A recent bear attack on the crypto market left every asset bleeding. Bitcoin [BTC], after witnessing a rather eventful 2021, recorded a major setback. The bears were crueler than ever. As BTC inched closer to $20K, the magnitude of fear in the market surged. Amidst this, analysts from a prominent on-chain metrics platform, Glassnode addressed the existing notion in the market.

During press time, Bitcoin was trading for a low of $20,220 with a 7.15 percent drop over the last 24-hours. The entire weekend as well as this week cost BTC a loss of 30 percent. While some believe that BTC would encounter an even steeper fall, a few others were rather positive about the crypto. Meanwhile, Glassnode analysts suggested that the ongoing bear market was veering into a deeper and darker phase than the previous bear market.

In a recent note, the analysts wrote,

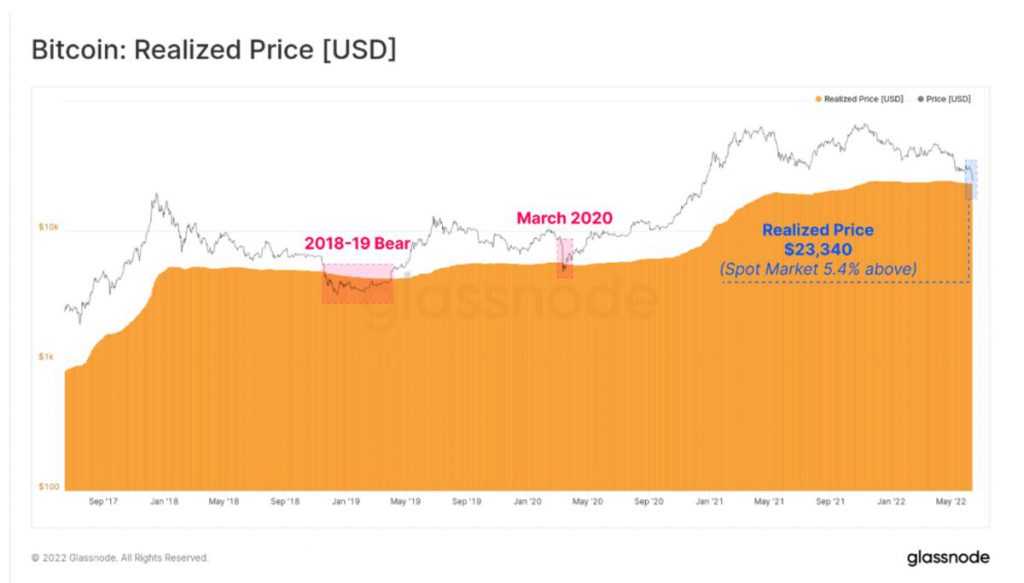

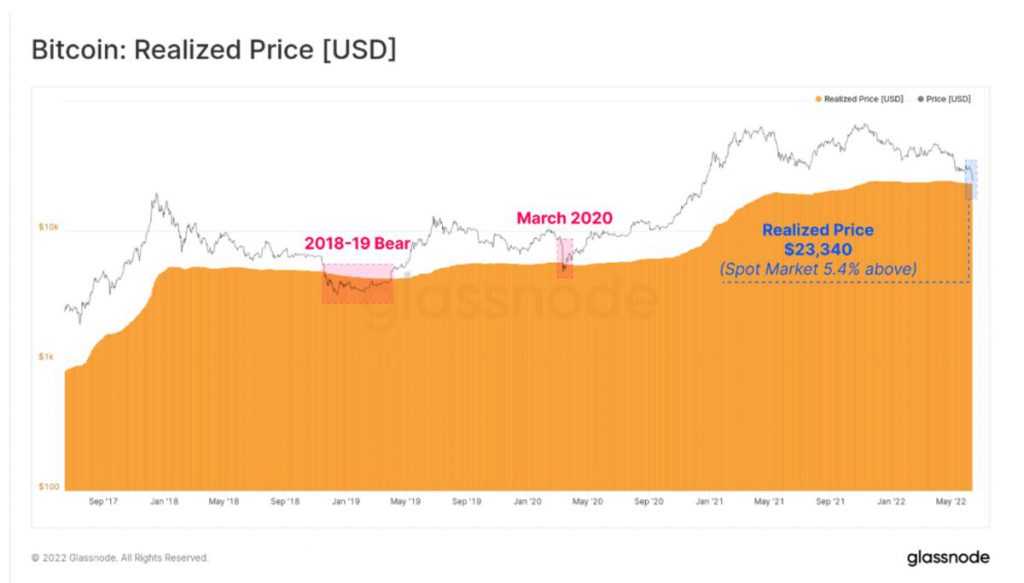

“The current bear market is now entering a phase-aligned with the deepest and darkest phases of previous bears. The market, on average, is barely above its cost basis, and even long-term holders are now being purged from the holder base.”

In addition to this, the Glassnode analysts revealed that Bitcoin was trading about $1,000 below its realized price and at press time it was as low as $3000.

With Bitcoin at this level, the sentiment in the market inclined toward “extreme fear.” The Fear and Greed Index of the world’s largest cryptocurrency was at 7.

Here’s how the crypto community is reacting to the bear market

The bear market has been harsh this year. The inflation-induced bear market has been costing people their jobs. An array of crypto firms decided to let go of numerous employees as they encountered extreme loss as bears took the front stage.

A few others decided to humor to keep up with the bloody market.

While several questioned Bitcoin’s roles as a safe haven, a few others were preparing for any further falls.