The crypto market has not been in quite good shape of late. The trends over the last couple of days have been quite indecisive. On Tuesday, for instance, most coins from the space tumbled, while on Wednesday, they posed a striking recovery. However, the bearish sentiment had started gaining steam, yet again, on Thursday. At the time of press, the cumulative market cap merely reflected a value of $1.71 trillion and was down by more than 4.7% on the daily time frame. As a result, most altcoins, including Ethereum had witnessed sharp dunks.

‘Tis the season to be bearish fa la la la la la la la la?

Well, the alt leader’s state has deteriorated substantially over the past few hours. On Wednesday, this token was trading at a level as high as $2753.5. However, at the time of press, during the early hours of Thursday, Ethereum was down on its knees to $2378.6.

On the 4-hour timeframe, the token has been trading within a descending channel for more than a week. Now, it’s on the verge of breaking below the lower trendline of the same structure.

There were signs of weakness all across the board – Ethereum was trading below its key averages [both the 50 DMA and the 200 DMA] on Thursday, the RSI had already dipped below 30 and the market was momentum deficit, for the cumulative volume traded across all exchanges was subpar.

Reality check: Where is Ethereum headed towards?

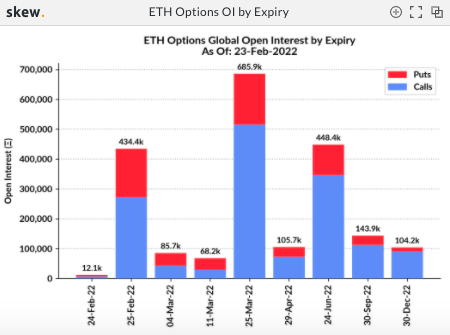

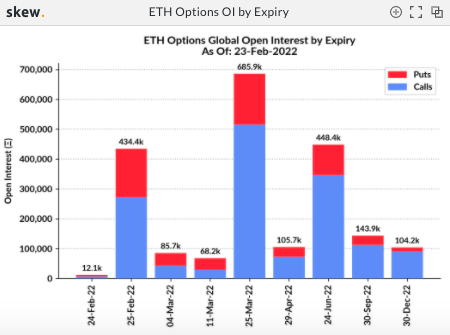

Keeping the state of affairs in mind, the odds of Ethereum witnessing a free-fall to the $1700-$1800 range is quite a possibility now. Amidst the evident bearishness, the Ethereum market is set to undergo a major options expiry tomorrow. As per data from Skew, the same involves 434.4k Ether, and at this stage, is one of the largest upcoming expiries.

As can be noted from the chart attached below, the trader sentiment remains to be divided, for there is a substantial number of both put and call contracts. However, a closer look would highlight that the latter, to a fair extent, is greater than the former.

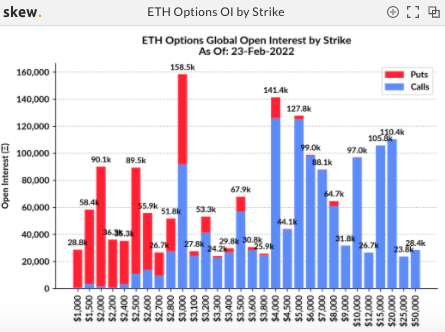

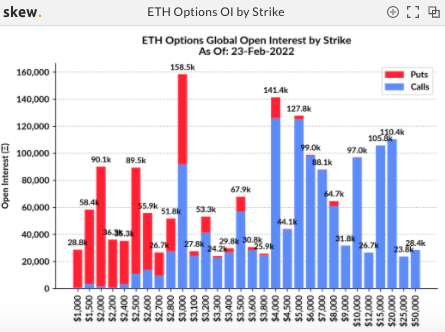

The strike price breakdown projected another interesting trend. Even though the chart seems to be dominated by blue bars, it should be noted that they all correspond to prices of more than $3k. The lower price band, on the other hand, is dominated by red bars or put contracts, and that’s what matters at this point.

Novel traders entering into the market today have been more inclined towards sell contracts when compared to buy. Per Skew’s current day data, a total of 8340 DBT contracts spread across three price ranges [$2500, $2300, and $2100] have been procured when compared to a mere 2954 call contracts at the $2700 strike price.

Given the fact that Ethereum’s current price is hovering around $2.3k and the odds of it dipping even further are higher than it recovering, the market could see another selling spree tomorrow. More so, because put traders would be triggered to exercise their option of selling their Ether. In such a case, the largest altcoin might end up creating new local lows going forward.