The four-letter acronym has dominated headlines so far in 2023 and sought to shift global power. Yet, many are uncertain of the intention behind its creation and what it could mean. So, just what is BRICS and its purpose?

Amid the talks of de-dollarization and GDP, there is an underlying history behind the fastest-growing collective bloc in the world. As they seek to alter how we understand the global economy, it is just as important to understand how the countries got to this point. Uncovering the BRICS members, their place in the collective, and what the future could hold in relation to the long-standing power of the G7 countries.

The Origin of BRIC

BRICS is an acronym for the bloc of nations consisting of Brazil, Russia, India, China, and South Africa. Moreover, the phrase was first coined by Jim O’Neil, a Goldman Sachs economist, all the way back in 2001. Subsequently, O’Neill claimed that by 2050, the nations present in what was then known as BRIC would dominate the global economy.

South Africa was added to the collective of nations in 2010, with the group gaining little traction since its inception. Alternately, the nations had not truly been seen as the proper replacement for the G7 dominance that had been present throughout the 2000s. Additionally, the United States was commonly understood in its dominant position, and the BRIC opposition had placed a ceiling on their potential interaction with the status quo.

At the time of Goldman Sachs proclamation, the collective was seen as nothing more than a little hype. Subsequently, the investment banking firm closed its BRICS-centered investment fund in 2015. The firm would merge the finances with other broader market funds, slowing down the hype train it had attempted to start.

Still, it had not been simply hype on the part of Goldman Sachs. The collective had represented good returns for institutional investors, likely due to the rising prosperity of the countries and the Goldman Sachs proclamation. Yet, the excitement had more or less dwindled with the firm’s exit until its most recent dominance.

Russia, India, and China

The Council on Foreign Relations notes that the collective, formed from the Goldman Sachs papers, was brought about by China, India, and Russia. Prior to the creation of the bloc, Russia had been a member of the G8 nations. Conversely, the country was expelled in 2014 due to its invasion of Ukraine’s Crimea. Interstingly, similar circumstances have led to the propulsion of the bloc’s vitality today, but more on that later.

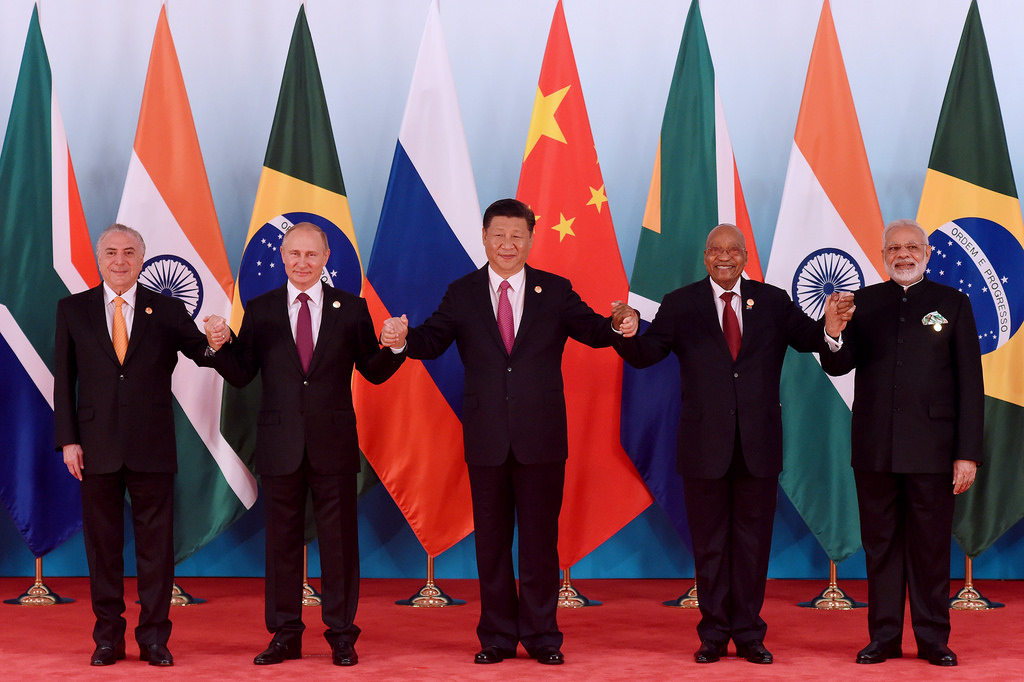

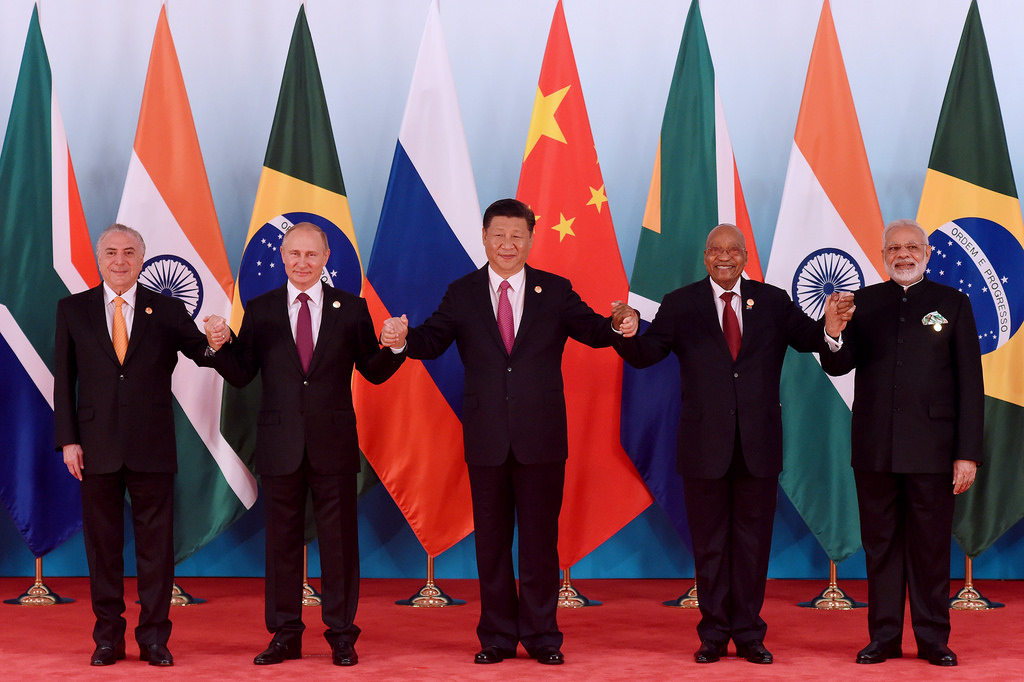

The leaders of the three nations, Vladimir Putin of Russia, Manmohan Sing of India, and Hu Jintao of China, first met with the prospect of making the idea a reality. Conversely, to this point, the Goldman Sachs proclamation was not rooted in anything more than an idea. Moreover, the following year, the BRIC collective was born with the first of its annual summits.

By 2011, the nations had invited South Africa to join their growing collective. Subsequently, it accepted, and the five-country organization was formed, which has formed the BRICS collective since. Yet, the nations are primarily an acronym for what many perceive as an emerging world market economy.

The World Market Growth

It is important to elaborate on one vital distinction. When Goldman Sachs made its original projection, it did not foresee political alliances or a trading association. Conversely, the firm predicted an economic bloc and noted its own shortcomings in its creation.

However, in 2001, O’Neil did note that the global GDP was set to rise 1.7% all the way back in 2002. Thus, it was noted that the BRIC nations were predicted to grow at a much quicker pace than the G7 countries. Those consisted of Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. Moreover, they represented seven of the most advanced economies on the planet.

Two years after O’Neil’s initial report, Goldman Sachs followed it up. This time, in 2003, Dominic Wilson and Roopa Purushothaman uncovered the potential economic rise that could take place by the year 2050. Subsequently, they stated that the BRICS nations would continue to grow at a much quicker pace than the G7 nations. The notion that the global economy’s power balance would look drastically different than in the 2000s So far, in 2023, the proclamation seems correct.

The Lessening Hype and How We Got Here

In 2007, Goldman Sachs published yet another report on the BRICS nations and their growth potential. Moreover, it discussed the Next 11, which were 11 emerging economies that had connections to the BRICS nations.

However, BRICS’ growth slowed following the 2008 financial crisis. Subsequently, an oil price collapse that arrived in 2014 led Goldman Sachs to step away from its ambitious proclamations.

Still, the BRICS acronyms have become synonymous with emerging global markets. However, it was seen with concern over economic differences among the countries involved. Specifically, China and Russia had seats on the UN Security Council, which presented different security governance than other members.

Alternatively, China and Russia operated in very different political spheres. Moreover, both regimes under Xi Jinping and Vladimir Putin represented authoritarian systems. Alternatively, India, Brazil, and South Africa have their very own trilateral consultation in the IBSA Dialogue Forum.

Still, the nations continued to grow and present an emerging market. Alternately, 2023 will see the BRICS nations officially surpass the G7 nations in global GDP (PPP). Fulfilling the early proclamation and understanding what BRICS is is as important as understanding its purpose.

What does BRICS Do?

Early in their existence, the BRICS nations were seen as a symbol of emerging global governance. Long had the world been forced to reconcile with the United States’ political operations in the World Bank and IMF. Specifically, that attraction to the BRICS concept is due to the replacement of Western influence on internal economies.

Following the 2008 financial crisis, the BRICS nations introduced a 2009 joint statement. Specifically, that statement called for reformation in international banking. Additionally, seeking “greater voice and representation,” for economies that are still growing.

What is seen as a turning point is the statement issued at the 2012 summit. There, the nations state that the BRICS represent “43 percent of the world’s population,” speaking to their needed inclusion. Now, that phrase has been echoed by the collective.

Still, the work that the collective has done has only increased in recent years. More than simply an annual summit, BRICS has increased its coordination in recent years and projected a level of unity not seen in the early 2000s.

BRICS and the New Development Bank

What may be an underrated aspect of their growth is the unification efforts propelled by BRICS. Moreover, what was initially more of a symbol evolved to be a true collective. Meetings of foreign ministers, finance ministers, and central bank governors exist on the growing calendar.

National security advisors, environment ministers, labor officials, and health officials all gathered between the countries. Consequently, what the group was in 2010 pales in comparison to what they are now. Then perceived as yet another global enterprise of countries seeking collaboration and economic success. Now, it is a full-fledged partnership of countries with an agenda and the power to execute it.

That growth cascaded into what may have been the greatest development of the collection thus far. In 2012, BRICS showed that they were serious about change, and took. on the World Bank in a move that surprised many. The creation of the New Development Bank.

The New Development Bank is considered by many to be the most important creation of the BRICS collective. Formed to combat the IMG and World Bank’s failed reforms in the 2010s, the bank is a fully operational financial institution. Moreover, each of the five countries has an equal share of $50 billion of the subscribed capital. Subsequently, its first development loan agreement was signed in 2017, just five years after the bank was created.

The Future of BRICS

Ultimately, in understanding what BRICS is and its purpose, it begins to put its current actions into perspective. The collective has long held to the prospect of global economic freedom, and its execution in recent months speaks to its focus on that ideal.

When the United States placed sanctions on Russia following the invasion of Ukraine, it catapulted BRICS hopes. Subsequently, countries that wanted to deal with Russia had to look away from the dominant United States. Therefore, they utilized other currencies and lessened their use of American systems.

These kinds of developments will only lead to a greater prevalence of the BRICS. Additionally, as macroeconomic factors and a potential debt default threaten the US, those prospects only grow. Interestingly, the original Goldman Sachs proclamation may prove to have some merit. Subsequently, how the story goes from here, will be incredibly interesting.