attitudes toward tariffs. The US dollar outlook from Goldman Sachs survey revealed that investors now see a 10-15% effective tariff rate as the new baseline, which represents a significant shift in thinking.

The USD prediction for 2025 is also being influenced by what analysts are calling “policy volatility.” Trade risks remain elevated, with tariffs having raised the average effective rate to approximately 18.6%, though investor attitudes have normalized around these levels as mentioned.

Dollar vs. Gold Relationship Breaks Historical Pattern

The dollar vs. gold correlation has not been able to be true to its inverse relationship and this has taken many traders by surprise. The price of gold shot above 3,149 per ounce in April when the dollar was relatively strong based on the average of the past. Now, gold reached a new all-time high of $3,900.

The amount of gold that central banks have been buying has been all time high, and China, Russia and even the developing markets have been playing a major role in adding more reserves so as to diversify their holdings not on dollar but on gold. The institutional demand is evidenced by the fact that the volumes in the trading of gold options were at record highs in April of 160,000 plus contracts per day.

The dollar vs. gold correlation now reflects a variety of forces: geopolitical safe-haven demand, inflation hedging issues and structural changes in the central bank reserve management policies. This complicates the dollar vs gold relationship as compared to the previous simple reverse pricing trend that existed in the past decades. The US dollar forecast today has to reflect this dynamic, since gold is not simply moving in the opposite direction to the dollar but responds to a wider range of global uncertainty factors.

Also Read: Analysts Warn De-Dollarization May Send Gold Prices to Record Highs

Late-Year Rally Prospects and Outlook

A dollar recovery may come in late Q3 or early Q4 either through inflation surprises that are more brisk or signs by the Fed that the pace of cuts will be slower than analysts currently project. Technical analysis indicates that DXY resistance is around 96.60-97.60 and the index is currently at an approximate of 2 standard deviations above the 50 year average of the index which indicates that there is still some over-valuing of the index.

Ostlund covered the risks of consensus positioning. A sign of a stretched market is a very one-sided position. Vehement consensus, in itself, is not something to cause the market to turn, but it makes it a market that is prone to comparatively sudden shifts due to even slightly catalystic factors.

Weak Bearish Tilt

The dollar projection over the next half year indicates a weak bearish tilt will continue, especially when the Fed follows through on anticipated reductions and investors keep placing capital in other assets. However, analysts shouldn’t overlook the structural support that the dollar’s position as the primary reserve currency of the world offers. One FX strategist explained the tension between short-term headwinds and long-term fundamentals, stating that it takes a brave soul to bet against the dollar on a long-term basis.

The 2025 USD forecast is questionable at the turn of the last quarter. The main triggers under focus are the releases in labor markets, and analysts consider the Nonfarm Payrolls data released in September very important in informing future Fed expectations. There are no vanishing political risks either, at least the issues of government shutdown are still hanging on sentiment and this may impact the reliability of data.

To date, the US dollar outlook today indicates that major technical levels are currently holding up the currency, but underlying forces could restrict the extent to which the currency can rise. Most analysts project USD into 2025 of between 95-98 at the end of the year on the DXY, and the currency may even experience a late rally under certain circumstances—however that is a big if at this point in time.