Amazon and Nvidia AI stock investors are fascinated right now with these two tech giants as they continue to battle for the top spot in artificial intelligence. While Nvidia currently leads with its impressive growth and that massive $2.3 trillion valuation, Amazon’s clever strategic AI investments and incredibly diverse business model hint at what could be a major leadership shift by 2030. At the time of writing, the e-commerce leader’s long-term vision, along with its dominant AWS cloud services, creates a really compelling case for future artificial intelligence stock growth that might eventually leave Nvidia in the dust.

Also Read: Chainlink (LINK) Vs. TRON (TRX): Which Is Better For This Dip?

Why Amazon’s AI Investments Could Outpace Nvidia by 2030

Amazon’s Strategic AI Advantage

Amazon’s stock analysis reveals that its approach definitely goes well beyond just e-commerce. The company has already invested a whopping $8 billion in Anthropic, and also developed their own custom silicon chips, while enhancing robotics automation across their vast fulfillment network. This multi-pronged strategy spans across retail, cloud computing, advertising, and logistics, which enables Amazon to implement AI solutions across so many different revenue streams.

Amazon’s 2030 outlook appears increasingly favorable as these early AI investments are starting to show some pretty promising results. AWS revenue growth has actually accelerated since the Anthropic partnership kicked off, suggesting that these investments are already bearing fruit though their full potential remains kind of unrealized.

Nvidia’s Growing Challenges

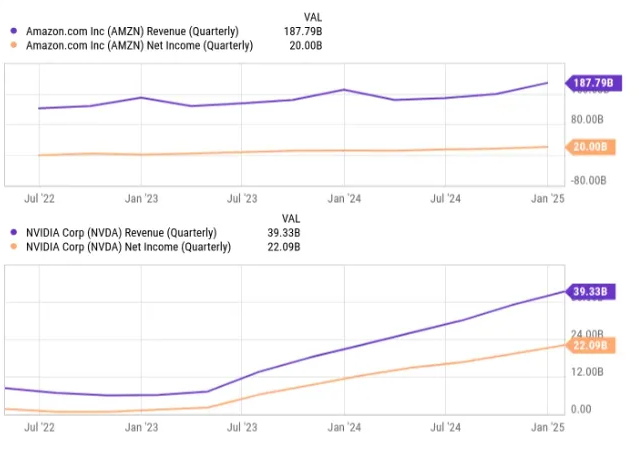

Nvidia’s growth prediction experts must account for the increasing competition in the market. Advanced Micro Devices has recently launched their competing MI300 accelerators, which are attracting major clients like Microsoft and Meta. At the same time, tech giants including Amazon are busy developing their own custom silicon, potentially turning the GPU market that Nvidia once dominated into more of a commodity.

Also Read: ‘Don’t Be Fooled by the Bounce’: BlackRock Predicts 20% Market Crash

This shifting landscape might force some pricing adjustments that could impact Nvidia’s revenue growth and profit margins. While the company’s new Blackwell architecture shows promise, maintaining that historical growth becomes really challenging as Amazon Nvidia AI stock competition intensifies and artificial intelligence stock growth spreads across multiple players in the field.

Future Growth Trajectories

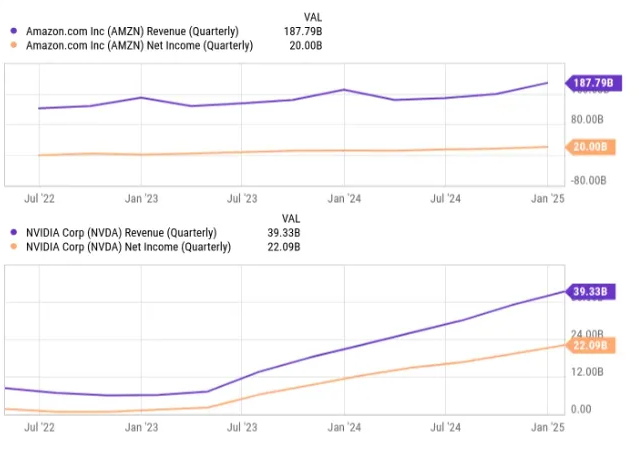

The Amazon vs Nvidia AI competition shows such contrasting approaches to the market. Nvidia has experienced explosive growth as the primary beneficiary of the initial AI infrastructure buildout. However, Amazon appears to be positioned right at the beginning of a new growth phase as its diverse AI investments finally mature.

Current financial metrics show that both companies trade at similar price-to-earnings ratios of around 30, despite their different market capitalizations. This valuation convergence suggests that investors can see comparable potential in both companies’ future prospects.

Also Read: Pi Network Eyes $3 as Price Rebounds 28% Amid Token Unlock Buzz

2030 Outlook

The future of AI technology presents significant opportunities for both companies. Nvidia’s growth prediction models suggest continued expansion but potentially at a somewhat decelerating rate as competition increases. Meanwhile, Amazon’s growth 2030 projections look increasingly favorable as the company leverages AI advancements across multiple business segments.

By 2030, Amazon’s broader implementation capabilities may provide superior long-term value in the Amazon Nvidia AI stock race. The company’s investments across various AI initiatives are building a solid foundation for sustained growth that could eventually surpass Nvidia’s more specialized market position, making it potentially more valuable for artificial intelligence stock growth investors.

The Amazon vs Nvidia AI competition will almost certainly intensify as both companies pursue leadership in the future of AI technology. However, Amazon’s diversified ecosystem may ultimately prove more resilient and adaptable to evolving market conditions than Nvidia’s hardware-focused approach.