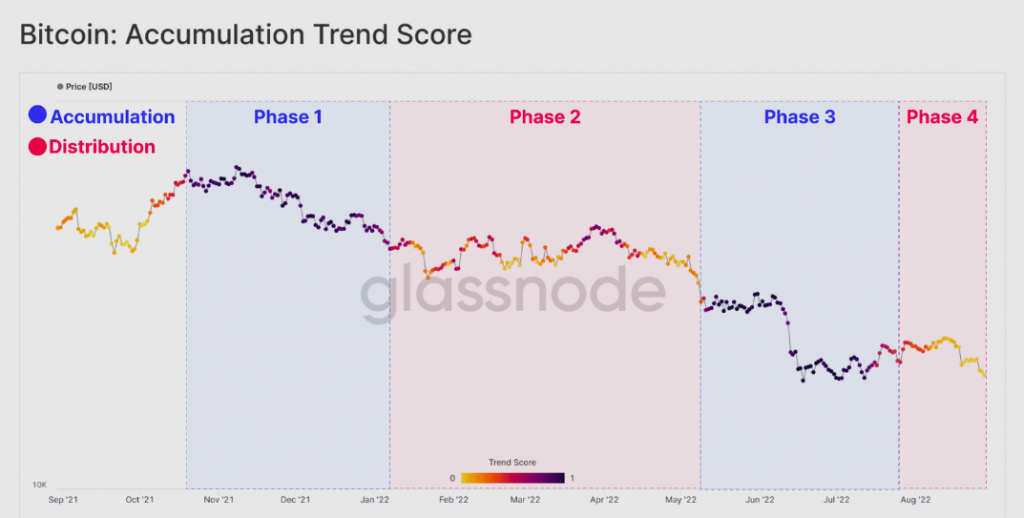

The Bitcoin market has seen different phases of accumulation/distribution take place over the past few months. During the market crash post the double-peak creation last year, market participants bought the dip, for they considered the same to be a perfect opportunity to enter the market. Resultantly, the accumulation trend score remained quite refined and was more inclined towards 1 [purple].

In the next phase, as participants got the bear market confirmation, the distribution trend shaped up, with underwater investors leading the way. Then, during the Terra ecosystem debacle, accumulation sprung up again as the lows were bought. And now, we’re currently in phase four, and the search for exit liquidity persists.

Per Glassnode, the opportunity to distribute coins and take profits was viewed as an opportunity of late by short-term investors. Resultantly, as depicted below, the trend score remains to be quite weak.

Owing to the said trend, Bitcoin continues to trade below its realized price—the average price at which each coin in circulation was last bought.

Extending the time frame

On the multi-year macro time frame, however, the reverse trend has been in play. Consider the state of the liveliness itself, for instance. This is a metric, as such, provides insights into shifts in macro HODLing behavior. And helps to identify trends associated with long-term HODLer accumulation or spending. Per the thumb rule, downtrends point towards HODLing, while uptrends signal spending.

As depicted below, the liveliness is currently in a strong downtrend and has broken below the triple peaks of the post-2018 bear market. Per Glassnode, the same is,

“coincident with a HODLing dominant regime.”

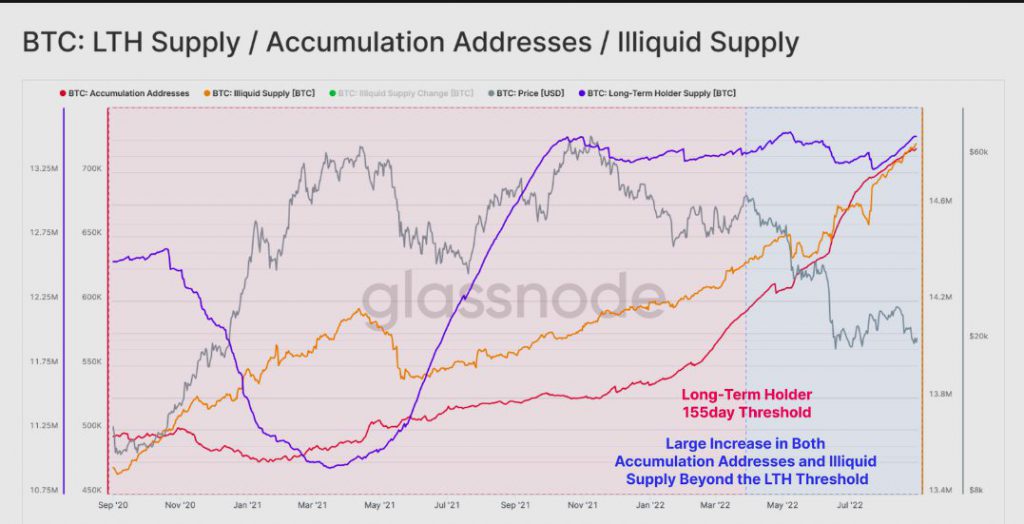

Furthermore, peeking into the supply dynamics and accumulation addresses will give us a better understanding of whether the conviction is indeed resolute or not.

As illustrated below, an “explosive increase” has been noted by the accumulation addresses. Alongside, the illiquid supply has also been on the rise. The same is definitely a positive takeaway and per Glassnode,

“This adds weight to a case that LTH supply may continue to push higher over coming months, which would provide confluence with the HODLer regime denoted by network Liveliness.”

Thus, we can infer that Bitcoin is currently stress-testing short-term holders. Long-term HODLers, on the other hand, seem to feel no impact by the ongoing price movements.