Bitcoin [BTC] has been making an entry into several industries. The world’s largest cryptocurrency is proving to be much more than a store of value asset. Earlier this week, Fidelity Investment decided to introduce BTC into its 401(k) accounts as part of retirement plans. As expected government officials have decided to contest the investment firm’s latest move.

The acting assistant secretary of the Employee Benefits Security Administration, Ali Khawar revealed that the agency was worried about Fidelity’s inclination towards Bitcoin. Speaking to The Wall Street Journal he said, “We have grave concerns with what Fidelity has done.”

Bitcoin witnessed massive growth post-pandemic. An array of mainstream platforms veered into the industry and embraced cryptocurrencies. Therefore, Khawar believes that the fervor around the market pushed Fidelity to onboard Bitcoin. This further pushed the department in expressing concerns about the same.

Why are government agencies still hesitant about embracing Bitcoin?

While Khawar believes that cryptocurrencies entail “intriguing use cases,” it still has a lot of growing up or “maturing” to do. This was particularly relevant concerning a retirement savings account, he added.

Bitcoin and other cryptocurrencies have proved to be a prominent medium of income for many. An array of millennials have quit their stable jobs to focus on crypto trading alone. While exchanges have eased the process of crypto trading several have been making massive profits through this. Similarly, it has been aligning as a prominent savings medium as well.

Right after Fidelity, SkyBridge Capital also decided to offer a similar retirement plan. But Khawar suggested that retirement savings were a significant need during old age, therefore the requirement of a stable market was highlighted. Khawar further said,

“For the average American, the need for retirement savings in their old age is significant. We are not talking about millionaires and billionaires that have a ton of other assets to draw down.”

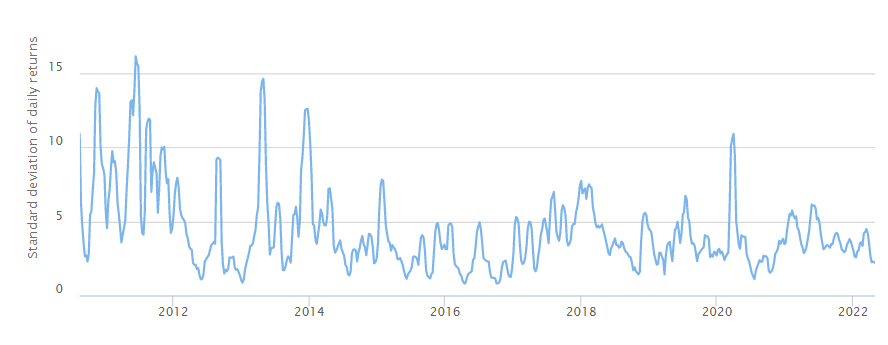

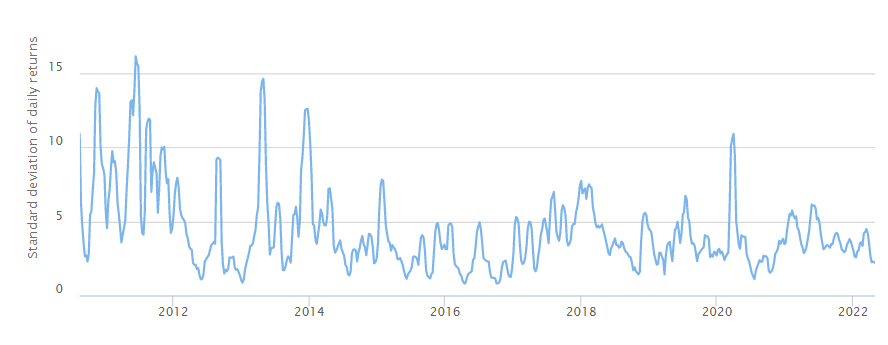

Additionally, volatility has been a serious concern to many. Officials quite often pick on the volatile nature of the crypto market. But data shows that Bitcoin’s volatility has significantly decreased over the last couple of years.

Currently, the 3-day volatility estimate of Bitcoin stands at a low of 2.19 percent.

While Fidelity is sure about its latest integration, the community is awaiting the consequences of the firm’s meeting with the US Labor Department.