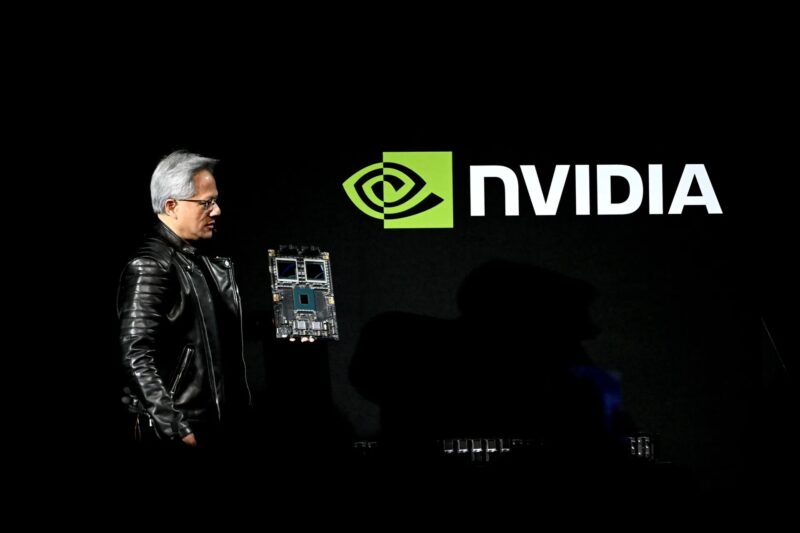

Nvidia (NASDAQ: NVDA) continues to sit at the top position of the AI chip boom in 2026. The company now powers everything that’s required to support the next-gen technology. This includes data centers, cloud computing, and generative AI models, among others.

Though Microsoft, Amazon, and Alphabet are trying to catch up, Nvidia remains undisputed in the 2026 AI chip boom. It is the leader in the segment, and even tech giants rely on its services. The company’s dominance comes from its near-monopoly in the high-performance GPU industry.

High-performance GPUs are also used to train and run large language models, which other tech giants depend on. Titans such as Meta, Amazon, Alphabet, and Google are spending billions, but Nvidia’s AI chips remain their preferred choice in 2026.

Also Read: Strategy’s $100 Resistance: BTC to Rebound, Send MSTR Higher?

What Can Stop Nvidia’s AI Chip Run in 2026?

Nvidia’s AI chip domination in 2026 is not free of risks, as the market can turn at any point in time. One major threat is the competition from its rivals, AMD and Intel. Both companies are accelerating their AI chip development, but are taking a new route. They are now investing in custom-built chips to take on Nvidia and reduce its dependence.

However, if this alternative grows faster than expected, Nvidia’s AI chip domination could be challenged. Another risk sounds like a double-edged sword that is ready to cut both ways. Higher spending in AI is putting off investors, but lower spending erodes industry confidence. The company has to balance between not tilting to any side, which poses danger.

Markets are also closely watching how the next-gen technology is playing out. If it plays out that AI would fizzle out like the Metaverse concept, Nvidia’s chip supremacy will be erased. In conclusion, the top-most spot in the technology market is permanently reserved for no one.