An insipid day of trading in the crypto market did not deter investors from parking their funds into HEX, which continued its winning streak for a third straight day. With its price now placed above a bullish pattern, investors could be rewarded with another 17% profit before bears take control.

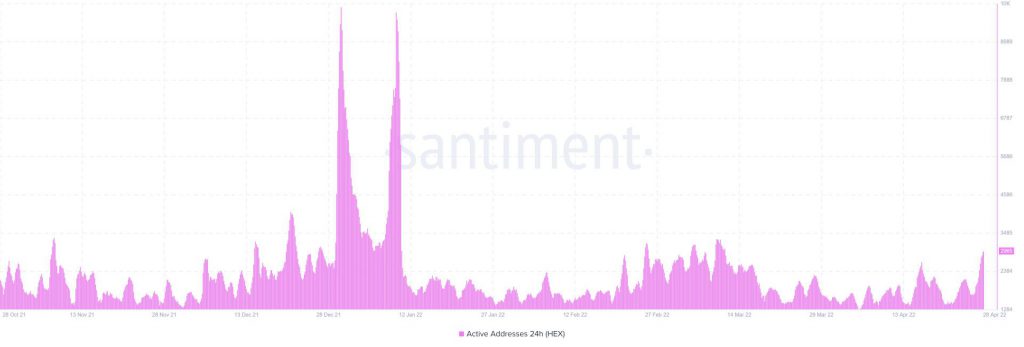

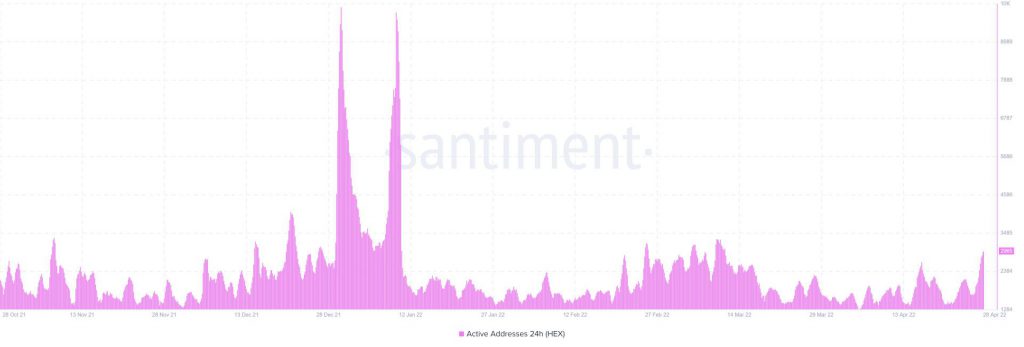

Although HEX’s faced a tumultuous period last couple of months, there were a few reasons to be bullish on its short-term outlook. HEX’s 4-hour candles traded above the 50 (yellow), 20 (red), and 200 (green) simple moving averages while the price had broken above an ascending triangle. With daily active addresses also improving, HEX’s short-term outlook was looking favorable.

HEX Short-term VS Long-term Disparity

Looking at the chart, HEX’s rise was supported by a spike in daily active addresses, suggesting that its daily gain was well backed by users interacting with the network and not just hype trading. Normally, this is a good sign for organic growth.

Like with most DeFi protocols, a healthy Total Value Locked (TVL) is a good barometer for success. In HEX’s case, however, a weak TVL threw a spanner in the works. The TVL count has dwindled since January as users have been less keen to stake their tokens on the protocol. Although the figure has improved a notch since March, it was still 71% lower than its September peak of $30.7 Billion.

Short-term Investors Can Still Profit

With all fronts to rise equally, the long-term outlook for HEX was uncertain. Even so, short-mid term investors can still make bullish bets. The price broke above an important ceiling at $0.1400 and there were minimal hurdles up to $0.1640. Should the broader market remain at risk in the coming days, HEX’s value could spike by an additional 17%.

Those looking to ride the HEX wave can wait for a retest of $0.1400 and enter at the same price level. Take-profits can be set at $0.1640 while a stop-loss at $0.1350. The trade setup carried a 4.18 risk/reward ratio.