No currency can replace the U.S. dollar as the world’s dominant reserve currency right now, according to recent IMF data that’s showing its continued strength despite all the growing challenges we’re seeing. While the greenback’s share of global reserves has actually declined from around 70% back in 2000 to about 58% at the time of writing, alternatives including the yuan and also cryptocurrencies face some pretty substantial barriers amid ongoing market volatility and various security risks in the financial system.

Also Read: China’s 5.4% Growth vs U.S. 2.4%: Why Trump’s Trade War Backfired

U.S. Dollar’s Continued Dominance Amid Market Volatility and Security Risks

The U.S. dollar still accounts for approximately 96% of invoicing across the Americas and also around 74% in Asia despite active currency replacement efforts by China and Russia. No currency can replace the U.S. dollar’s established financial infrastructure and global trust in the near term, especially with the current market volatility we’re experiencing globally.

China’s Yuan Ambitions Face Structural Challenges

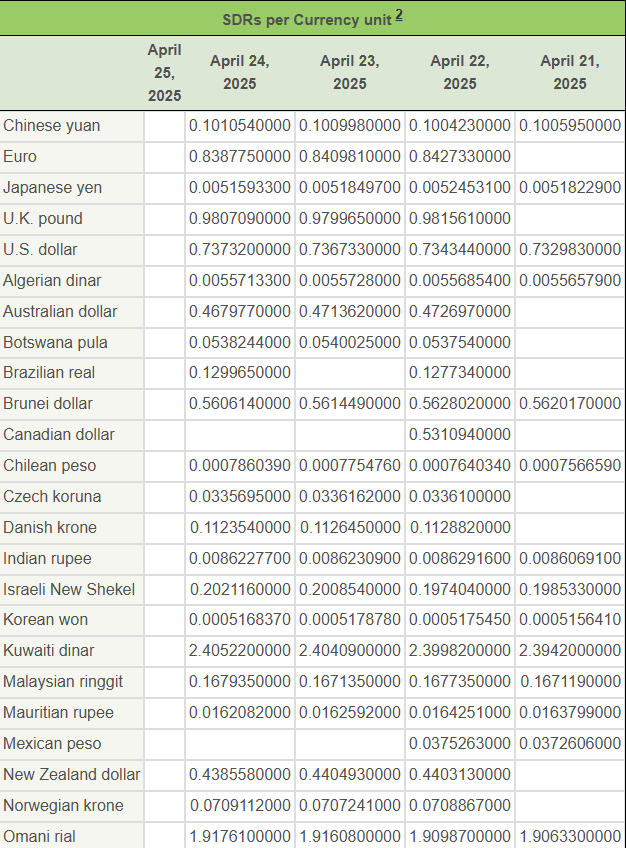

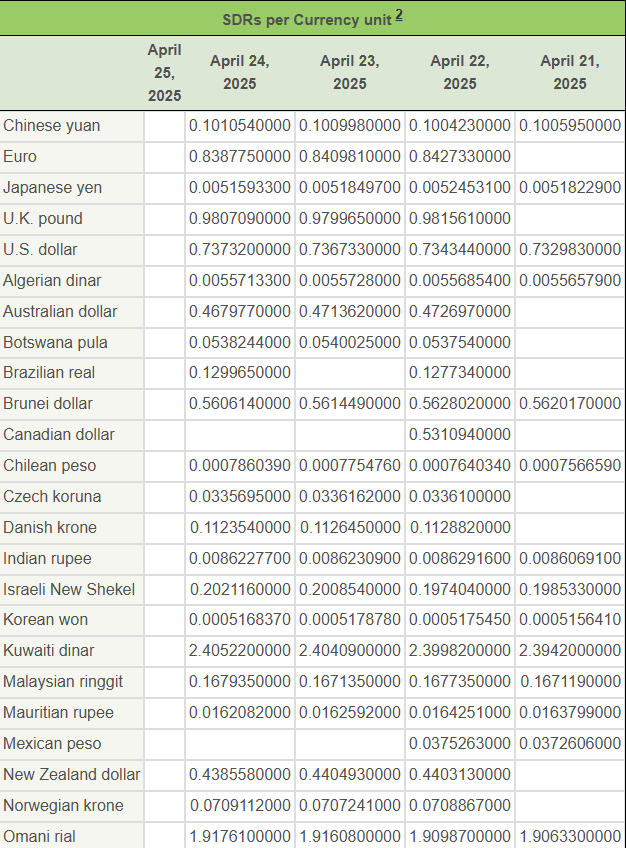

The yuan represents only about 2.7% of global foreign exchange reserves compared to the U.S. dollar’s 58%, which really highlights the significant gap that any currency replacement would need to overcome. The yuan faces several hurdles due to China’s strict capital controls and also their limited market openness, creating additional security risks for potential investors from around the world.

Professor Bary Eichengreen, International Economist at UC Berkeley, stated:

“Every leading international and reserve currency in history has been the currency of a republic or democracy, where there are checks on arbitrary action by the government.”

Market volatility in emerging economies further complicates the yuan’s prospects of replacing the U.S. dollar in international transactions and central bank reserves anytime soon.

The BRICS Currency Alternative

BRICS nations have discussed creating an alternative currency for quite some time now, but no currency can replace the U.S. dollar without addressing the fundamental economic differences between the member states. The diverse economic structures within BRICS make establishing any kind of common monetary policy exceedingly difficult amid the existing market volatility that affects these economies differently.

Also Read: Is It Too Late? What $100 in Dogecoin Could Grow Into by 2035

Dollar Alternatives Face Significant Barriers

The Carnegie Institute report stated:

“Russian politicians often mistakenly claim that the yuan’s international expansion foreshadows the dollar’s collapse. In fact, higher yuan internationalization means that the Chinese government needs more dollar reserves.”

The growth of alternatives serves to underline currency replacement challenges because minor alternatives usually deepens dependence on U.S. dollars by creating new dependency patterns. The combination of security challenges together with regulatory unpredictability currently forces digital currencies into a position where they cannot threaten U.S. dollar control.

Crypto Regulatory Uncertainty

Cryptocurrency markets face persistent regulatory uncertainty and major security risks that continue to prevent institutional adoption across the board. No currency can replace the U.S. dollar without stability, particularly when crypto alternatives experience extreme market volatility that central banks simply cannot accept for their official reserve holdings.

Also Read: Meta Platforms: Why Jim Cramer Is Bearish on META Stock

The Dollar’s Enduring Position

Despite all the challenges and talk about alternatives, the U.S. dollar remains pretty much unchallenged by other options right now. As economist John Maynard Keynes famously quipped:

“In the long term, we’re all dead.”

This perfectly captures why no currency can replace the U.S. dollar in the near future – while change may eventually come someday, immediate alternatives remain unviable due to persistent market volatility, growing security risks, and ongoing regulatory uncertainty in the global financial system.