Bitcoin has been see-sawing up and down in the $40k-$45k range over the past couple of days. Before that, it spent most of its time in the last week of February oscillating in and around $36k-$39k.

Ethereum, on the other hand, noted an incline from its wick low of $2.3k to $3k in the period between 24 February to 1 March. Post that, after registering two long and successive red candles, the largest’s alt was back to $2.7k at the time of press.

Bitcoin assumes control, yet again

Towards the end of February, Ethereum’s price movements had more thrust and vigor when compared to that of Bitcoin’s. However now, things have already changed and the baton is back in the king coin’s hands.

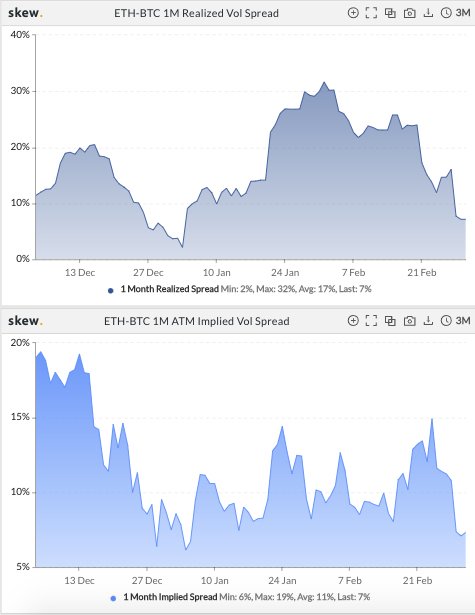

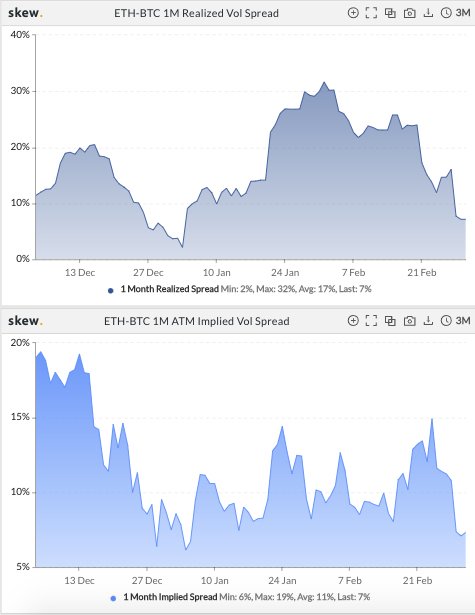

As can be noted from the snapshot affixed, the ETH-BTC realized volatility spread started shrinking right after registering a 3-month peak on 1 February. This means that volatility in the Ethereum market has gradually started evaporating when compared to that of Bitcoin over the past 4-weeks.

Nevertheless, the ETH-BTC implied volatility spread—that shows the amount of volatility expected by market participants—registered a multi-week high on 24 February. But now, the same is back to its December low levels. This means that towards the end of last month, traders expected Ethereum to take the lead and pave the path, but now, expect Bitcoin to do the same.

What’s next – a bull market or a bear market?

Well, at this stage, not much can be said with surety. For Bitcoin’s uptrend to commence, it would first have to break past the $45k barrier, and then, for the bull run to take concrete shape, it would have to register a close above $52k.

Futile attempts to attain the said ranges would, however, see the king-coin prolong its correction phase. In effect, ETH would follow BTC’s footsteps and wouldn’t hesitate in turn in the same direction that Bitcoin does.

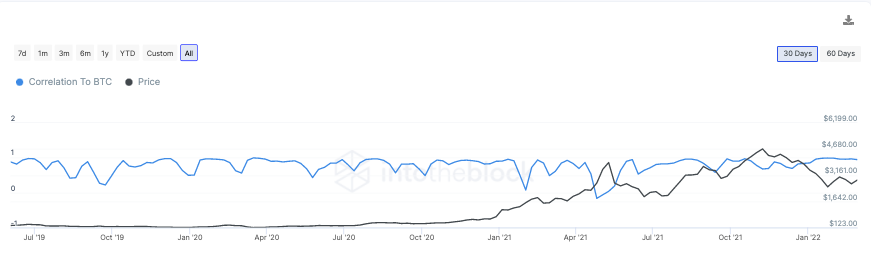

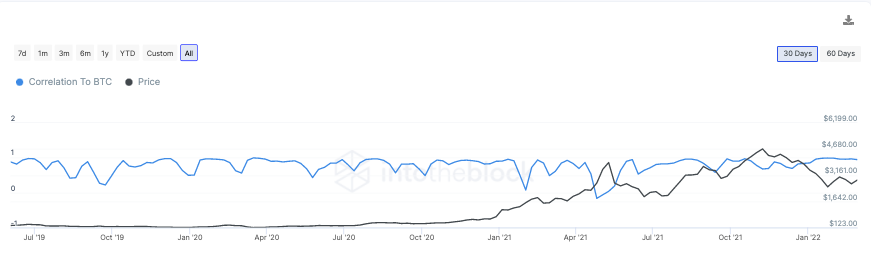

More so, because both the asset’s prices have customarily moved in tandem, thanks to their high correlation. In fact, after inclining of late, ETH and BTC’s correlation stood as high as 0.94 at the time of press.

Ultimately, Bitcoin possesses the keys to both, bullish and bearish, locks. Based on how it is triggered by market participants, it will choose to open one of them going forward. Until then one thing is clear – the magnitude of BTC’s pumps/dunks is set to be more than that of ETH’s because of the free-fall noted on the volatility spreads.

All things considered, Ethereum lagging behind only adds an additional burden on the shoulders of Bitcoin.