Ethereum (ETH) has experienced a tumultuous journey throughout the second quarter of 2024, characterized by remarkable surges and retracements. Presently valued at $3,376.56, it has rebounded significantly from its recent low of $3,056. However, amidst various market influences, including regulatory uncertainties, the pivotal question arises: Can ETH sustain its Q2 momentum?

Volatile Rallies and Corrections Define Ethereum’s Q2 2024

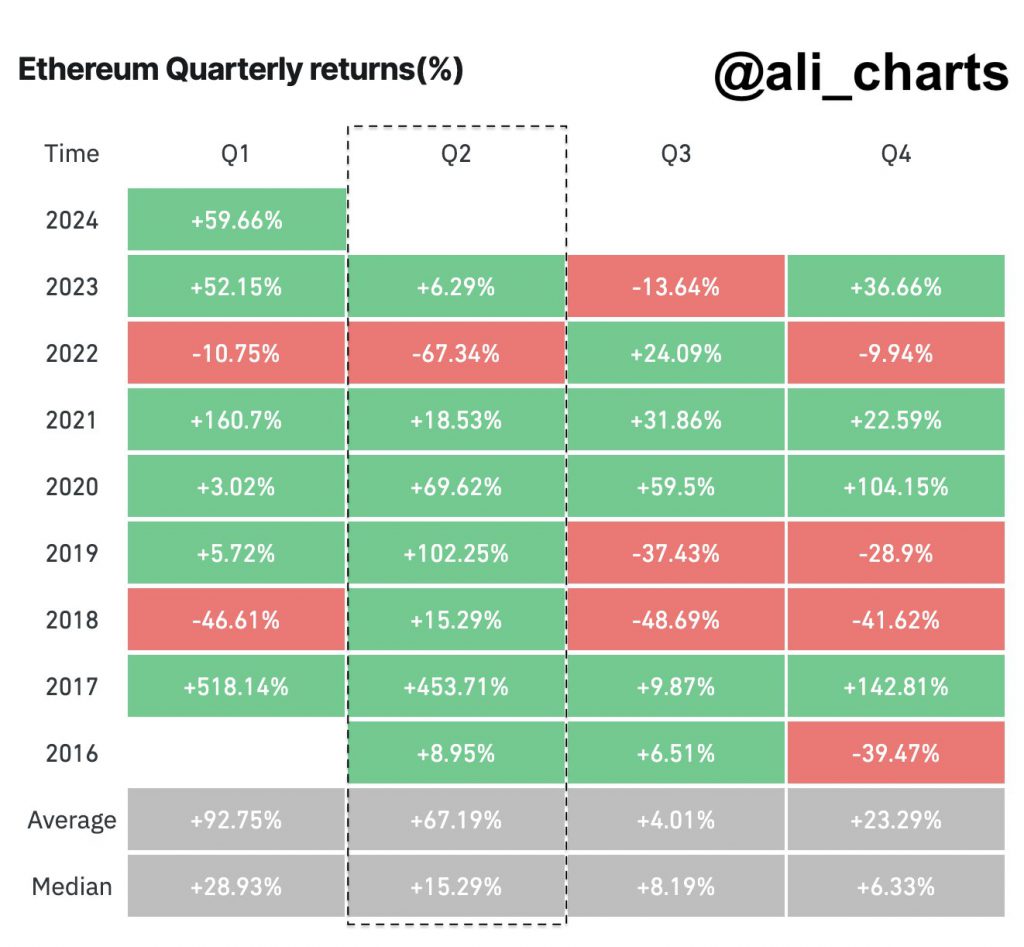

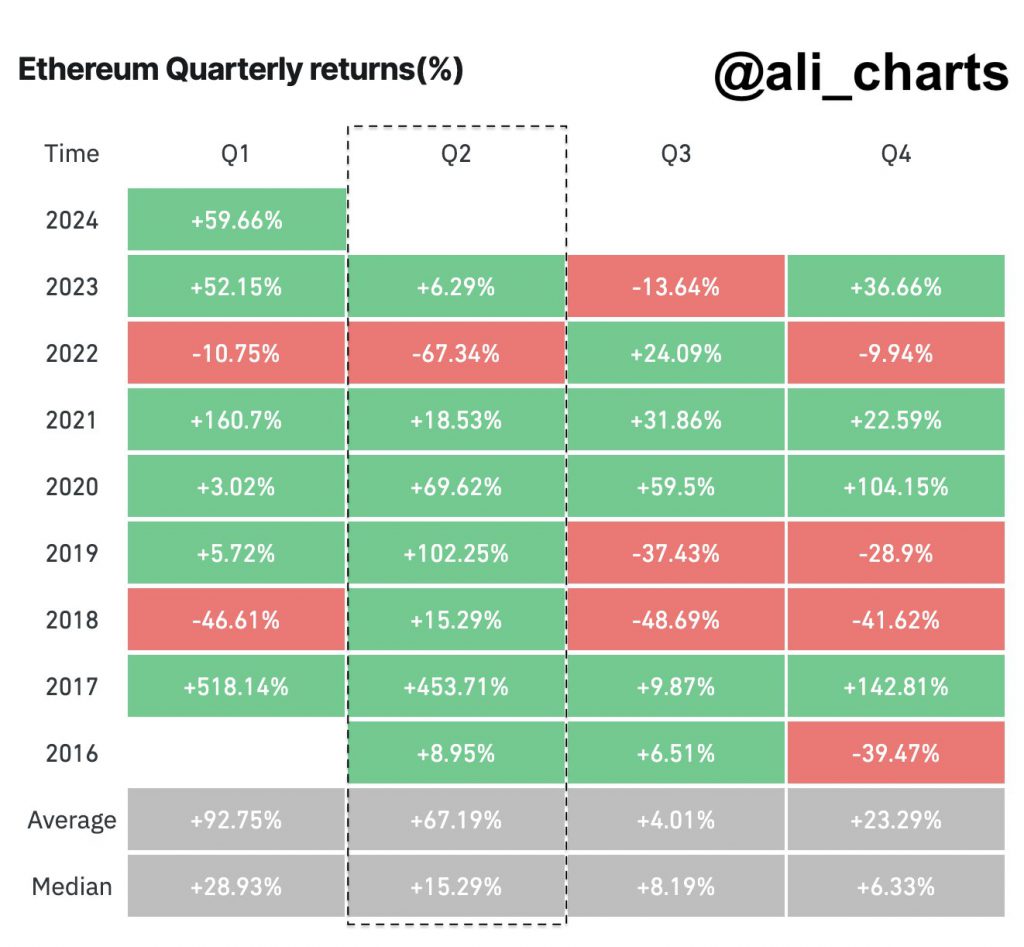

During the quarter’s onset, Ethereum witnessed an astonishing surge of 82% from Feb. 1 to March 12, reflecting a buoyant investor sentiment. This surge echoed the consolidation phase observed in late January, indicating Ethereum’s potential for notable growth. Notably, Ali Martinez, an analyst, has underscored the historically bullish nature of Q2 for Ethereum, further fostering optimism among traders.

Also Read: Fidelity Files for Spot Ethereum ETF With Staking

Regulatory Hurdles and Analyst Optimism Shape Ethereum’s Trajectory

Nevertheless, the cryptocurrency market faces challenges despite this positive outlook. A significant determinant of ETH’s trajectory is the potential delay in approving a spot Ethereum exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC). The introduction of such an ETF could facilitate institutional investment and propel ETH’s price. However, delays or regulatory obstacles in this process could result in market turbulence and uncertainty.

Contributing to the array of speculations are differing viewpoints from professionals in the industry. While Bloomberg analyst James Seyffart humorously boosted expectations by suggesting a 99% likelihood of an Ether ETF approval in May, his colleague Eric Balchunas took a more negative stance, estimating the chances at only 25%. Balchunas’ doubts are rooted in the absence of communication from the SEC, indicating a grim prospect for the approval procedure.

In light of these dynamics, cryptocurrency experts have devised price projections for ETH in April 2024. Based on past price fluctuations and market trends, the average ETH rate for April is anticipated to hover around $3,701.57. While this forecast inspires confidence in Ethereum’s performance, it’s crucial to acknowledge the cryptocurrency market’s inherent volatility. Forecasts suggest minimum and maximum price ranges for ETH in April at $3,657.54 and $3,745.59, respectively, highlighting potential gains and corrections.

In conclusion, ETH’s Q2 momentum in 2024 promises continued growth, buoyed by historical trends and positive analyst outlooks. Nonetheless, regulatory uncertainties, notably surrounding the approval of an Ethereum ETF, pose potential obstacles to its upward trajectory.

Also Read: Bitcoin & Ethereum Have $15B Worth of Options That Expire Today