What happens in Vegas, stays in Vegas, but not for long. As Metaverse makes its way deeper in the United States of America, the Texas Securities Commissioner, “What happens in the Metaverse, does not stay in the Metaverse.”

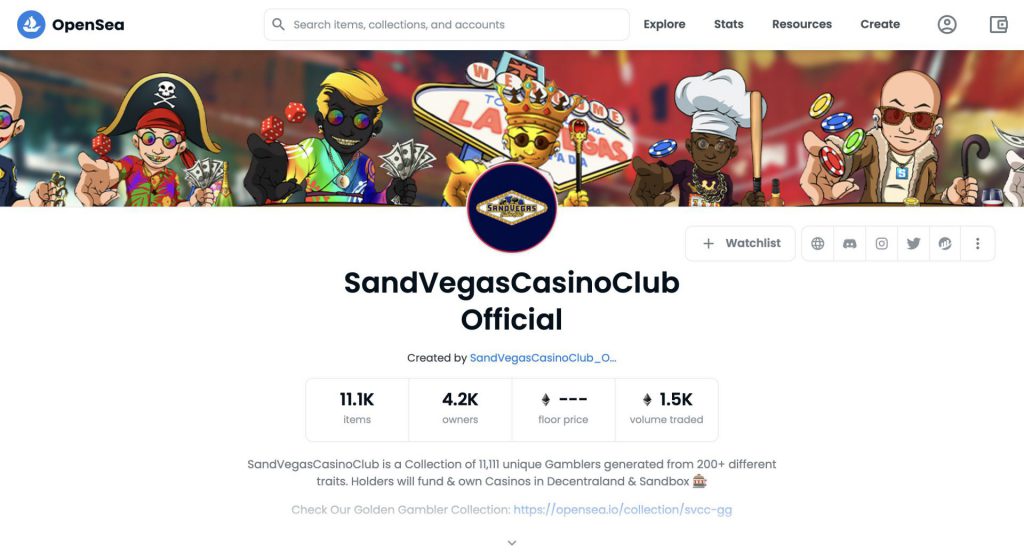

Per reports, Cyprus-based Sand Vegas Casino Club has been ordered by securities regulators in two U.S. states to stop selling NFTs that promise a cut of profits from casinos on Metaverse platforms. The Casino Club was using a portion of the proceeds from the 11,100 “Gambler” NFTs to purchase land in Decentraland and the Sandbox. With a forecast of acquiring $24,480 from the “Gambler” NFTs and up to $81,000 per year from the higher-end “Golden Gambler” NFTs, it had claimed to share profit from the operations with the NFT holders.

However, this did not settle well with the regulators. Moreover, the Texas authorities alleged that the Casino said the NFTs are not regulated as securities, despite the profit-sharing model as a selling point. Well, unregulated files have been trying to make the most of the hype before regulators step in and some NFT players were banking on the same.

The field of cryptocurrency as a whole has seen stringent moves from the authorities mainly in the United States. Recently, decentralized finance [DeFi] platform Celsius announced that US investors would be unable to earn rewards on its platform unless they are accredited. This move followed a stream of changes on the platform and its Earn product after a conversation with regulators.

This will lead new deposits from 15th April from US users to be transferred to custody accounts by the crypto lender. However, the accounts will only be paid interest if the account owners are considered accredited investors. With these changes, Celsius has joined the league of its competitors BlockFi and Nexo, who also succumbed to the regulatory pressure over lending products.

Interestingly, the Sand Vegas Casino Club is not based in the United States. So the authority of these regulators is being heavily questioned. However, when has that stopped the US regulators from flagging shifty operations?

As the existing and kind of established sub-sects in the crypto field were facing heavy regulatory scrutiny, NFTs were also within reach. On-Chain data indicated that the Gambler NFTs currently have 4200 holders, while Golden Gambler NFTs have 624. A large group of people awaiting a share of profits from the operations.

Per reports,

“The Gambler NFTs have a 30-day average price of 0.3293 ETH, or $1030 while the Golden Gambler NFTs have an average price of 1.89 ETH or $5900.”

The Casino Club is also working on a web-based casino scheduled to launch in the summer as per its roadmap. However, due to the limited number of Metaverse users, even this web-based casino may not see a large volume of people.

However, this regulatory shakedown conveys that the regulators were paying attention to the developing Metaverse space. They may have missed the boat with cryptocurrency, but it looks like they were not ready to let Metaverse out to sail without proper regulations.