Bitcoin’s price has remained stagnated at around $42k over the past few days. On the daily window, the king-coin has registered a mere 0.2% uptick, while on the weekly window, the coin has shed only 0.3% of its value.

Despite the inert state of the market’s king-coin, the global crypto market cap has lost up to 7% of its value in just the past 24-hours. So, if Bitcoin did not cause this time’s market tumble, which set of tokens did – memes, DeFi, or meta/gaming?

Top tokens from the first category have had a pretty decent week. Dogecoin, for instance, has declined by only 3% and 5% respectively in the daily and weekly window. On the other hand, Shiba Inu has inclined by similar numbers in said timeframes.

As far as DeFi tokens are concerned, Uniswap, PancakeSwap, and Compound have managed to keep their losses capped under 3% and 10% in the 24-hour and 7 day period.

So, have meta-tokens dragged the market down?

Well, looks so.

The correlation between coins from this space has notched up with time. On most instances in the recent past, they’ve either rallied/plunged together or have followed the uptrend/downtrend path one behind the other, in succession. Well, something similar has happened this time too.

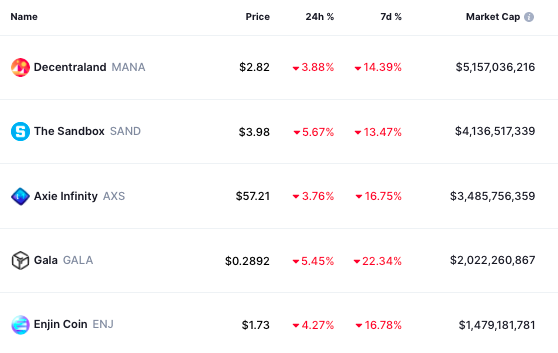

As can be noted from the snapshot attached below, the losses of the top 5 meta-tokens have been higher when compared to tokens from other categories.

SAND investors were the biggest daily losers, while GALA managed to perform the worst amongst the top 5 meta/gaming tokens in the past week.

Would the meta-token losses extend?

Likely not. At press time, the meta token market was starting to see buy-side momentum building up.

Consider this – Except on the 10-minute window, the number of SAND tokens bought had exceeded the number sold substantially. In fact, most other tokens too depicted green numbers.

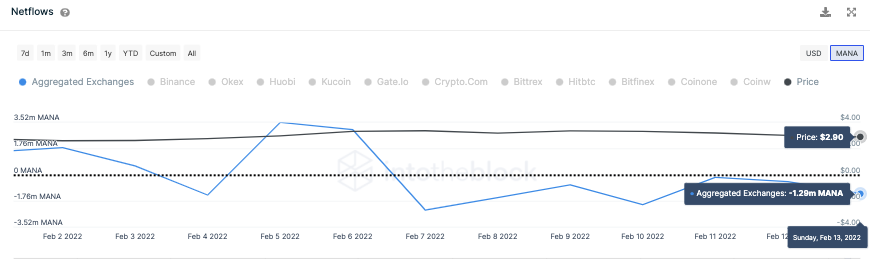

The presence of the buy-bias was further confirmed by the exchange net flows. This metric, for most top meta coins, has been negative of late, implying that market participants have been taking advantage of the dip and buying tokens at a discount.

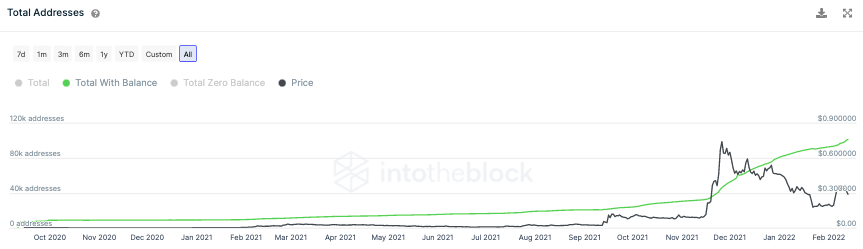

As far as MANA is concerned, the same can be evidenced from the chart attached below.

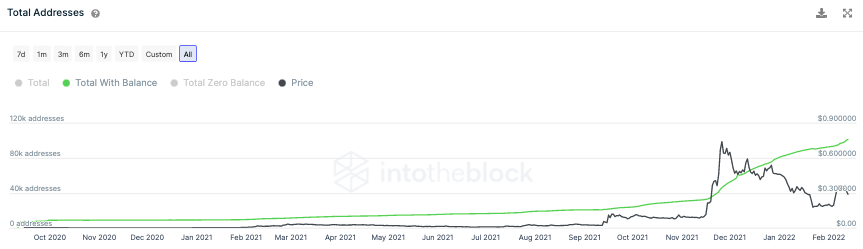

Apart from the buying momentum picking up pace, the network activity of these tokens has been getting sharper. The cumulative GALA addresses with balance, for instance, have continued abiding with their uptrend, despite the bearish price movements.

What history says

Over the past few months, one trend has become quite concrete – the rise of volatility in the meta market. This trend started taking shape in the third quarter last year when Axie Infinity’s native AXS token rallied by close to 1100% in a period of three months from August to November. For context, Bitcoin and Ethereum appreciated by merely 60%-80% each in the said period.

The meta-baton was then handed over to other tokens like SAND, MANA, and GALA who managed to post striking returns in even shorter timeframes. From the end of October to the end of November period, SAND climbed up by 950% on the charts, while MANA inclined north of 700% in the same time period.

GALA, on the other hand, typically took a fortnight to appreciate by 930% in November.

With the volatility on the rise, these meta tokens have evidently been susceptible to more fierce pumps and dumps when compared to other large and mid-cap coins from the market. Although top tokens from the meta category have shed a fair amount of their respective values in the 7 February to 14 February valentine’s week, they collectively do make a case to rebound in a similar fashion in the short-term, thanks to the momentum starting to swing in their favor.