Less than a day back it was reported that Ethereum whales have been accumulating MATIC tokens in anticipation of a potential rally. However, a few hours later, the pendulum started swinging more towards LINK, another crypto from the top 20 list.

Popular whale-wallet tracking platform WhaleStats, in a recent tweet, highlighted that LINK was one of the ‘hot’ picks and has been involved in a host of ”big transactions” of late. The platform’s tweet also noted that Chainlink was not only the ”most traded” token, but was also “on the top most used smart contracts” among the 1000 biggest ETH wallets.

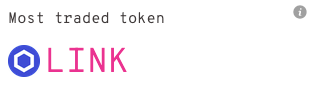

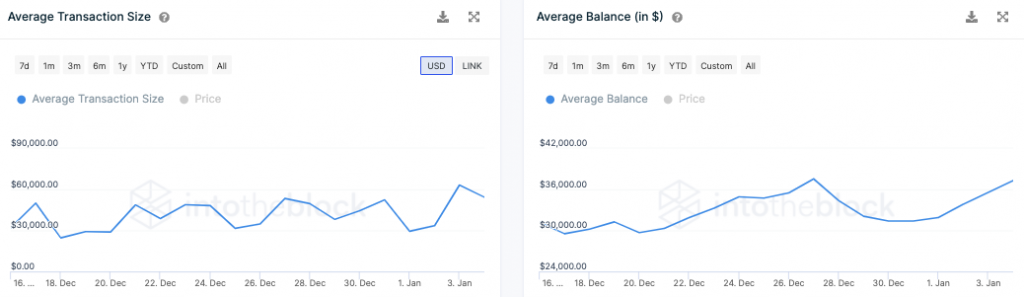

Consequentially, the average transaction size and average HODLer balance have shot up. In fact, both the metrics were seen hovering around their weekly highs at the time of writing.

LINK’s ‘aligned stars’

Chainlink’s price movement over the past few days has been quite sizzling and has, by and large, been characterized by long green candles. When compared to 1 January’s $19 lows, LINK was trading around $26 at press time.

Thus, it wouldn’t be wrong to assert that the increasing returns created a ripple effect and invited whales to mass-purchase these tokens.

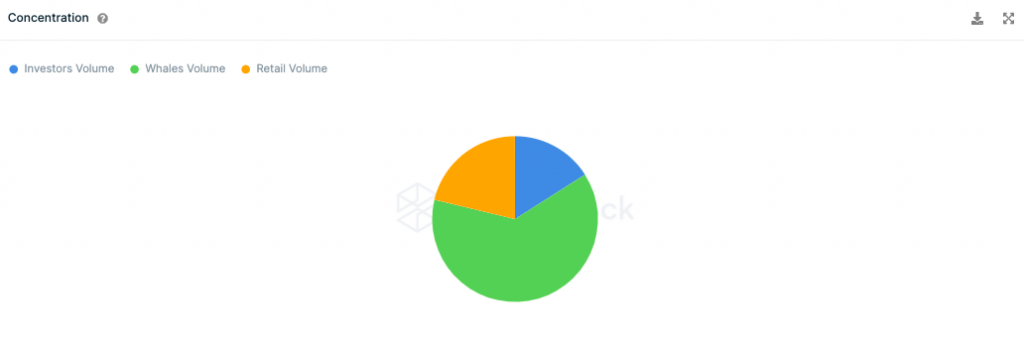

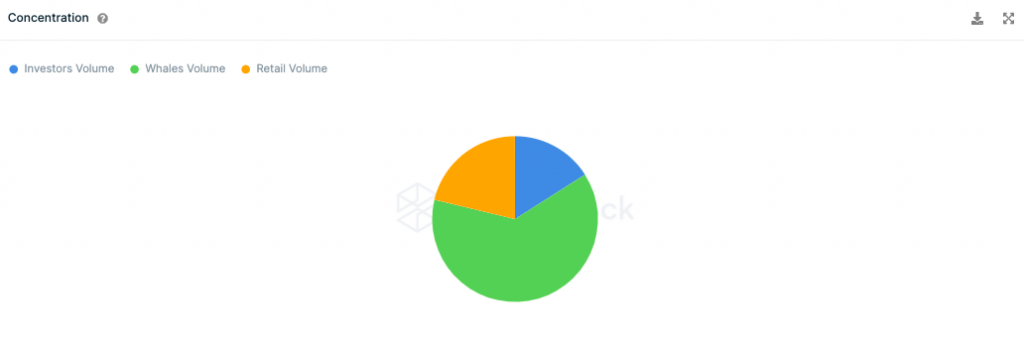

Additionally, LINK’s distribution stats has always been engrossing. It is a known fact that more than two-thirds of its supply is held by whales.

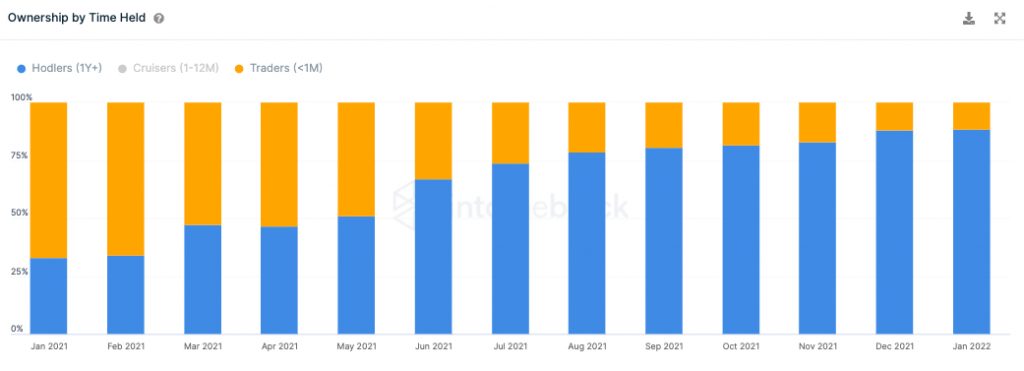

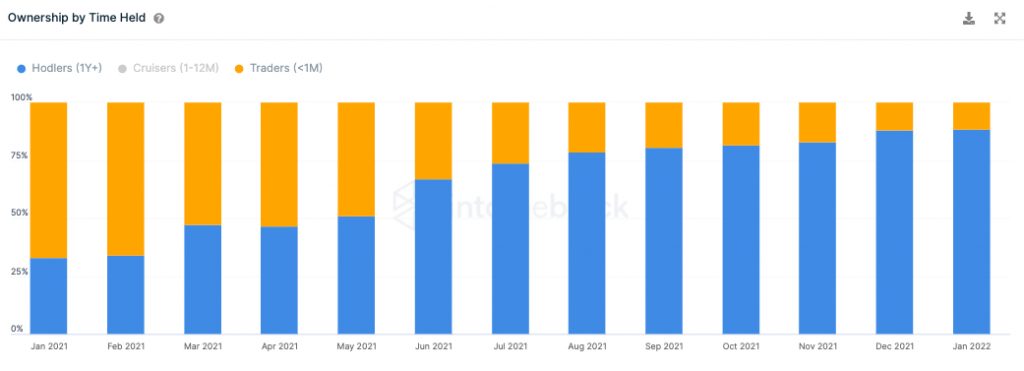

But, these whales are not swing traders. They are legitimate HODLers and have stood by the token through thick and thin.

As can be seen from the snapshot attached below, the number of traders has gradually shrunken, while the number of HODLers has already started dominating. This indicates the organic transition of market participants from being traders to becoming to HODLers. On any given day, this is a good sign.

So, with the on-chain environment looking satisfactory at the moment, market participants can expect Chainlink to continue inching higher on its price charts and creating local highs.