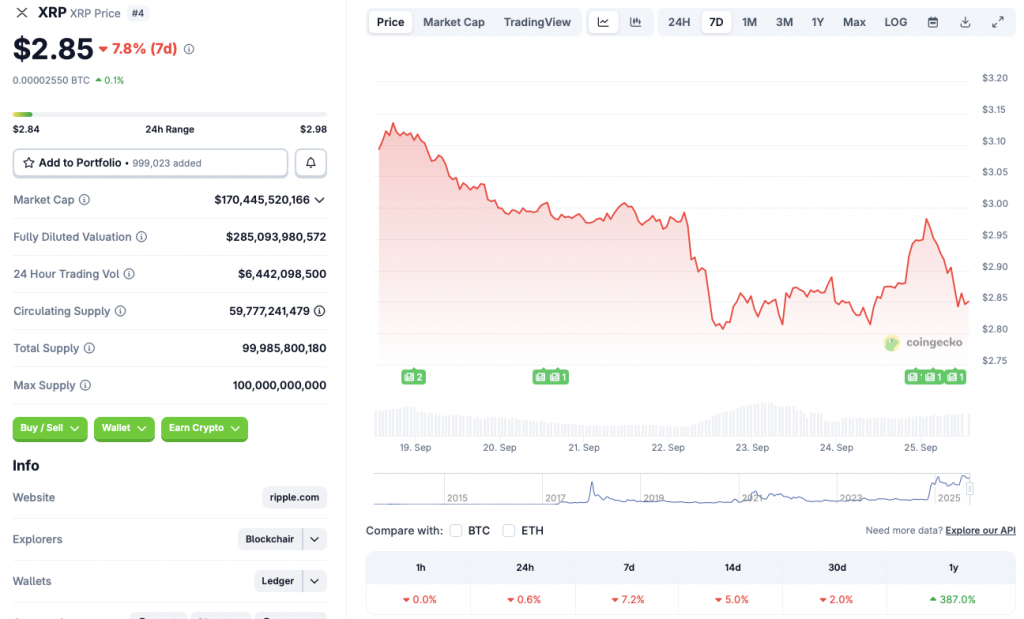

XRP had a bullish start to the year, breaching the $3 mark in January for the first time in seven years. The popular crypto also rose to a new all-time high of $3.65 in July. Since its peak, XRP has seen a gradual price dip. According to CoinGecko, XRP is down 0.6% in the last 24 hours, 7.2% in the last week, 5% in the 14-day charts, and 2% over the previous month. XRP’s latest fall comes despite the SEC approving the Hashdex Nasdaq Crypto Index US ETF to include the asset in its portfolio, according to an X post by NovaDius Wealth President Nate Geraci.

Why Is XRP Falling Despite the SEC’s Nod for Hashdex Nasdaq ETF?

XRP’s latest price dip is likely due to the larger market correction. Bitcoin (BTC) has dipped to the $111,000 price point, and other assets are following its trajectory. The market-wide dip could be due to uncertainties around the US monetary policy. Investors are most likely diverting their funds to the stock market and gold, both of which are seeing record numbers.

XRP’s correction is also surprising, given that the Federal Reserve recently announced a 25 basis point interest rate cut. Interest rate dips usually lead to investors taking on more risks. However, market participants seem to be taking a step back from risk-heavy assets.

Despite the correction, there is a high chance that XRP will recover the $3 price level over the coming weeks. October is considered bullish for the crypto market, with many calling it “Uptober.” Moreover, the Federal Reserve is expected to roll out another interest rate cut next month. Both developments could lead to the market recovering its losses.

Also Read: Traders & Whales Buy 30 Million XRP After Price Fell To $2.8

On the ETF side of things, there is a high chance that the SEC will approve at least one XRP ETF sometime this year. The financial watchdog has taken a bullish stance on the crypto industry, with Chair Paul Atkins vowing to make the budding sector thrive in the US.