The VeChain network is pressing all the right buttons since the start of 2023 surpassing new milestones in two months. The network surpassed 2 million known addressees on Tuesday and facilitated over 20,000 contracts. The daily transaction is also seeing a spike as the blockchain recorded a significant jump in in on-chain activity fueled by Fortune 500 blockchain adoption. veChain is recording tremendous activities and VET’s price is a low-hanging fruit that’s up for grabs in the markets. Is VeChain a good investment for the long run? Let’s find out!

Also Read: VeChain Price Prediction: When Could VET Reach $0.1?

VeChain: Could VET Be Low Risk & High Potential?

Nothing comes without the risk factor in the stock and cryptocurrency markets, as the ‘tag’ risk is always associated with them. While VET is available for purchase at less than a Cent, it comes with a lot of baggage along with it. It’s price was unable to climb above the $0.50 threshold during the bull run in 2021 and is down 92% from its all time high of $0.28.

Reaching its ATH from here could be a herculean task considering that the global markets remain weak. There’s uncertainty of job cuts, rising inflation, and murmurs of an upcoming recession is growing louder.

Also Read: VeChain: What Is the Likelihood of VET Reaching $1 by 2030?

Therefore, taking an entry position into VET might now might not be a good financial decision. The markets could take a u-turn this year shedding all gains that it generated since January.

However, taking an entry position during the dip and accumulating VET along the way could be a sound choice of investment. VeChain has potential and could rally hard when the bull markets make a comeback.

In conclusion, avoid short-term investments in VET and chose the long-term to get decent returns during the bull run.

Also Read: VeChain: When Will VET Breach Its All-time High of $0.28?

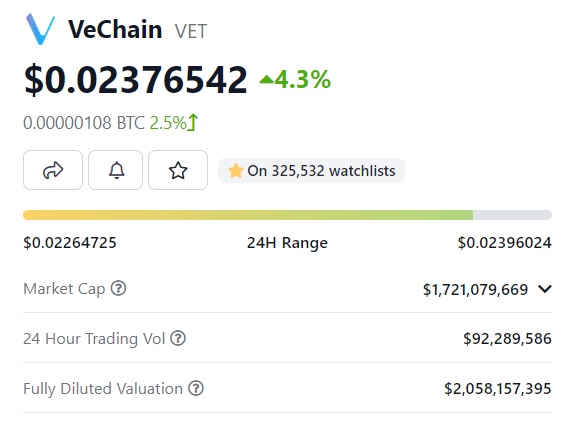

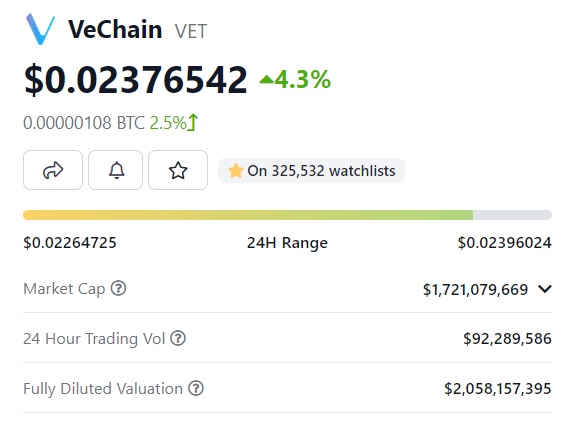

At press time, VeChain was trading at $0.023 and is down 4.3% in the 24 hours day trade. VET is also down 91.56% from its all time high of $0.28, which it reached in April 2021.