Fantom has been the talk of the crypto town lately. The DeFi coin was at the center of Andre Cronje’s crypto hiatus and many were wondering whether it would be able to pull its weight in the crypto market. To diffuse such concerns, FTM has noted a timely 10% pump in a weak broader market and an extended recovery is definitely on the table.

Fantom Now On eToro

Yes, FUD can be painful for any project but Fantom was out to prove its critics wrong. The project bagged a listing on popular cryptocurrency trading platform eToro which not only expands Fantom’s digital footprint in Israel but also opens the doors to potential eToro’s 25 Million users.

Even though listings by themselves are responsible for generating long-term organic growth for any project, whales offered extra assistance. Data from Whalestats indicated that top Ethereum whales did not shy away from loading up on Fantom during its price decline. FTM was a part of the top 10 purchased tokens among the top 100 whales on 15 March, with an average purchase amount greater than that of Shiba Inu’s. Fantom was also among the most used smart contracts over the last 24 hours.

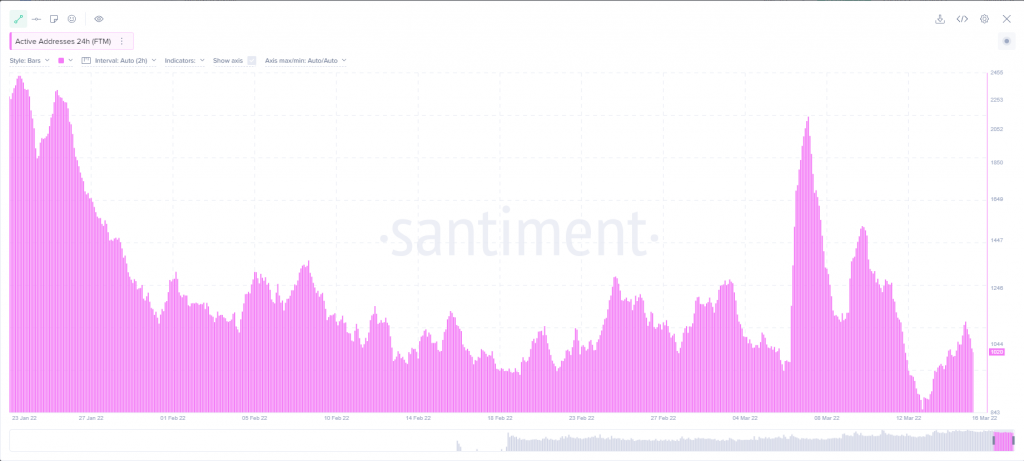

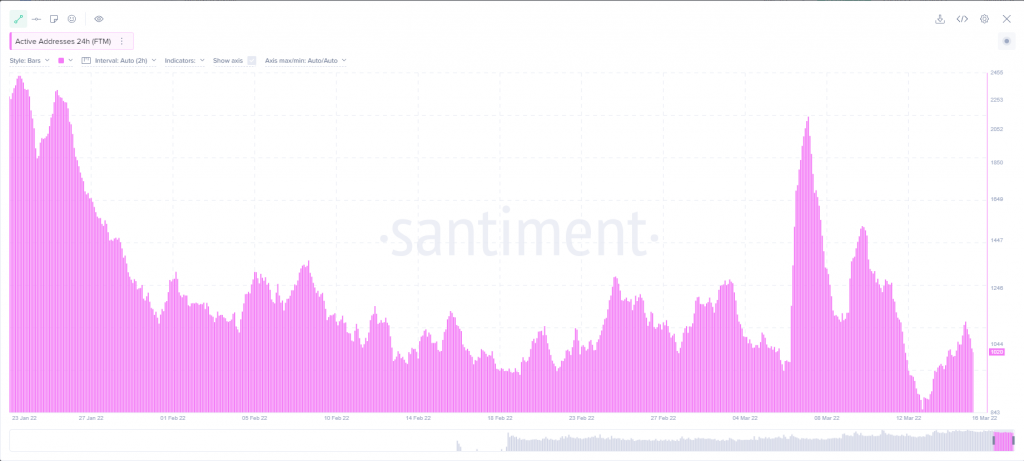

Daily Active Addresses Recovery

Daily active addresses can sometimes be an indication of where a trader’s mindset is at. A spike in DAA followed by a price decline is indicative of selling behavior. This was most notable between 6-8 March. FTM’s DAA increased sharply right after Andre Cronje’s crypto exit as investors dumped their FTM tokens.

However, the narrative was slowly changing. The DAA fell to a 5-month low on March 13 and picked up by 37% over the next few days. Since the rise coincided with FTM’s price hike, it was a clear sign that more addresses were now buying FTM tokens instead of selling them.

Fantom’s Price – Not Ghastly Anymore?

To answer whether FTM’s pump can lead to an extended recovery, it’s important to look at the chart. The daily chart showed that FTM regained its position within a major support area after a 10% pump on 15 March. This was a much-needed development for the bullish side as chances of a sharper rally are higher within important support zones. Should FTM hold above $1.15 over the near term, there is a good chance that investors would be rewarded with more gains.