VanEck’s Bitcoin Strategy exchange-traded fund (ETF) launch. This comes after approval by the United States Securities and Exchange Commission (SEC).

The firm’s move comes after ProShares launched its Bitcoin Strategy ETF on the New York Exchange on Monday. ProShares had applied for approval by the SEC back in August. This makes VanEck the second Bitcoin futures ETF to start trading on the NYSE.

Shortly after its launch, ProShares’ BTC Strategy ETF traded shares worth $280 million in just 20 minutes. Nearly $1 billion had been traded by the time the trading day was coming to an end. The US is following in the footsteps of Canada and some European nations that have permitted BTC ETFs and other exchange-traded products to go live.

VanEck had a filing with the SEC where it shared that the public offering of its BTC Strategy ETF offers exposure to the crypto asset through futures contracts.

The speculated date launch is Monday which comes after the effective date of the filing.

As shared by the firm, they will release the ETF,

“as soon as practicable.”

The investment firm’s Strategy ETF will trade on the Cboe BZX Exchange.

VanEck’s Bitcoin Strategy Exchange-Traded Fund

Many ETFs have been presented before the SEC for approval but have failed. What makes VanEck’s ETF any different? Unlike the rejected ETFs, the one done by VanEck will not offer direct exposure to Ether or BTC.

Instead, the ETF will provide exposure through cash-settled BTC future contracts. These contracts would have to be traded on Commodity Future Trading Commission registered exchanges. Additionally, VanEck will pool the future contracts to be used from investment vehicles and other exchange-traded products.

Bitcoin Strategy exchange-traded funds give investors exposure to crypto without the direct exposure of selling, buying, or storing crypto. This is particularly advantageous for investors with no knowledge of crypto wallets or exchanges.

AdvisorShares Managed Bitcoin ETF, the Galaxy Bitcoin Strategy ETF, the Invesco Bitcoin Strategy ETF, and Valkyrie Bitcoin Strategy ETF are all awaiting approval by the SEC.

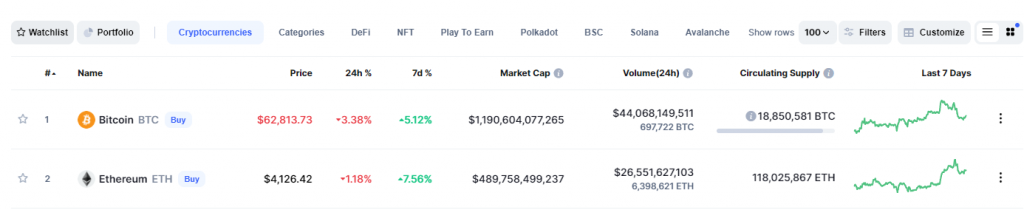

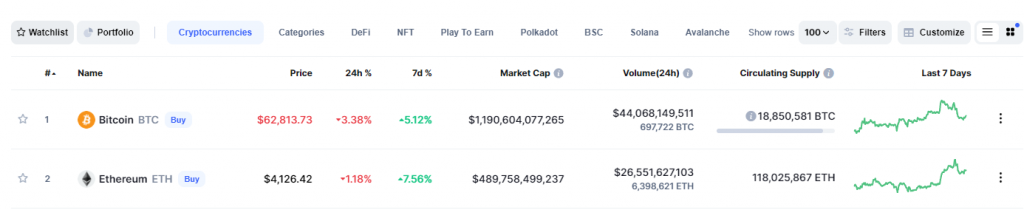

News of VanEck’s potential listing comes after both the BTC and ETH prices reach their all-time highs. ETH and BTC are trading for $4,126 and $62,812, respectively. BTC has achieved its all-time high mark due to the successful debut of ProShares ETF. Additionally, the anticipation of the launch of BTC futures ETFs has been linked to the rise in BTC prices. The total crypto market capitalization is currently at around $2.63 trillion.

About VanEck

Apart from its ETFs services, the firm also offers various products in the gold sector. VanEck recently (in September 2021) rebranded to focus on bettering its ETF services. ETFs currently account for over 75% of the assets under their management.

VanEck integrated Think ETF as a subsidiary after buying the Dutch ETF provider. This acquisition expanded the offering of their ETF services to Europe. VanEck is based in New York City. The company was founded in 1958.