Following a bug exploit that allowed a user to withdraw $800,000, Anchor Protocol’s issues continue to spiral. With ANC now close to falling below the daily 20-SMA (red) on the chart, the price was expected to decline further until it tags $0.086-$0.076 support.

Recently, several Anchor Protocol users took to Twitter to share their disappointment with the platform. Some claimed that they were unable to access their deposited UST while others said that the website was unresponsive. Although Anchor Protocol formalized an investigation, it was unknown whether the issue had been resolved at press time.

As the complaints were brought to light, it wasn’t surprising to see investors maintain a cautious tone. The price was down by 32% in the last three days, at a time when most other alts were recovering from their lows.

Anchor Protocol – A brief run back

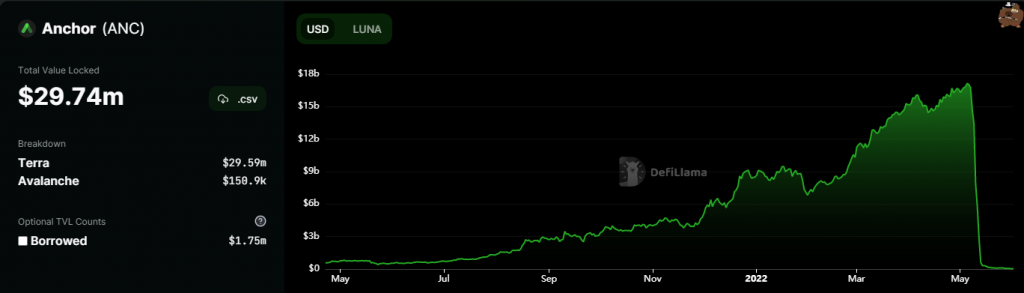

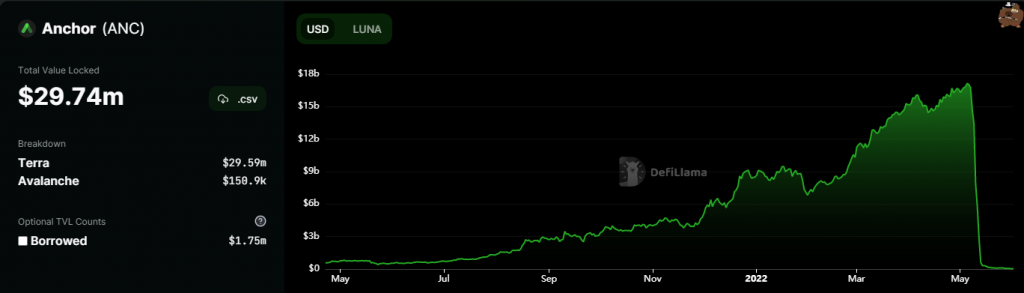

Part of the Terraform Labs, Anchor Protocol is a DeFi tool that allows users to earn returns through depositing Terra UST on the platform. Several experts have claimed that UST’s biggest use case comes from Anchor Protocol. This was evident as up until April, 72% of the UST circulating supply was locked in the DeFi tool. However, following the UST-Terra collapse, the narrative changed completely.

As of April, Anchor Protocol was one of the largest liquidity providers in the market, with a Total Value Locked of $17 Billion. However, as users dumped UST following its dep-pegging against the US dollar, the TVL became a shadow of its former self. At press time, the TVL hovers around $30 Million, down by 82% from its peak. Several reports even made rounds that Anchor Protocol was one of the reasons why the LUNA-UST collapse happened in the first place.

ANC Price Prediction

With FUD driving ANC below its daily 20-SMA (red) on Wednesday, the sell-off could catch more steam in the coming days. A lack of near-term support levels meant that the market was vulnerable to a 63% decline before touching $0.086-$0.076- a relatively safer defensive zone on the chart. However, traders are advised to maintain caution until ANC tags its aforementioned support.