The cryptocurrency market was slowly starting its recovery journey. While the market was hoping to witness an uptick in March, several assets recorded a massive decline. The world’s largest cryptocurrency Bitcoin (BTC) dropped by nearly 7% throughout the past week. Amidst this, the king coin reclaimed the $83,000 mark and restored hope in the market. Will the asset bank on its current momentum and reach a high of $150,000?

Also Read: PI Coin: 82.8 Billion Controlled by Core Team—Is Pi Network Truly Decentralized?

A Look At Bitcoin’s All-Time High

Bitcoin started 2025 on a great note. The king coin hit an all-time high of $109,114.88 in January. Even though its only been two months since BTC attained this peak, the asset is currently trading 23.67% below its high. At the time of writing, the world’s largest cryptocurrency was trading at $83,216.10. This comes after a 0.46% rise over the past 24 hours. Earlier today, BTC dipped to a low of $79,931.85.

Also Read: GTA 6 Insane Detail: Store Heists, Car Chases & Cash in Underwear?

Is $150,000 An Achievable Target?

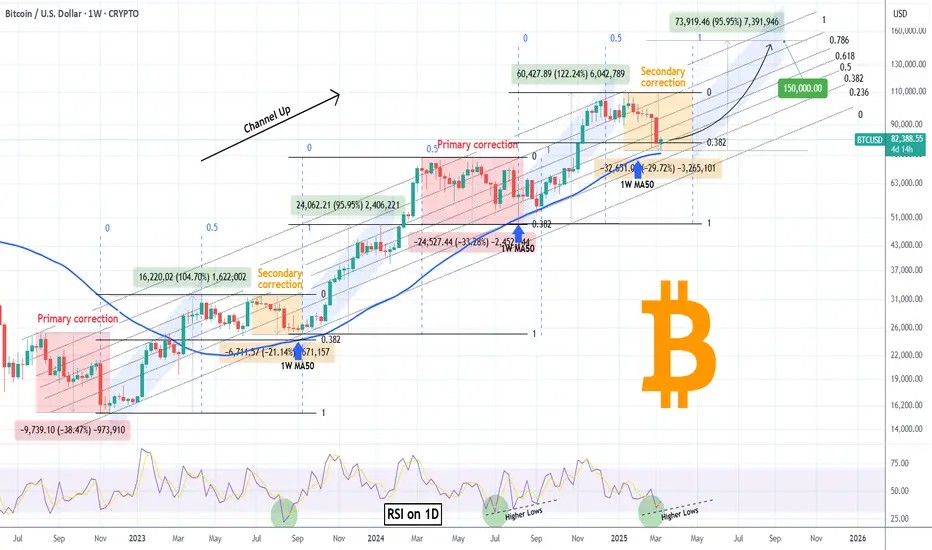

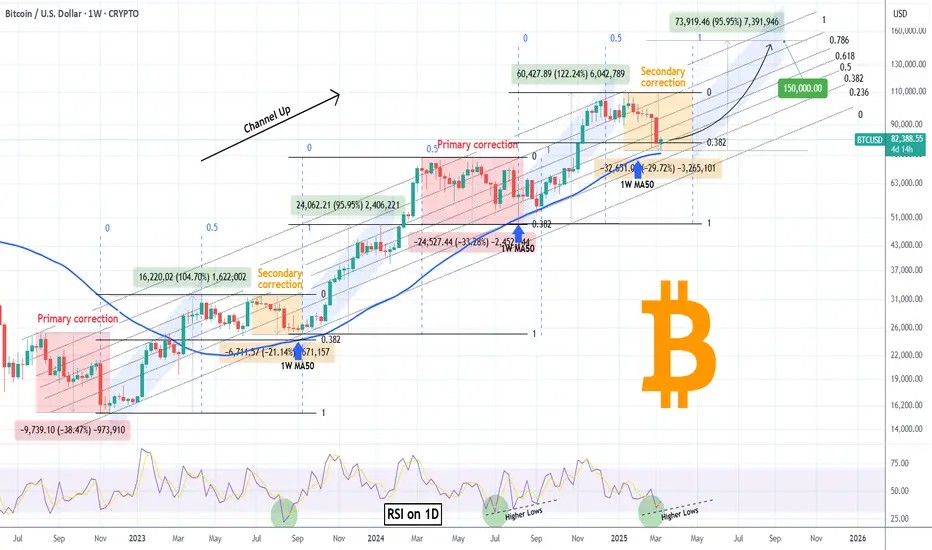

An analyst recently revealed that Bitcoin is all set to hit a high of $150,000 sooner than later. In a recent post on TradingView, an analyst noted that following a short test of the 1-week MA50 support level earlier this week, Bitcoin is beginning to show indications of a recovery. It’s unclear if this will result in a complete recovery, but past trends indicate that bull cycles for Bitcoin often peak around the end of the third year, which is anticipated to happen in 2025. Elaborating on the same, the analyst said,

“The Channel Up can be classified into two main Phases so far: each has a Primary correction (red) of more than -30% drop, followed by a rally (blue), then a Secondary correction (yellow) of more than -20%, followed by the second and last rally (blue). All rallies have so far been around +100%. Based on this model, we are now on the Secondary correction of Phase 2.“

The previous dips have recovered from the 0.382 Fibonacci retracement level and the 1W MA50. Bitcoin’s price has, however, marginally dropped below the 0.382 Fib level this time. Last week, the 1D RSI almost hit oversold levels, which is often indicative of a bottom formation. The next rally may begin by the week of April 28, according to historical time-based Fibonacci patterns, although the recovery process might take another four to six weeks. A 95.95% price gain may propel Bitcoin to almost $150,000 by late September, in line with its historical bull cycle peaks, if it follows the weakest rally of this cycle.

Also Read: Gold Price Hits $3,000 All-Time High Amid Record 2025