Ethereum’s ‘Wall Street token’ status is solidifying right now as VanEck CEO Jan van Eck officially calls it the preferred cryptocurrency for financial institutions, and with Ethereum price prediction 2025 targeting some pretty ambitious levels, the Ethereum $6k target is becoming increasingly realistic amid growing Ethereum institutional adoption that’s been happening.

“Ethereum is the Wall Street token,” says @JanvanEck3. pic.twitter.com/9NAqjh8r0x

— VanEck (@vaneck_us) August 27, 2025

Ethereum Wall Street Token Insights: Price Prediction, Adoption & Risks

VanEck CEO Endorses Ethereum Wall Street Token Status

Jan van Eck has been positioning Ethereum Wall Street token as the industry standard during his recent Fox Business appearance, and the VanEck executive outlined why Ethereum institutional adoption is accelerating across traditional finance right now.

Van Eck stated:

“Ethereum is the Wall Street token”

The CEO went on to explain that every bank actually requires reliable blockchain infrastructure for stablecoin transactions, which emphasizes the Ethereum Wall Street token dominance that’s been building. He also reinforced his Ethereum price prediction 2025 outlook by adding:

“It’s going to be Ethereum or something else that uses Ethereum’s kind of methodology called EVM”

Van Eck highlighted institutional pressure, noting:

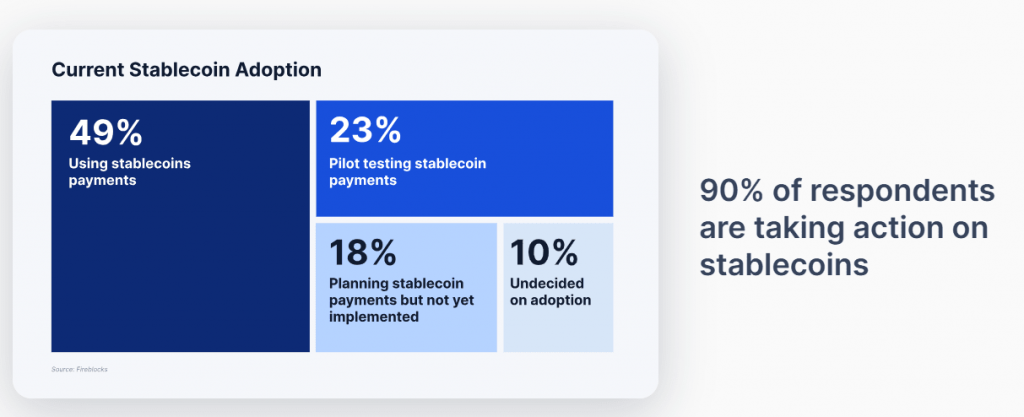

“Companies have to employ technology to enable stablecoin usage over the next 12 months”

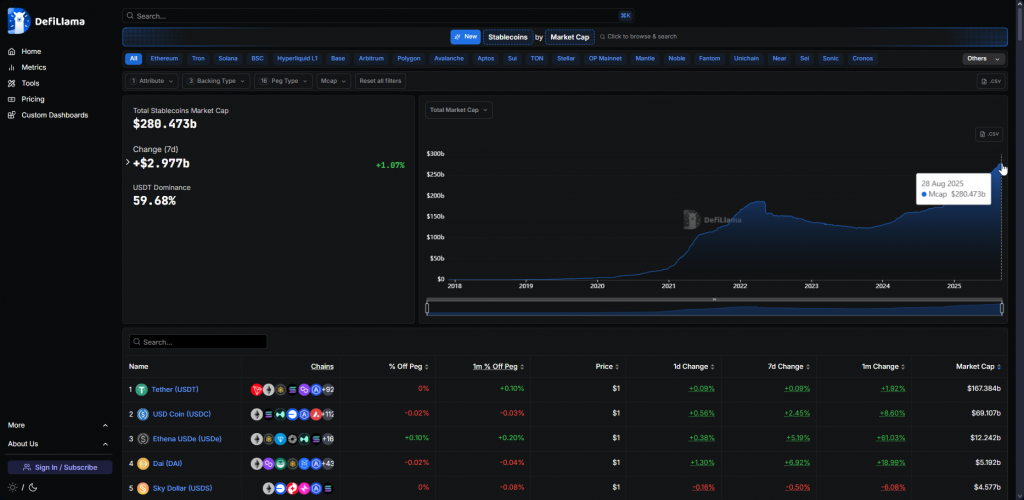

The pressure is being felt across the board, and 90% of institutional players are exploring stablecoin integration according to some recent data.

Also Read: Ethereum Whales Stir the Market: Can ETH Break $6K in Sept?

Technical Analysis Supports Ethereum $6k Target

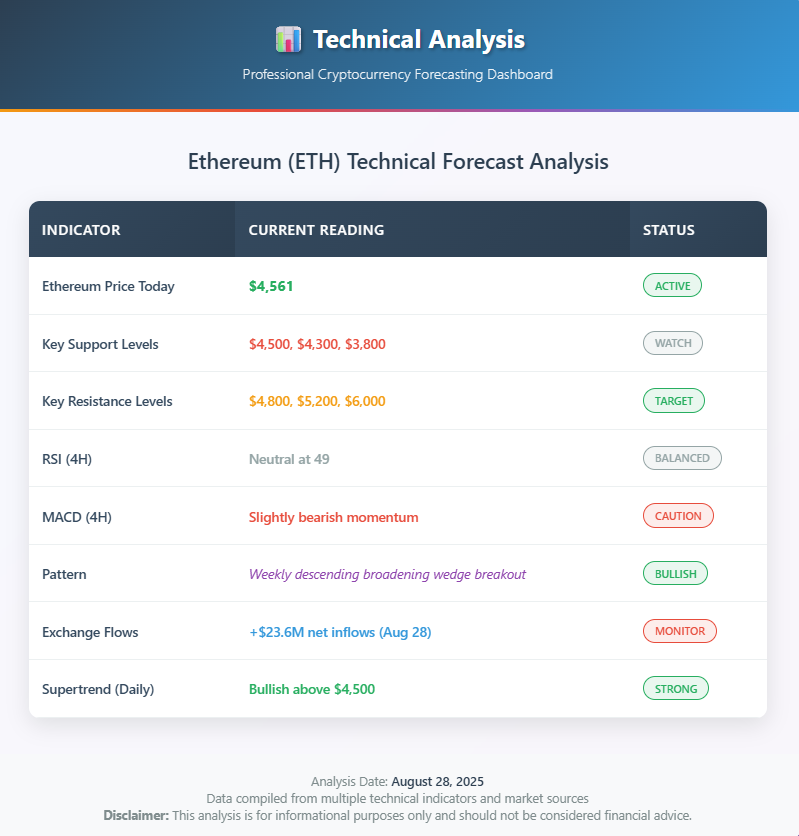

Current Ethereum price prediction 2025 analysis shows the token is trading around $4,561 right now after it broke from what was a descending broadening wedge pattern. The Ethereum $6k target actually appears achievable based on technical indicators along with the Ethereum Wall Street token momentum that’s been building.

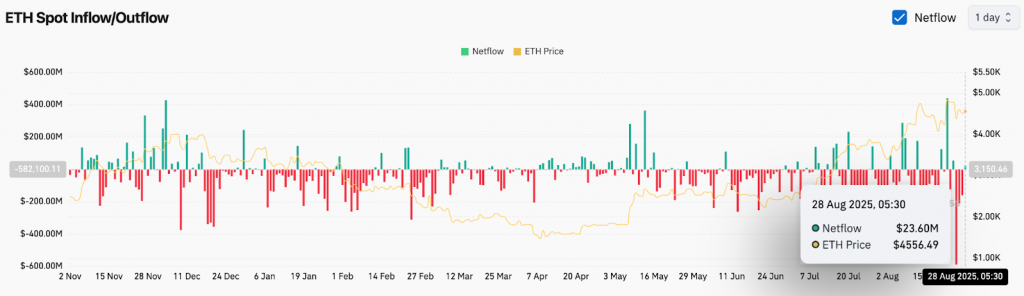

Market data reveals net inflows of $23.6 million on August 28, which supports the Ethereum institutional adoption narrative. Key resistance sits at $4,800, and successful breaks could target the Ethereum $6k target zone.

Also Read: Ethereum ETF Inflows Outpace Bitcoin ETFs: Is ETH a Better Buy?

Ethereum Investment Risks and Market Dynamics

Despite the bullish Ethereum Wall Street token sentiment that’s been growing, Ethereum investment risks still persist through market volatility. Ethereum institutional adoption faces some challenges from regulatory uncertainty along with technical scalability concerns that affect Ethereum price prediction 2025 targets.

Exchange flow data indicates mixed signals right now, and some whale transactions have been moving substantial ETH holdings. The Ethereum $6k target remains dependent on maintaining support above $4,300 levels.

🇺🇸 Tom Lee predicts Ethereum will hit $15,000 by December. pic.twitter.com/JoViskUkEK

— Crypto Rover (@rovercrc) August 27, 2025

Tom Lee’s projection actually reinforces optimistic Ethereum price prediction 2025 scenarios, though Ethereum investment risks include potential retracements toward $3,800 support zones that could happen.

VanEck’s Ethereum Wall Street token designation reflects growing institutional confidence, with BlackRock’s ETHA managing over $17 billion in assets right now. The path toward the Ethereum $6k target depends on sustaining current Ethereum institutional adoption momentum while managing the inherent Ethereum investment risks through these volatile market conditions.