The crypto market has noted a moderate recovery over the past day. While Bitcoin noted a 1% incline in the last 24 hours, Ethereum and other top Altcoins like Chainlink fetched slightly higher returns. Consequentially, the crypto market cap was hovering close to $970 billion at press time, up by 1.4% when compared to yesterday.

Cryptos on radar: LINK, AAVE, MATIC

With no clear directional bias being established yet, market participants have gradually been cashing out profits from their altcoin investments. Take the case of LINK and MATIC itself. The ratio of on-chain transaction volume in profit to loss for both the cryptos has been hovering above 1 [to be precise, at 1.26], confirming the said behavior pattern.

For DeFi token AAVE, on the other hand, the profit:loss transaction ratio stood below 1, at 0.59. And as illustrated below, AAVE corrected after profits were booked by its investors.

Given the current market sentiment, if Bitcoin stabilizes, then the said tokens can continue rallying. Elaborating on the same, one of Santiment’s recent tweets noted,

The early week price rises have led to high profit-taking levels for Chainlink, Polygon, and Aave. Typically, these can be some short-term top signals, but if accompanied by stability from Bitcoin staying over $20k, there could be room for growth.

Profit booking is usually not a welcoming sign, for hinders price growth. If viewed the other way round, however, it marks the exit of weak hands and prepares the environment for a more sustainable rally.

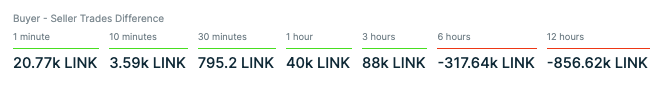

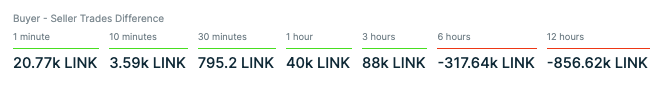

At press time, participants remained divided. For all three cryptos, sellers remained persistent on elongated time frames. On short time frames, however, buy trades were higher than the sell trades.

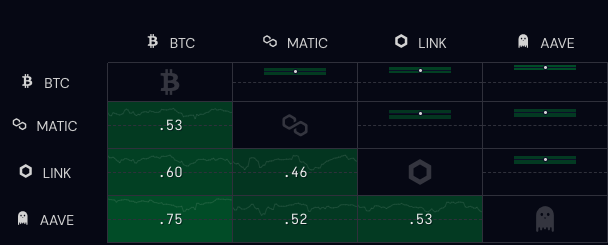

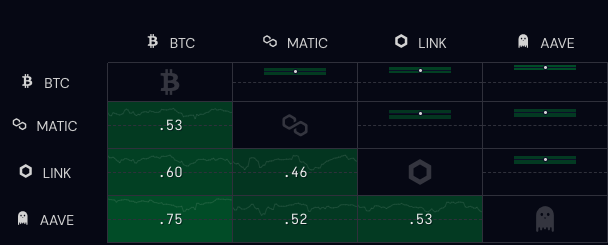

The said cryptos share a positive correlation with Bitcoin. Per data from CryptoWatch, the same stood at 0.53 for MATIC, 0.60 for LINK, and 0.75 for AAVE, re-emphasizing why it is essential for the largest crypto to stay afloat to sustain the post-profit-booking rallies for the said tokens.