In the latter half of March, Ethereum climbed up on the charts from around $2500 to $3600. Post that, however, it started shedding value and descending on the charts. From the said local peak, Ethereum is already down by close to 20%.

Like BTC, even ETH has been trading below its crucial averages for quite some time. After beginning Friday on a pessimistic note, the king-alt was valued at $2.88k, down by 1.8% in the day’s trade.

Ethereum trading below $3k is not a good sign

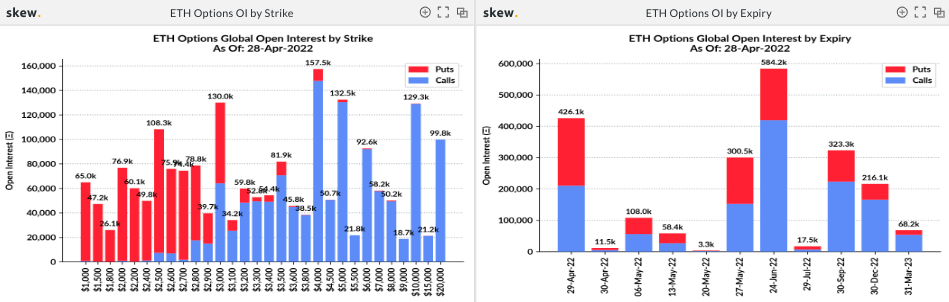

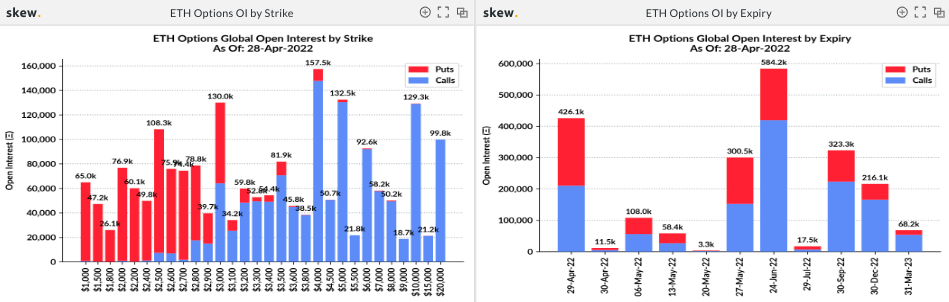

Today is the last Friday of the month and the Ethereum market is set to undergo a substantial options expiry involving 426.1k Ether. The snapshot attached below [right] shows that the number of calls and put contracts are more or less equal.

Per the strike price chart [left], puts are dominating lower prices upto $2.9k. At $3k exactly, the number of calls exceeds the number of puts, while post that rage, call contracts have an upper hand.

So what does this mean? If Ethereum continues to hover below $3k, traders would be triggered to exercise their option of selling their respective coins at the time of expiry. From thereon, if the selling pressure balloons up even more, then not much would be able to stop Ethereum from extending its correction phase.

The odds of a trend flip

Well, the volatility in the Ethereum market has been dipping for, both, the micro and the macro frame. At press time, the same was at par with the levels noted in June 2020. So, with the absence of volatility, expecting Ethereum’s price to fling to $3k in the span of merely a few hours doesn’t seem to be very feasible.