Barring a couple of instances towards late December, Bitcoin’s price has largely remained under the $50k benchmark over the past four weeks. The new year, however, started on a slightly higher note, with the king-coin registering a green candle on its daily price chart.

The short-term respite, to some extent, did seem to be the beginning of a trend reversal. BTC, nonetheless, chose to continue treading on the downtrend path. At the time of this analysis, the coin was seen trading at the brink of $47k.

Is Bitcoin reaching a level of trading exhaustion?

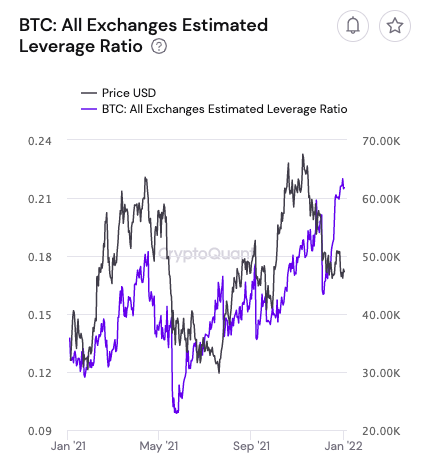

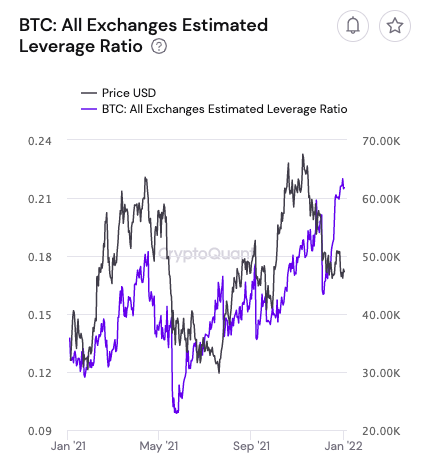

Analyzing the state of a couple of key metrics would help us in answering the question with clarity. At press time, the estimated leverage ratio was seen hovering around its yearly highs. This means that the Bitcoin market is currently overheated. High leverage usually acts as a double-edged sword.

Nonetheless, as far as Bitcoin is concerned, whenever the leverage ratio has peaked, the price in most cases subjected itself to downtrends. In the recent past, the aforementioned scenarios unfolded in the periods towards the end of November and September last year.

Silver Lining

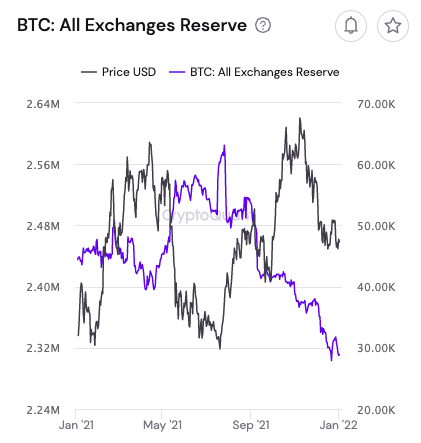

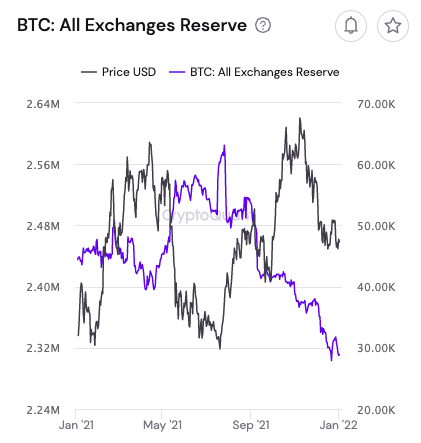

Towards the end of December, Bitcoin’s exchange reserve metric defied its downtrend and noted a substantial increase. However, after creating a local peak of around 2.334 million, it re-commenced its downtrend. The exchange reserve indicator highlights the amount of Bitcoin held in all exchanges’ wallets.

So, a rising number indicates an inflow. The same, more often than not, resonates with people disposing of their holdings. On the contrary, a downtick on this metric implies the movement of coins into private wallets and cold storage. The outflow, in such cases, indicates investors’ confidence.

So, if the downtrend becomes even more concrete and manages to nullify the recent uptrend, market participants can expect Bitcoin’s price to start inching higher. Else, a prolonged downtrend is most likely on the king coins cards.

Key levels to watch out

Alongside the state of the metrics, market participants need to keep an eye on Bitcoin’s price chart too. Currently, the king-coin has been trading under its moving average, which ain’t really a healthy sign.

Nonetheless, the region around $45.4k has acted as strong support for Bitcoin since December. Hence, it remains crucial for its price to continue trading above the aforementioned level to eliminate a downtrend to the lower $40k range.

Going forward, if bulls manage to reclaim an upper hand, then BTC would be tested around $48.6k and $52.1k.