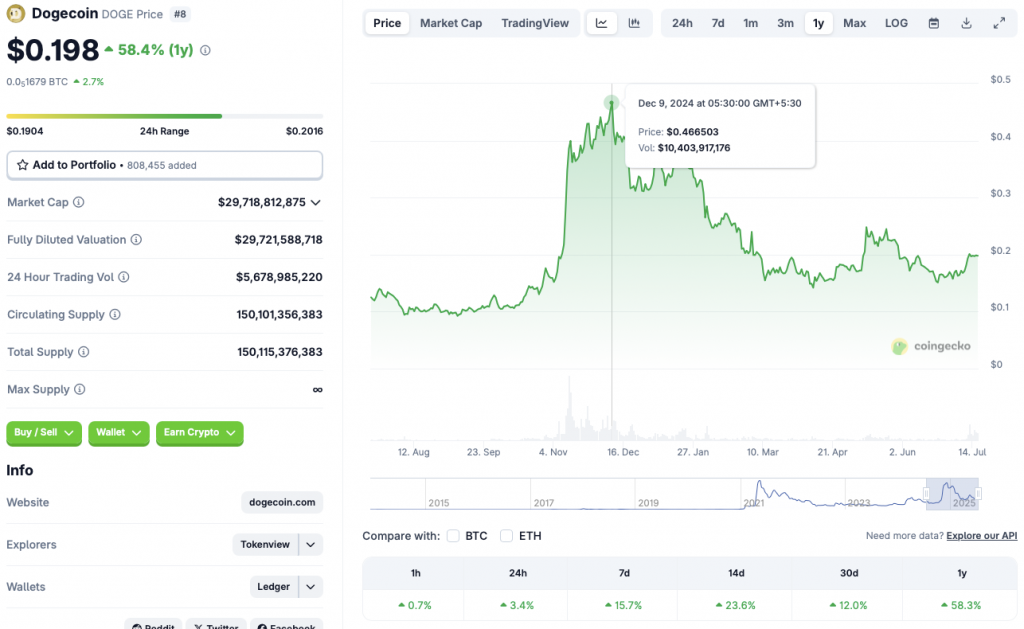

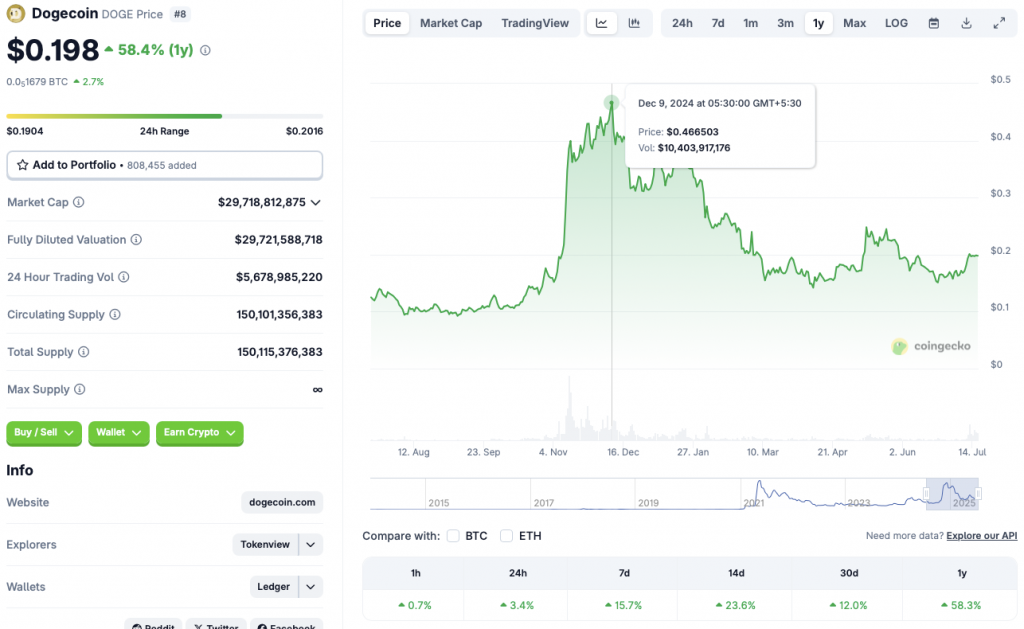

Dogecoin (DOGE) has experienced a massive rebound over the last week. The original memecoin is up 3.4% in the daily charts, 15.7% in the weekly charts, 23.6% in the 14-day charts, 12% over the previous month, and 58.3% since July 2024, as CoinGecko reveals. While the rally is commendable, DOGE’s price is still down by nearly 73% from its all-time high of $0.7316. Many investors continue to hold the memecoin at a loss. Let’s discuss what you should know before selling.

Also Read: Dogecoin Faces 7% Correction: Should You Buy The Dip Or Wait?

What Dogecoin Holders Should Know

Historically, DOGE and Bitcoin (BTC) have shared a strong correlation. This means that BTC’s price movements often dictate DOGE’s rally. This pattern is evident from the latest upswing as well. Bitcoin (BTC) hit a new all-time high of $122,838 on July 14. BTC’s rally triggered a rally for DOGE as well. We could see DOGE follow BTC’s trajectory for the rest of this cycle as well.

Dogecoin (DOGE) also has a spot ETF application awaiting approval at the SEC. An ETF approval will likely lead to a surge in institutional inflows for the memecoin. Such a scenario could lead to DOGE hitting a new all-time high. BTC’s record price movements followed the SEC’s approval of 11 spot ETFs in 2024.

This cycle has likely seen more institutional inflows than retail participation. A spot ETF approval could lead to DOGE seeing the necessary inflows to reclaim its peak price levels.

The lack of retail investors this cycle could be due to the Federal Reserve’s decision not to lower interest rates. President Trump has repeatedly asked Fed Chair Jerome Powell to cut interest rates as soon as possible. A rate cut could lead to a resurgence of retail players. Such a development could lead to DOGE experiencing a continued rally.

Also Read: 2025 vs. 2030: How Far Can $1K in Dogecoin (DOGE) Really Go?

Despite the bullish possibilities, it is uncertain if Dogecoin (DOGE) will reclaim its all-time high of $0.7316 anytime soon.