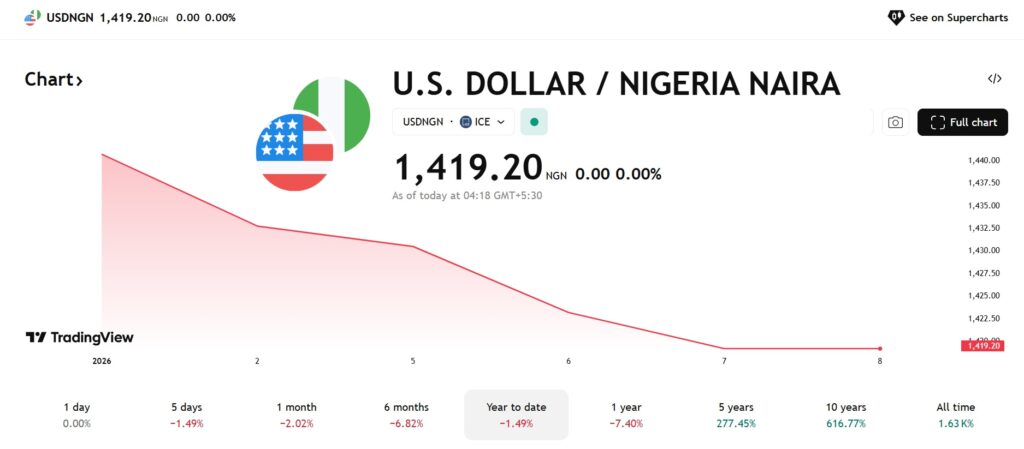

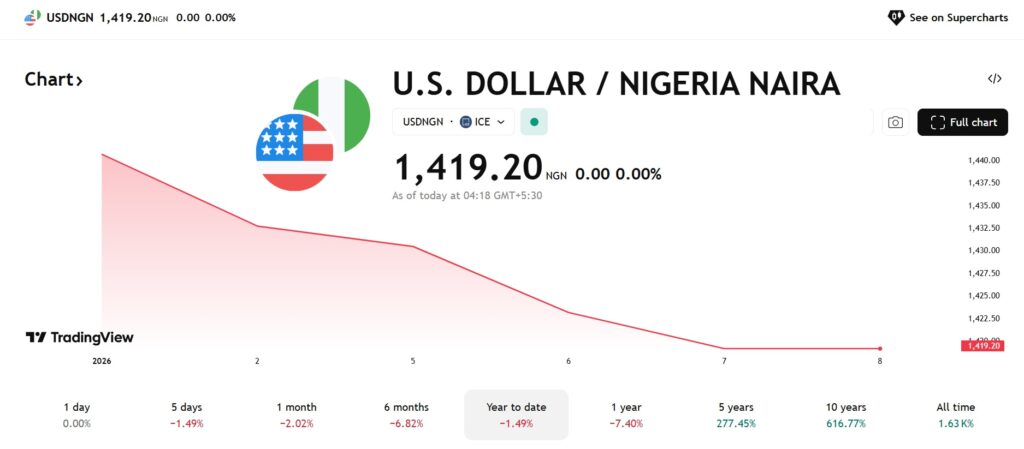

The Nigerian naira (NGN) is appreciating against the US dollar in the forex market in 2026. The NGN continued its tremendous rally from 2025, rising by 7.40% in a year. This year alone, it spiked nearly 1.5% against the USD, marking a stellar rise in the charts. The rise comes after Nigeria’s foreign reserves rose to $45.62 billion during the first week of January. The DXY index, which tracks the performance of the USD, shows the currency falling 9% in a year.

The latest data from the Central Bank of Nigeria shows that the naira reached N1,418.26 per US dollar. It is up from N1,419.07 on Tuesday and further firmed up against the greenback. Currency investors are betting big on the local currency as the greenback is on the back foot. The country’s external reserves are also providing a psychological cushion for the local currency. Investor confidence is soaring, and local businesses are gaining the most from the situation.

Nigeria’s Naira Goes Up Against the US Dollar

Wednesday’s uptrend saw the Nigerian naira experience a slight gain of N0.80 vs the US dollar. Overall, the local currency is faring well on a day-to-day basis and staying on top of the greenback. Even in the black market, demand for the naira remains strong and is trading at a slight premium. The currency is stabilizing, making it a viable investment for forex traders.

Also Read: Nvidia Insists China Pay Upfront For Its H200 AI Chips

The optimistic outlook for the naira comes after the Nigerian government took several steps to protect the currency from the US dollar. It includes accepting oil payments in the local currency and not the greenback. National refiners have been accepting the local currency for six months, strengthening the naira. However, several refiners have opposed the move as it eats into their revenue and balance sheets.