There is very little to be optimistic about Bitcoin right now. The price continues to consolidate at around ~$20,000 and several on-chain indicators are turning bearish. While the long-term market indicates further decline, there might be some form of temporary respite over the next week. Few signs are suggestive of recovery, and that might lead to a potential bounce over the weekend.

Active Addresses rise to the rescue?

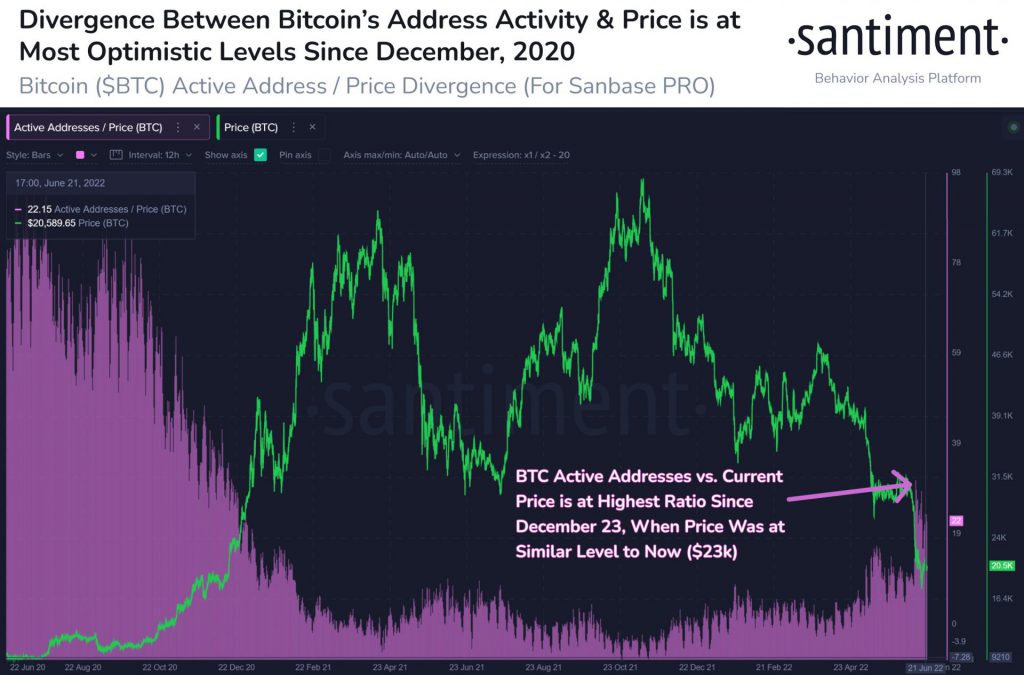

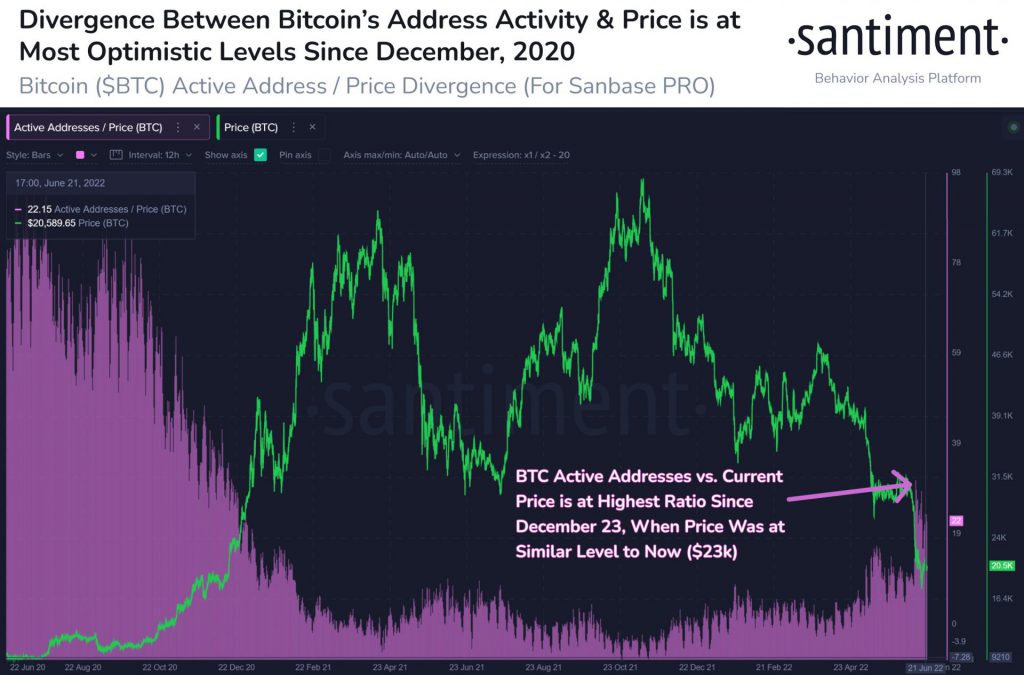

According to Santiment, the amount of Bitcoin unique addresses that are presently interacting within the network has risen. This is positive reinforcement for a bullish rally and a similar divergence was last formed in December 2020. During the same time, BTC peaked over its 2017 high of $20,000.

Another bullish sign that was observed included Coinbase outflows from Bitcoin whales. At press time, the average BTC outflow on Coinbase reached a 9-year high. However, it is important to note that their average inflows were significantly high as well.

In contrast, miner selling pressure has continued to rise and some analysts were expecting a miners-influenced capitulation period. Keeping that aside for the moment, BTC’s price may react in the following way.

Bitcoin Moonshot and back?

Now, moonshot might be a term used out of context in this scenario, but a re-test on the $23,030 resistance would also be welcomed. At the moment, BTC‘s price is recovering on an incline resistance(yellow line) but the scenario will majorly improve if the asset jumps above the aforementioned resistance. Following a strong rally, a lack of resistance could shoot its valuation just below $30,000.

While the asset would remain more than 50% behind its all-time high, there will be some reduction in losses. Historically, the price range between $17,000-$20,000 has become one of the most heavily traded ranges in BTC’s history.

Over the week, Bitcoin could possibly swing either way and the weekend would be a crucial time to plan trade strategies around the largest digital asset. Yet, it is important to keep in mind that the market remains bearish and risk management is foremost important for investors.