The plummet of FTX dragged the entire market down. Even though Bitcoin [BTC] and several other assets survived the Terra crash, the market was forced to revisit previous lows. Amidst all of this, speculations about how Bitcoin, Ethereum [ETH], and the entire market were dead began surfacing. However, Ethereum whales and sharks were trying to restore hope in the community.

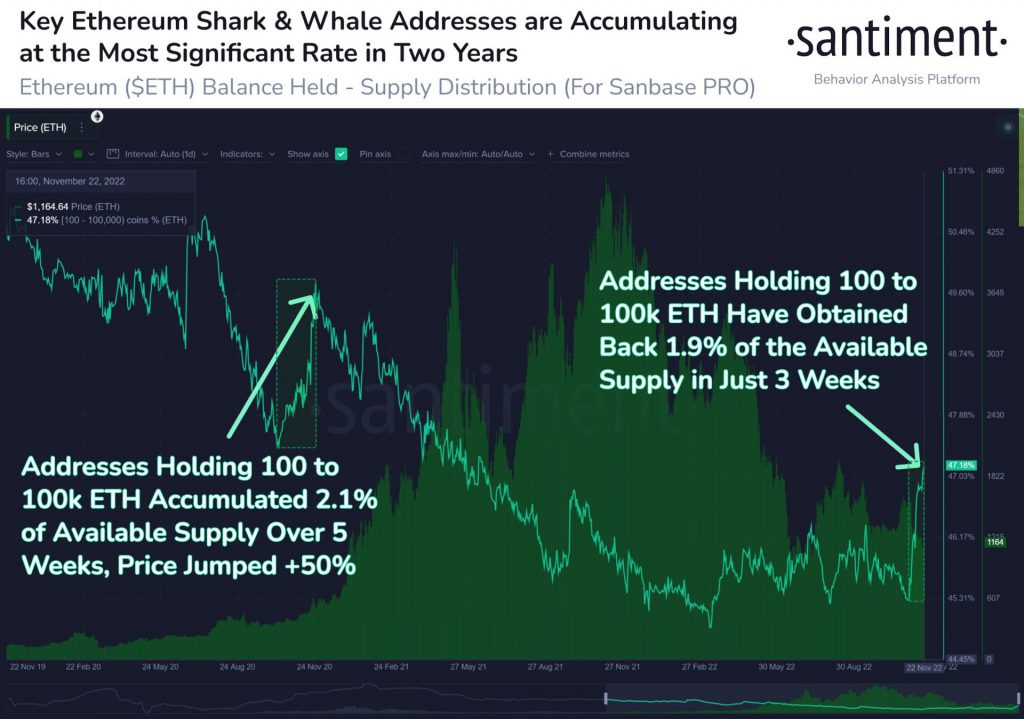

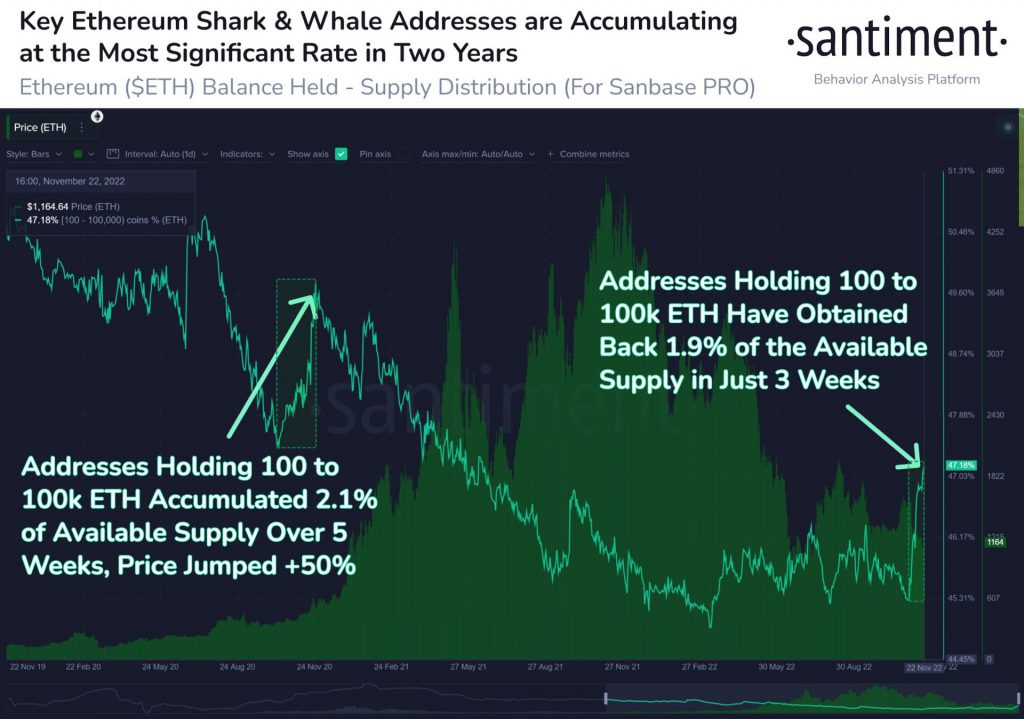

A recent chart curated by prominent on-chain analytics firm, Santiment highlighted how whales and shark addresses were pocketing ETH. These Ethereum whales and sharks reportedly accumulated 2 percent of the existing supply over the last three weeks.

Santiment further pointed out the occurrence of a similar pattern about two years ago. The aforementioned whale addresses amassed 2.1% of the supply in a span of five weeks instigating Ethereum to surge by over 50%. It stated,

“Ethereum’s active shark & whale addresses continue accumulating with prices less than a quarter of their #AllTimeHigh levels a year ago. In Oct/Nov 2020, these 100 to 100k $ETH addresses assisted in pushing $ETH to a +50% price rise over 5 weeks.”

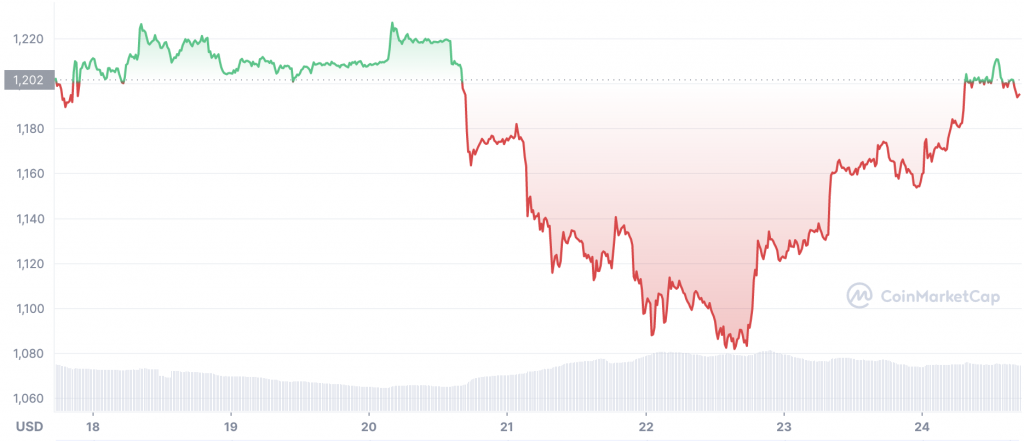

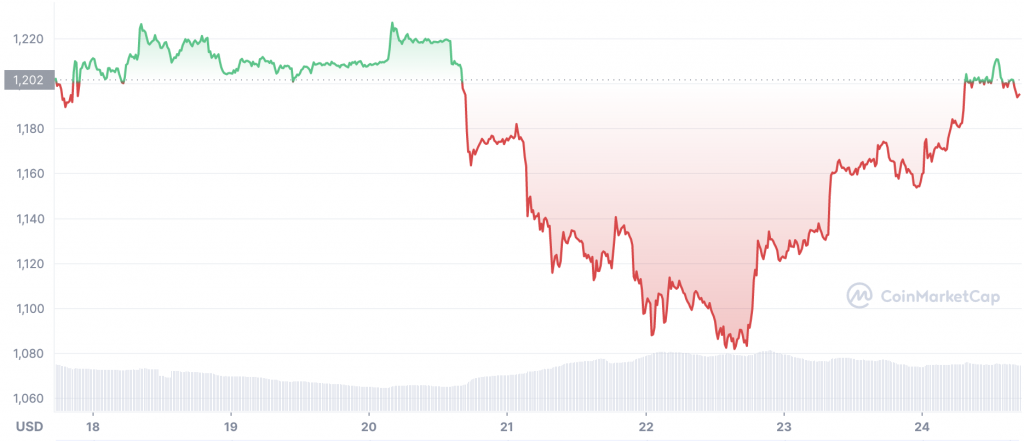

Earlier this week, Ethereum’s large whales that hold ETH worth $10.9 million to $1.09 billion increased their holdings. These whales reportedly added 947,940 ETH worth about $1.03 billion on November 22. It should be noted that this was the 5th largest single-day addition over the last year.

With the whales pouring significant funds into the network, the community speculated a possible boost to ETH’s price.

Here’s how Ethereum fared this week

With no major fluctuations in its price, Ethereum was trading for $1,195, at press time. Over the last 24 hours, the asset went on to bag 1.77 percent gains. Earlier this week, the asset dipped to a low of $1,081.14. However, earlier today, it managed to surge to a high of $1,227.84.

With most assets, including Bitcoin plummeting to their yearly low, Ethereum managed to stay afloat. With the whales elevating their holdings, they could be contributing to ETH’s presence above $1K.