The US dollar’s strength after the Fed’s hold presents a mixed picture as markets are still trying to accommodate the central bank’s latest policy decision. The USD is struggling to gain any real momentum following Wednesday’s announcement that kept interest rates steady at 4.25%-4.50%, with projections for about 50 basis points of cuts still expected for 2025.

Also Read: Pi Network Rallies 3%: PI On Target For New All-Time High

How Fed’s Hold Affects US Dollar Strength and Market Outlook in 2025

Fed Chairman Powell had this to say during the post-meeting press conference:

We are not going to be in any hurry to move on rate cuts. (…) If the economy remains strong, we can maintain policy restraint for longer.

The rather cautious Fed stance has resulted in the US Dollar Index moving sideways around 103.50, showing pretty limited directional conviction at the time of writing.

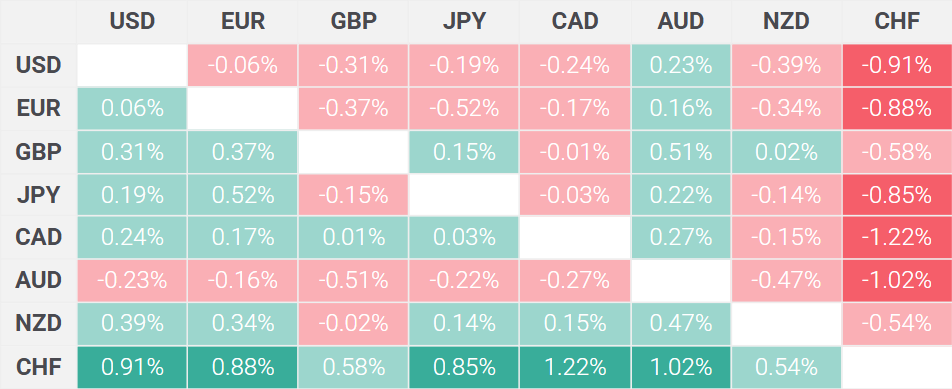

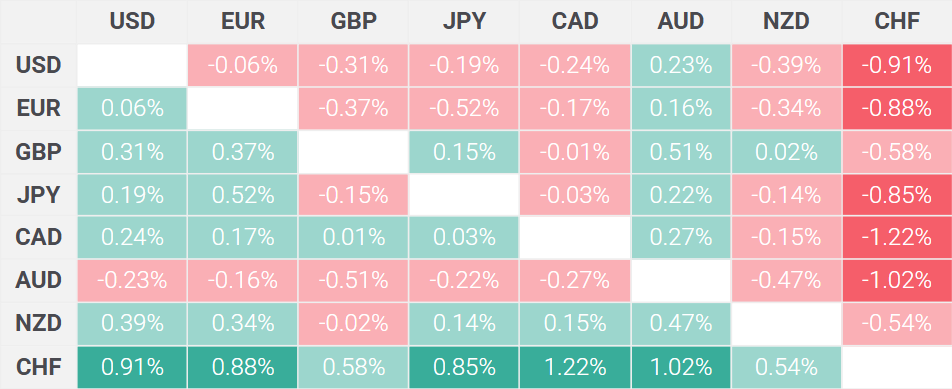

Dollar Performance Against Major Currencies

The weekly data reveals that the US dollar’s strength after the Fed’s hold has definitely weakened against several currencies, most notably losing around 0.91% against the Swiss Franc, about 0.39% against the New Zealand Dollar, and also 0.31% against the British Pound. Its only notable gain was approximately 0.23% against the Australian Dollar.

Central Bank Decisions Driving Currency Movements

Currency traders are now focusing on the Bank of England’s decision and vote split for any possible clues about future monetary policy direction. The GBP/USD is currently trading below 1.3000 while the UK unemployment rate continues to hold steady at 4.4%.

At the same time, the Swiss National Bank is widely expected to cut its policy rate to 0.25%, yet USD/CHF has somehow found support above 0.8750. These various central bank decisions really do significantly influence US dollar strength after Fed’s hold in the current market environment.

Also Read: Beating The Dollar: Here’s How Much Gold Russia Has Stored Till Now

Economic Data Influences Market Direction

The US dollar forecast for the rest of 2025 will heavily depend on the upcoming economic indicators. Today’s US economic calendar features Initial Jobless Claims and also Existing Homes figures, which may provide some new insights into overall economic health.

The Fed’s revised GDP growth forecast shows an adjustment from 2.1% down to 1.7%, which reflects more cautious economic projections that will likely impact dollar performance in the coming months.

Gold Reaches Record Highs

Gold touched a new record high above $3,050 on Thursday, reflecting ongoing uncertainty about the dollar’s trajectory. This kind of inverse relationship between gold and the US dollar continues to be an important key indicator for forex markets.

Also Read: Cardano Prediction: AI Sets ADA Price For March 25, 2025

The US dollar forecast for 2025 remains pretty complex as the Fed tries to balance inflation concerns against growth considerations. Analysts are continuing to monitor economic data for any signals about future dollar strength and central bank policy adjustments.