Towards the end of February, Cardano dipped below the $1 threshold. Since then, the token’s price has been oscillating below the said level. Nevertheless, on 19 March, ADA broke above its short-term downtrend line, as a result of which, it could pull off a weekly 19% hike.

Even at the time of press, ADA’s bullish prospects seemed to be intact. The RSI reading, for instance, was close to 60 and the tail of the indicator’s curve was seen pointing up north. A congruent reading was noted only back in January before this.

Further, Cardano has been trading above its SMA over the past few days, indicating another sign of strength.

So, if the bullish bias persists, ADA would be in a position to rally by another 13% rally, upto its 38.2% Fib level. In such a scenario Cardano would be able to reclaim the $1 mark. Thereon, if bulls still manage to dominate, the spike could extend all the way upto $1.192.

On the bearish side, if the broader market sinks, the bullish thesis could be invalidated. The SMA and the downtrend line have the potential to like as viable supports and restrict ADA from revisiting the $0.7 range.

Cardano’s ranking woes

Quite recently, Sino Global Capital’s CEO Matthew Graham took Twitter to implicitly hint that Cardano could drop on the rankings chart and exit the top 20 list. In a tweet captioned “practicing some arrows,” the exec happened to shuffle the crypto standings and ADA was the only token, that Graham had pushed to the bottom of the list.

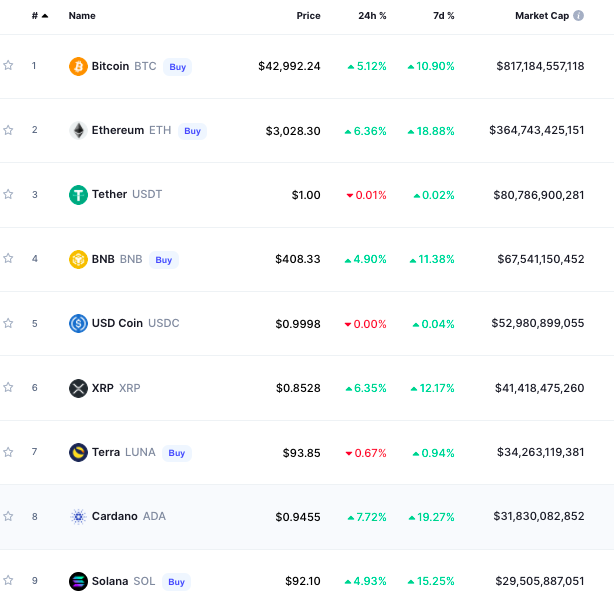

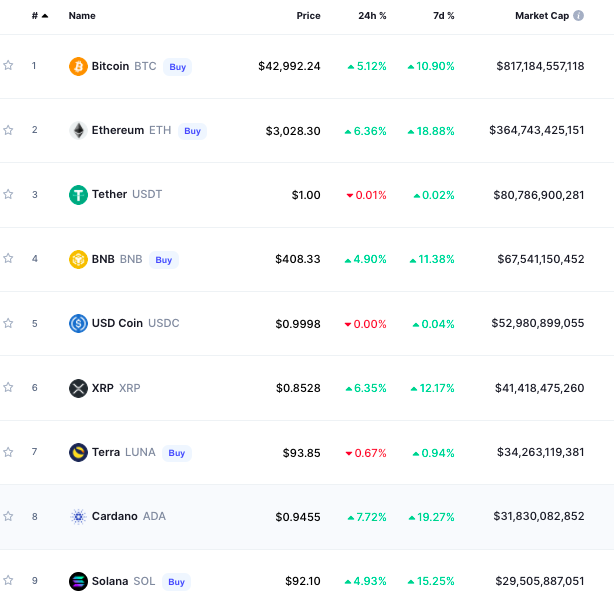

Before assessing whether or not Graham’s projections hold water, consider the snapshot attached below. Leaving aside stablecoins and LUNA, all large-cap coins have witnessed an uptick in the 4%-6% range. Cardano was, however, a step ahead and had inclined by close to 8% in the same time frame.

Similarly, when the weekly numbers are taken into account, Cardano yet again managed to out-shadow the RoI figures of all its counterparts.

Thus, Graham’s prediction may not be realized in the short term. Over things terms, however, the landscape might change, especially because ADA’s has price has hardly reacted to any developments in the recent past.

Post the Alonzo hard fork last year, for instance, the community expected a rally. However, ADA failed to deliver. Even as the state of its metrics showed signs of improvement recently, ADA failed to react on its price chart.

Thus, for its ‘redundant’ tag to be removed, ADA would have to start responding via price movements to the developments happening within its ecosystem. If it isn’t able to do so, then nothing much could stop it from being displaced by other top coins on the rankings chart.