Gold prices fell today as traders lowered their expectations of an early interest rate cut from the Federal Reserve. Furthermore, US Treasury Yields delivered higher returns this month, pulling US stocks, commodities, and gold prices down. Spot price for the yellow metal fell 0.8% to $2,030.10 per ounce. Meanwhile, futures prices fell 0.6% to $2,037.70 per ounce.

Also Read: Analyst Who Correctly Predicted Gold Prices Gives New Target for 2024

Traders have their focus on the upcoming consumer price index (CPI) data for December, due this Thursday.

Will gold prices pick up after the CPI data?

The US CPI data will follow a strong payroll report. Due to a strong payroll report, traders expect inflation to have increased. An uptick in inflation may lead to the Fed halting or pushing interest rates, but no cuts. The Fed has said that sticky inflation data and strong labor markets would keep it from cutting rates too early.

Also Read: BRICS: Central Banks Record Gold Buying a US Dollar Defense

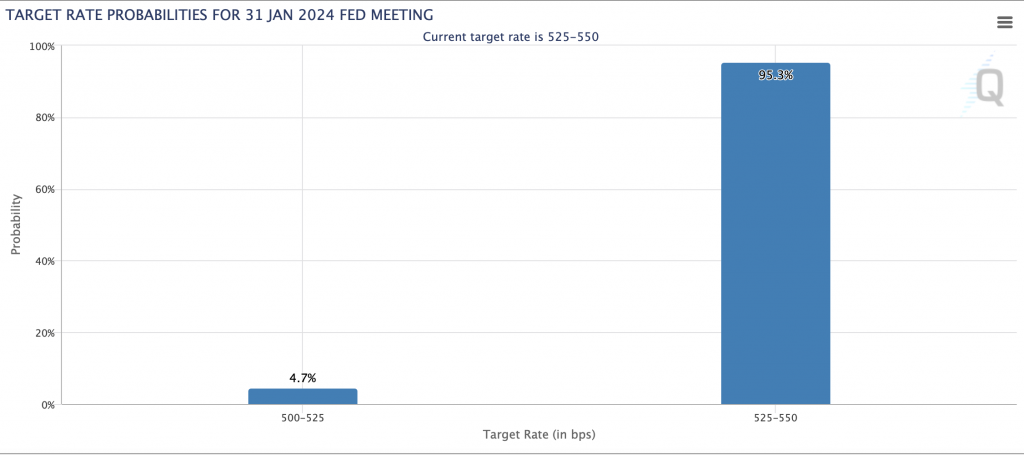

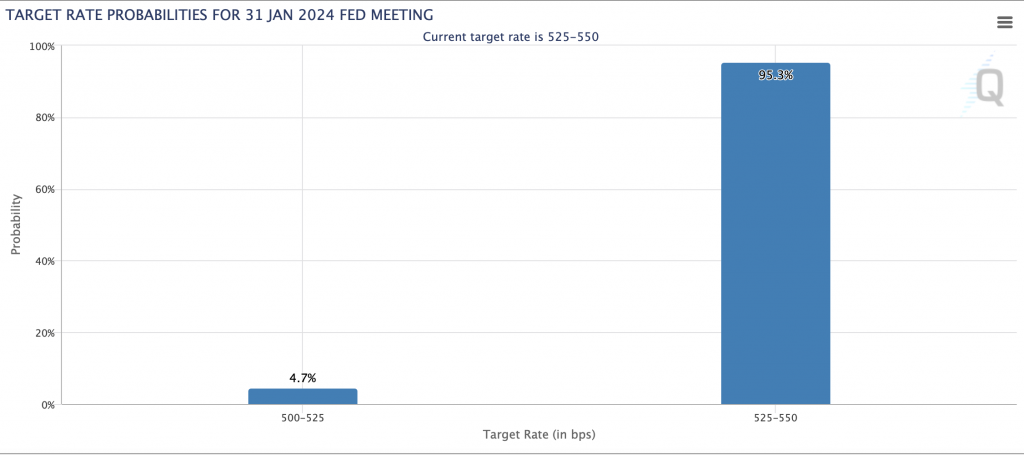

According to the CME FedWatch Tool, there is a 95.3% chance of interest rates hitting 525-550 basis points. Meanwhile, only 4.7% anticipate interest rates to hit 500-525 basis points.

Gold prices will likely take a hit from the Fed’s “higher for longer” approach regarding interest rates. Rising interest rates took a toll on gold prices for most of 2023. Nonetheless, the Fed may cut rates later this year. However, analysts at ING pushed back their expectations for an interest rate cut from March to May.

If interest rates go down later this year, we may see an uptick in gold prices. However, the Fed will consider cutting rates only if inflation figures drop. US inflation fell to 3.1% in November, down from 3.2% in October and 3.7% in September. Despite the inflation cooling over the last few months, the figure is still above the Fed’s 2% target.