The stock market is filled with many new stocks waiting for their turn, standing patiently in the queue for investors to pay heed to. This new stock, however, has managed to catch the attention of Warren Buffett and Cathie Wood, who have staked millions in this respective stock to gain stable revenue and profit from these stocks.

Let’s learn more about this new stock that has managed to captivate two of the world’s biggest investment giants. Understanding the dynamics of these stocks can help new investors.

Also Read: Solana: Here’s How High SOL Can Peak In October 2024

Diving Deeper Into the New Stock Alert: Nu Holdings

New Stock Alert: Nu Holdings

Nu Holdings is described as a leading financial business that offers multiple finance-centric services directly to its consumers via its smartphone app. The company was one of the first to launch direct finance services via an app in Latin America in 2013, taking the sector by surprise. Its innovative approach really set it apart from other traditional stocks.

This development added more strength to the company’s portfolio, helping it gain a wider base and grow consistently over time, much like other successful stocks.

When the firm launched its own services in 2013, its demand skyrocketed instantly, making it one of the desirable and dependent financial services domains to gain expertise. Per the Motley Fool, Nu’s demand went from 0 to 100 soon after its launch, as it onboarded 100 million new customers over ten years, showcasing the potential of high-growth stocks.

Cryptocurrency Ventures And Revenue Growth

The firm recently ventured into the cryptocurrency domain and has successfully onboarded nearly 1 million users since the launch. The new service allows users to send and recover Bitcoin, Ethereum, and Solana directly via their wallets. To ensure transparency in the domain, the firm has partnered with chain analysis to track transactions against unethical elements, echoing the approach taken by traditional stocks to secure investor confidence.

Speaking about the positive revenue metrics, the firm is already charting its own revenue path. Nu’s sales base is inching towards hitting $8B. Meanwhile, its earnings are also solid, attracting new momentum with each passing day. Over the next five years, analysts are counting on Nu to claim new highs, possibly expediting its earnings by 54%, much like other rising stocks.

“The growth portion of the equation comes from Nu’s rapidly expanding profits, as users leapfrog from cash to the digital and credit age, while a recent pullback provides a more compelling valuation for new investors, indicating a strong future for the stock,” the report adds.”

Also Read: UAE Central Bank Approves AED Stablecoin: A New Era Begins

Nu Holdings Forecast: Is It Worth a Buy?

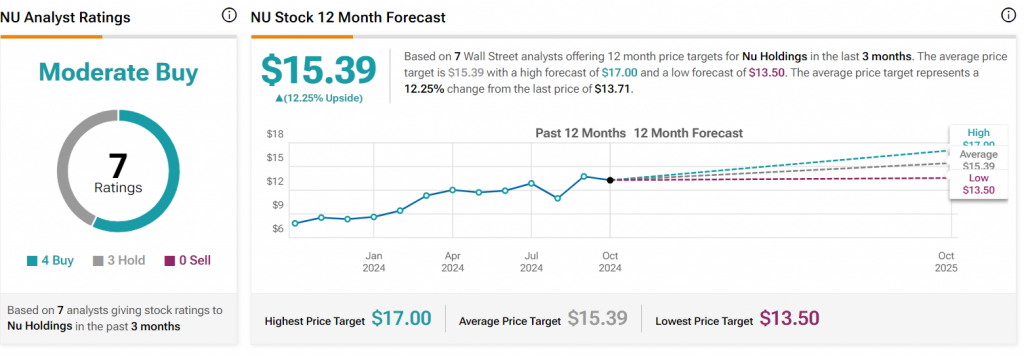

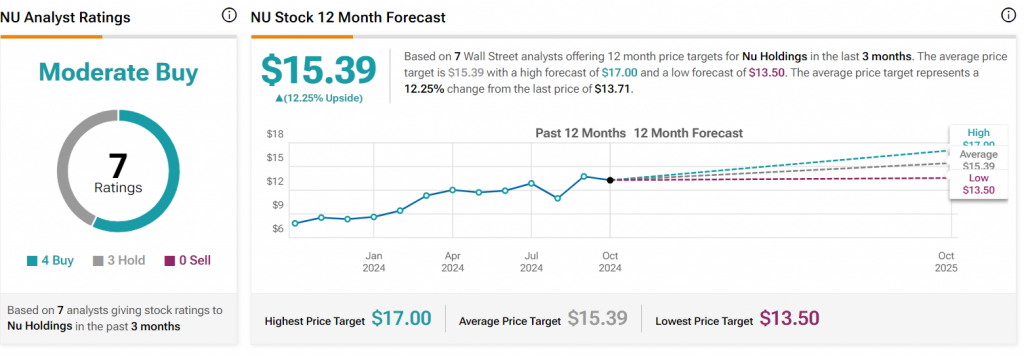

When it comes to affordable stocks, Nu definitely stands out. Warren Buffett and Cathie Wood both have invested in Nu Holdings. The firm’s stock price is currently $13, with a forecast hinting at a potential surge to $17 in the coming months, showing why keeping an eye on such stocks is essential.

“Based on 7 Wall Street analysts offering 12-month price targets for Nu Holdings in the last 3 months. The average price target is $15.39 with a high forecast of $17.00 and a low forecast of $13.50. The average price target represents a 12.25% change from the last price of $13.71.” Nu Holdings’s analyst rating consensus is a moderate buy. This is based on the ratings of 7 Wall Street analysts and shows promising potential compared to other stocks.”

Also Read: VeChain Weekly Price Prediction: Can VET Hit $0.03 This Week?