A handful of developing countries in Asia, Africa, and Latin America launched de-dollarization initiatives hoping to pull the US dollar down from the world’s reserve status. The main agenda of de-dollarization is to put local currencies ahead of the US dollar for global trade and commerce. The development, according to them, would strengthen their native economies boosting the prospects of local currencies in the foreign exchange market.

Also Read: Wages in the US Rise 7%, Home Prices Skyrocket 45%

Moreover, things have not gone down as planned as the US dollar outshined all local currencies in 2024. The USD outpaced other currencies this year despite threats of the de-dollarization agenda that’s gripped the developing world.

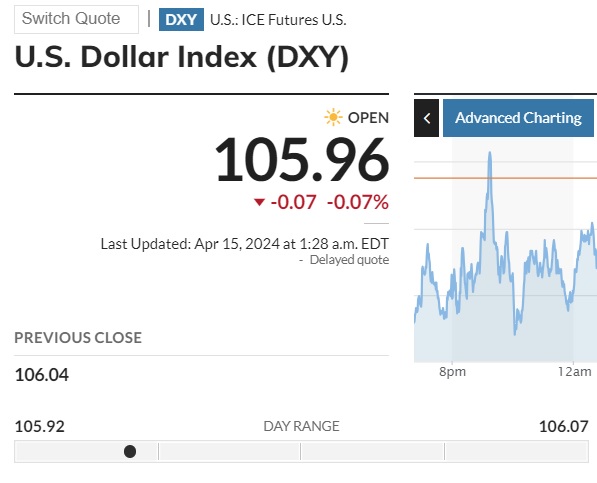

The DXY chart, which measures the US dollar’s performance shows it climbing above the 106 mark. The US dollar plummeted to 101.8 early this year causing turmoil in the American economy giving hope to the de-dollarization initiatives. However, USD bounced back strongly and touched 106.8 in April this year showcasing its might in the global currency markets.

Also Read: Gold Rush Can Make Prices Reach $7,000 an Ounce: Prediction

Local currencies such as the Chinese Yuan, Japanese Yen, and the Indian Rupee were hammered by the US dollar. Even leading currencies like the Sterling Pound received a beating against the USD despite being the second most traded currency. The de-dollarization agenda seems to have little to no effect on the US dollar as it charts its own course in the markets.

What De-Dollarization? The US Dollar Climbs Above Adversity

De-dollarization agenda is put to the test as local currencies like the yuan, yen, and rupee are falling to new lows. China, Japan, and India had gone the de-dollarization path to make their local currencies yuan, yen, and the rupee stronger.

Also Read: $100 Oil per Barrel Possible as Middle East Tensions Rise: Citi Group

Additionally, currency investors believed in the USD’s prospects and purchased it at every dip in 2024. This cemented the USD’s resistance at every price level making it bounce back harder.

The development spelled doom to the yuan, yen, and rupee as the US dollar trounced above all local currencies. While the de-dollarization threat is real, the US dollar is not a paper tiger that folds like a card and diminishes. It packs a punch much harder whenever it falls to new lows giving local currencies a run for their money.