The broader market’s recovery has sort of stalled over the past few hours. Reflecting a value of $1.73 trillion at the time of press, the global crypto market cap had shrunk by 2.4% over the past day. In fact, all major large-cap coins were down by 2% to 6% on the daily time frame.

Amidst the humdrum state of the market, NuCypher [NU], the 132nd ranked crypto, had noted a 25% incline and was trading at $0.59 at the time of press.

In effect, this token has also been the most-traded token amongst top Ethereum whales over the past day. Trades usually encapsulate both buy and sell-side transactions. So, the question that matters at this stage is – Are whales buying or selling this token?

Tricky Trade

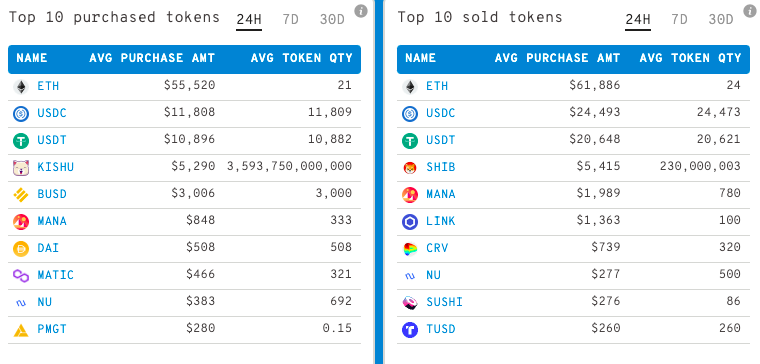

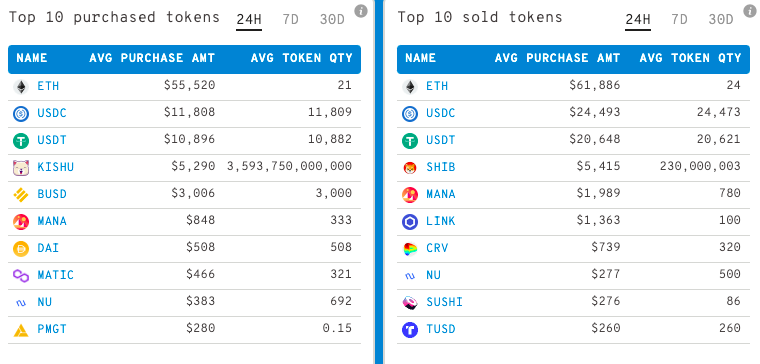

Well, over the past 24 hours, the Ethereum rich list has indulged in both buy and sell transactions involving the NU token. As per data from whale transaction aggregating platform WhaleStats, 692 NU tokens worth $383 had been bought versus 500 tokens worth $276 that had been sold.

Even though the buy transactions have an upper hand in this case, it should be noted that the difference is not that drastic.

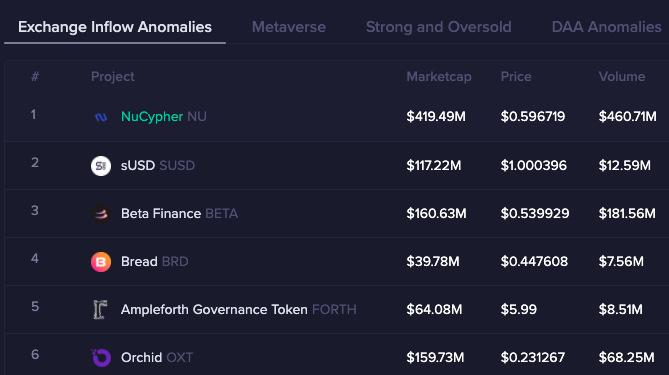

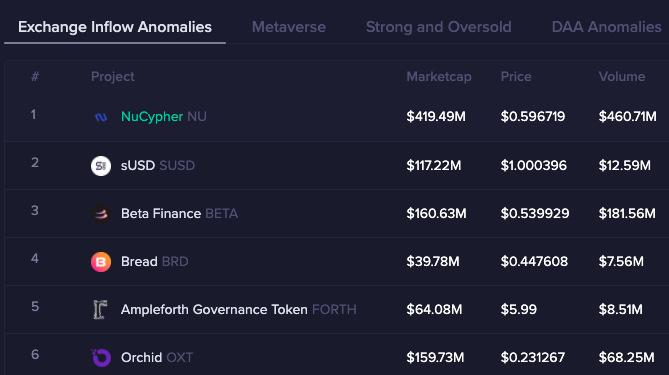

As far as the bigger picture is concerned, NuCypher has witnessed the largest exchange inflow anomaly over the past day. As per Sanbase’s explorer screener, exchanges witnessed an inflow volume worth $460 million in the said time period.

The rise in the inflow numbers usually resonates with HODLers selling their tokens and has more often than contributed to bringing down any underlying asset’s price.

So, if the sell-side pressure gains more steam with time, then it wouldn’t take much time for NU to start to negate its gains.