By faring exceptionally well on almost all fronts, Cardano has been in a pretty good position of late. As highlighted in an article yesterday, it has been buried under ‘great’ moments.

Despite the broader market having some blood on its floor on Wednesday, Cardano’s weekly gains remained intact. After surging by more than 23% in the said timeframe, ADA was seen trading at $1.2 at the time of press.

What are whales upto?

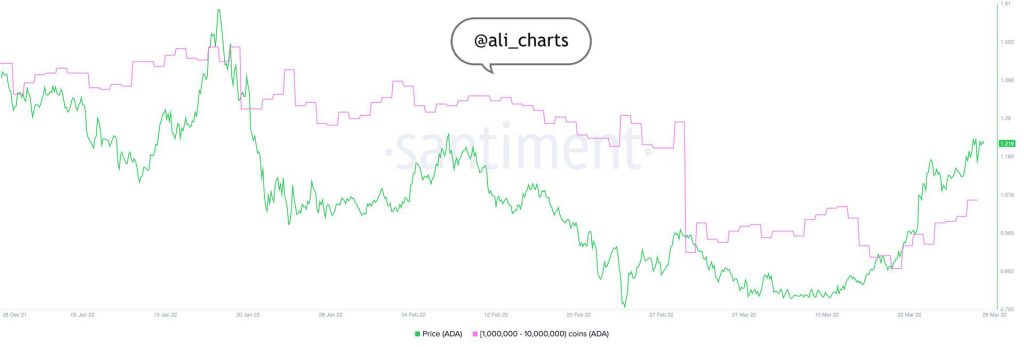

Since the past week, Cardano whales have been backing the price rise. According to data from Santiment, the number of whales on the Cardano network has increased by 1.7%.

Approximately 42 addresses holding 1,000,000 to 10,000,000 ADA tokens have been created since 21 March. A bird’s eye view would suggest that the uptick is insignificant, but it shouldn’t be forgotten that these whales HODL between $1.2 million and $12 million in ADA.

HODL your horses

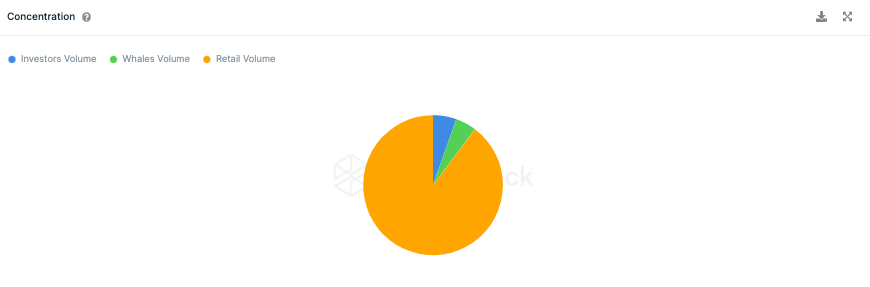

On any given day, whales accumulating tokens is a positive sign for the price. But, before getting too excited about the same, let’s peek into the ownership dynamics of Cardano.

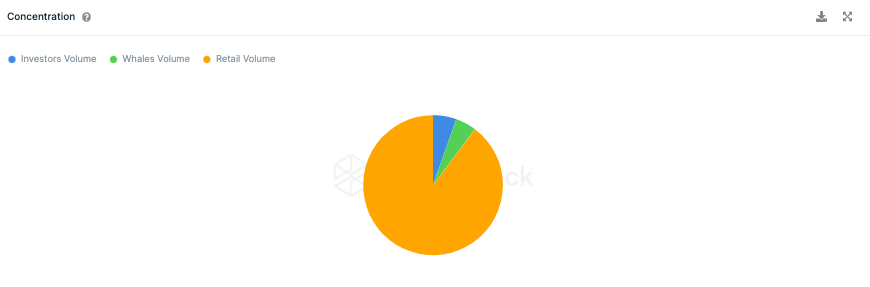

As per ITB’s data, retail participants HODL close to 90% of the token’s circulating supply, while the remaining 10% is shared almost equally [approx. 5% each] by whales and investors.

So, keeping in mind their negligible footprint in the market, their actions would not be able to dictate Cardano’s price much over the long term. Retail players too would have to step up alongside to aid ADA’s uptrend persists.