Loopring’s LRC and Polygon’s MATIC are two of the many tokens whose correlation with Bitcoin has witnessed an uptick of late. The said metric was at its 30-day high for both the coins and reflected values of 0.91 and 0.95 at the time of press. Simply put, this means that the odds of LRC and MATIC mirroring BTC’s price movements in the days to come is substantially high, for their fates are now intertwined.

How are Loopring and Polygon individually faring though?

The state of the on-chain metrics for both the networks hasn’t been up to the mark of late. As can be seen from the chart below, the number of new and active addresses on Loopring peaked on 23 March, but couldn’t sustain there for long. At the time of press, merely 1.1k addresses were active, while the new addresses number stood much lower at 391.

As far as Polygon is concerned, the peak on this front happened pre-maturely on 9 March. The current numbers are evidently deflated [4.13k active addresses, 1.95k new addresses] when compared to the local peak [10.5k active addresses, 2.38 new addresses].

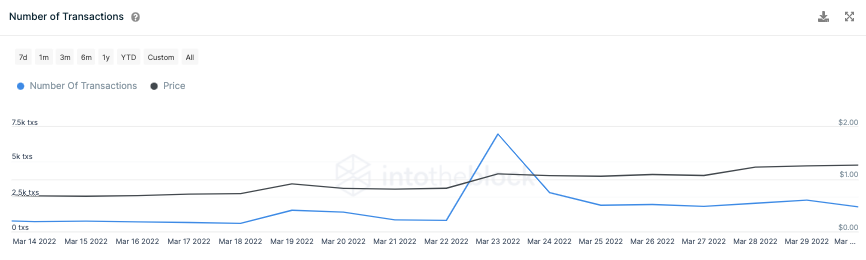

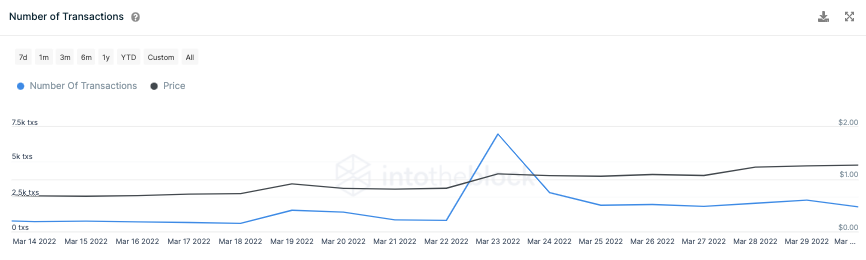

Parallelly, the number of transactions carried on on their networks too witnessed bumps on their charts recently, but have become flat of late.

On Polygon 5.4k transactions were carried out over the past day while the number was as low as 1.77k for Loopring. Looking at the said numbers, it wouldn’t be wrong to speculate that market participants’ interest w.r.t. Polygon and Loopring has been fading away.

So, when Bitcoin appreciates, the price boats of LRC and MATIC too would be lifted simultaneously, but the real challenge of sustaining up there would continue to haunt them. Thus, only when the state of the network-related metrics notches up, it’d make sense to expect a stronger growth phase.