Visa’s stablecoin launch plans are now confirmed, and the payments giant is actually integrating digital currencies into its massive $15.7 trillion network. At SIBOS 2025, Visa declared a pilot program of stablecoin prefunding via Visa Direct and the new program is expected to modernize the cross-border payments as well as provide liquidity to businesses worldwide. The Visa stablecoin launch is in fact a solution to the slow and expensive international transfers that has been haunting the financial system quite long enough now.

Visa Stablecoin Launch Set to Boost Cross-Border Payments and Adoption

The launch of Visa stablecoin allows financial institutions to pre-fund Visa Direct account using stablecoins rather than using traditional fiat currency. This new strategy of stablecoin adoption 2025 is to use digital assets as ”money in the bank” to get instant payouts and even removes the need to deposit large amounts of fiat currency beforehand, a standard practice in the past.

Chris Newkirk, President of Commercial & Money Movement Solutions at Visa, had this to say:

“Cross-border payments have been stuck in outdated systems for far too long. Visa Direct’s new stablecoins integration lays the groundwork for money to move instantly across the world, giving businesses more choice in how they pay.”

Also Read: Trump Jr: Stablecoin Surge Will Protect Dollar Hegemony Globally

Integration Details and Network Expansion

Visa is currently in a pilot program of its stablecoin launch, and the company is currently collaborating with a few select firms that fit certain criteria. The company plans to increase the initiative in 2026. The industry indeed anticipates Solana integration to happen, given the rapid speed of transactions on the network and its low costs. By the time of writing, Visa Direct stablecoin features enable institutions to literally transfer money in minutes instead of days.

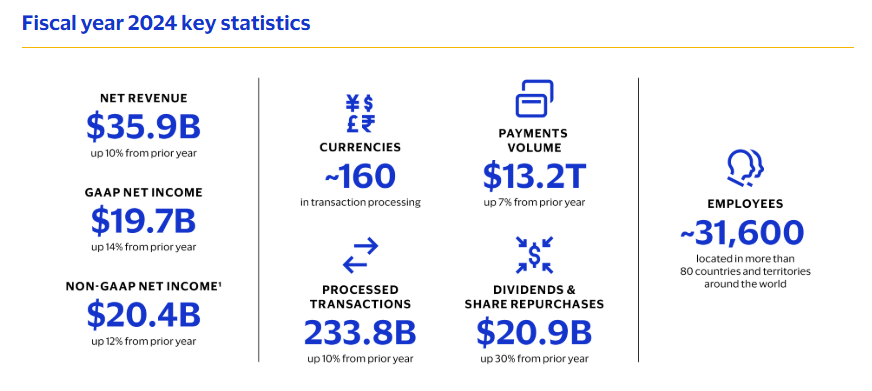

Cross-border payments through the Visa stablecoin launch reduce exposure to currency volatility while also stabilizing treasury operations for businesses. The program leverages Visa’s existing infrastructure, which handled 233.8 billion transactions in fiscal 2024—a massive volume.

Also Read: Kaia Stablecoin Super App Debuts Under LINE Next’s Project Unify

The high influx of major players to the stablecoin sector such as Visa now is accelerating the stablecoin adoption 2025. The Visa Direct pilot stablecoin integrates blockchain programmability and the trusted global Visa network to provide businesses with access to cross-border liquidity much faster.