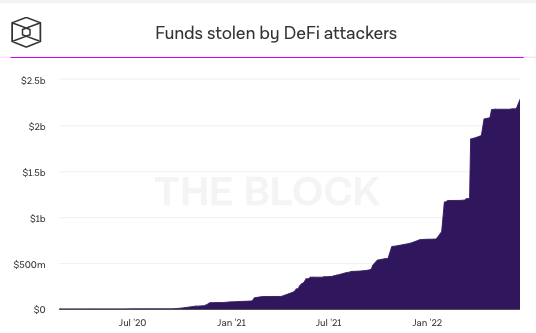

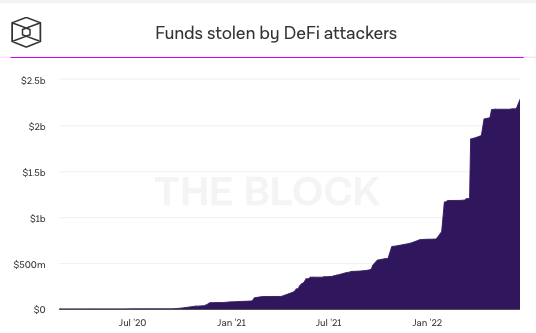

The crypto space has remained prone to attacks since its inception. However, with time, the number of hacks has only been escalating. As far as this year is concerned, DeFi compromises have occupied the center stage. Since January, the funds stolen by such perpetrators have seen a steep incline.

Per data from The Block, the ecosystem has lost more than $2.2 billion owing to DeFi hacks so far. The number has ballooned up nearly 3 times when compared to January’s $759.7 million. The same is depicted in the chart below.

The Solana ecosystem underwent an extensive multi-million hack a couple of days back. And the same continues to be the talk of the crypto town. Funds from users’ wallets were drained due to the inadvertent transmission of private key information. Recent revelations brought to light that the Solana protocol or its cryptography was not essentially compromised. Instead, the whole incident has allegedly been tied to Slope Wallets.

Read More – Solana hack: No Network Breach but Slope Wallets compromised

Tax implications for Solana hack victims

In most cases, hackers do not return back stolen funds. And essentially, users end up bearing the consequences for it. However, for users affected by the latest hack, looks like there’s some kind of relief that can be redeemed.

Sydney-based tax consulting platform Crypto Tax Calculator recently conveyed via a Twitter thread that crypto lost via hacks or exploits could likely be declared as a loss for tax purposes. Different jurisdictions, however, have different rules.

As far as Australia is concerned, the ATO has a clear set of guidelines w.r.t. lost or stolen cryptocurrency. And if any of the guidelines are met, users will be able to claim those losses as capital losses and offset them against capital gains made. The thread noted,

“In Australia, the ATO has a list of guidelines that need to be met for a crypto asset to be considered ‘stolen’ or ‘hacked’, which if met may be able to be claimed as a capital loss.”

In the US, however, stolen or hacked crypto is not usually claimed as a capital loss. The firm encouraged hack victims to talk to local tax professionals to discuss their options. Elaborating on the why aspect in their blog post, Crypto Tax Calculator noted,

“In the US, capital losses previously fell into two categories: casualty losses and theft losses. After the IRS tax reform in 2017, only a casualty loss that is a direct result of a federally declared disaster can be tax-deductible.”

Similarly, in the UK, the HM Revenue and Customs [HMRC] doesn’t recognize a loss of crypto as a disposal event. This means that it isn’t subject to Capital Gains Tax and cannot be claimed as a capital loss. Alongside, the HMRC also doesn’t recognize theft of crypto to be a disposal event, even if that cannot be claimed as a capital loss. However, revealing an option that was worth giving a shot, the consulting firm’s blog post read,

“The only way to successfully claim any lost, stolen, or hacked crypto against your capital gains would be to file for a Negligible Value Claim with the HMRC.”