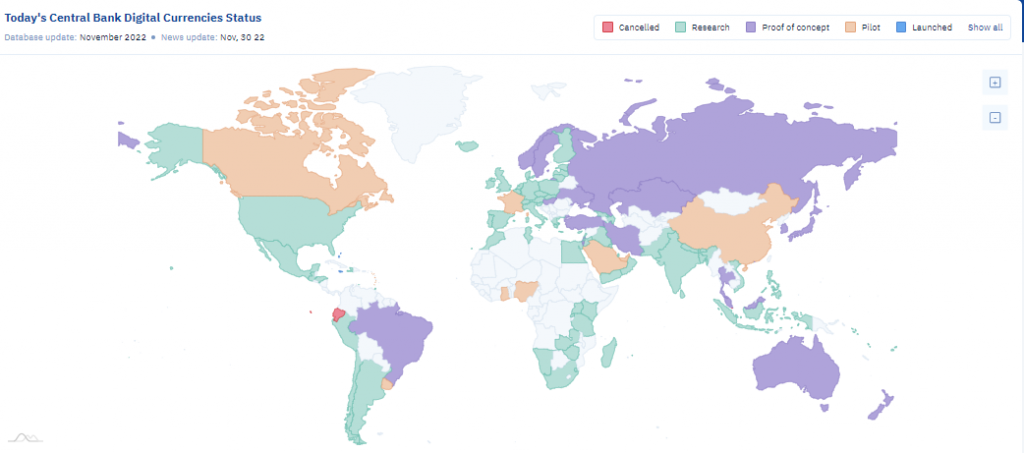

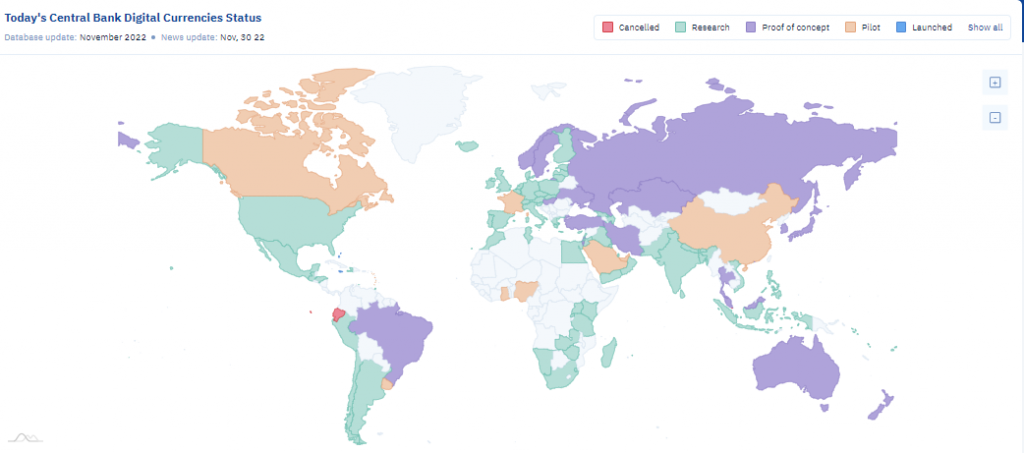

Of late, nations across the world have been testing the Central Bank Digital Currency [CBDC] waters in full spree. In May 2020, only 35 countries were considering a CBDC. However, by mid of this year, 105 countries—representing over 95% of the global GDP—were exploring a digital money backed by the central banks. In fact, among the G20 countries, 19 were reportedly analyzing a CBDC.

The visual illustration depicting the status as of November 30, 2022, has been attached below. Notably, most countries are currently either in the Research, Proof of Concept, or Pilot Testing stage.

CBDCs: A Threat To Cryptos?

CBDCs, on their part, are quite essential for financial inclusion. A recent Central Bank of Bahamas research paper from Q3 2022 affirmed that there was a “positive correlation” between a CBDC and financial inclusion.

With the digital inclination swiftly rising, people around the world have been reducing their dependence on cash. In such a scenario, having e-versions of currencies would likely turn out to be handy. Parallelly, the minimal volatility factor will also play a key role in helping foster adoption.

Nevertheless, there are concerns that crypto’s “mode of payment” could be threatened going forward. Elucidating on the same via a textual commentary to Watcher Guru, Anastasia Kor—the CMO and Board Member of crypto firm Choise.com—said,

“For authoritarian governments like that of China, the advent of CBDC can be the demise of cryptocurrencies, but in most cases, experts are proposing a future where crypto and CBDCs can co-exist.”

She opined that “many users” will prefer the “confidence and freedom” that comes along with the decentralized nature of privately issued digital currencies over the centralized nature of central back-backed e-currencies.

In fact, prominent Indian Blockchain Expert Pushpendra Singh also stressed the centralized and decentralized aspects. While talking to Watcher Guru, he said that he did not think CBDCs posed any threat, as such, to the crypto ecosystem.

Are All The Birds Flocking Together?

The Bahamas, as such, is considered to be a global leader in CBDC development, following the launch of its CBDC—Sand Dollar—in October 2020. In fact, it was the first country in the region to launch a central bank-backed digital currency.

This summer, Jamaica became the latest country to launch a CBDC—the JAM-DEX. Parallelly, the Bank of Jamaica (BoJ) also went on to legalize the Central Bank Digital Currency, making it akin to cash.

With its first CBDC trial series launched in April 2020, China is also fairly ahead in the race. As of January 2022, a reported 261 million users had set up digital wallets for the e-CNY, with more than $13 billion worth of transactions executed. The country also rolled out the digital currency for visiting foreign athletes during the Beijing 2022 Winter Olympics.

Testing the real-life use cases and the usage of CBDCs for settlements has also been going on at a swift pace. France and its neighboring country—Luxembourg—recently participated in a trial in the tokenized financial markets. The two nations used an experimental CBDC to settle a bond worth 100 million Euros [$104 million]. The General Director of the French central bank affirmed that a well-designed CBDC could play a “critical role” in the development of a safe tokenized financial asset space in Europe.

The Bank of Japan, on its part, is planning to launch its Digital Yen CBDC pilot in early 2023. As such, the central bank’s plan is to experiment with the digital pilot for two years and discuss whether to move forward with the issuance in 2026.

Parallelly, Singapore has collaborated with French and Swiss Central banks for its CBDC Project. As reported recently, the MAS has embarked on its journey to explore the prospects of CBDC for cross-border transactions. The country’s national bank went on to label the said project Ubin+.

Also Read: India’s Central Bank to Start Retail CBDC Pilot on December 1

State of Affairs in India

India is one of the latest countries to join the trial and testing bandwagon. In fact, the said Asian country just launched the first pilot for its retail digital Rupee (ex-R) on December 1.

Evidently, a host of other prominent countries are way ahead in the CBDC race. Opining on whether or not India was at a positional disadvantage, Kor told Watcher Guru,

“This CBDC trial by the Reserve Bank of India is right on time as the development team has learned from other central banks from around the world that have conducted their own trials.”

In fact, Singh was also on the same page and opined that India could strategically learn from the pros and cons of the models and designs of other countries.

Singh further highlighted that the Unified Payments Interface or UPI was “very popular” in India. He opined that going forward, CBDCs could eclipse the said payment mode. However, Singh went on to warn that adoption would take time. Elaborating on the same, he said,

“A CBDC could fundamentally change the structure of the Indian financial system. CBDC can replace UPI and reduce transaction cost, but adoption will take time.“

Commenting on similar lines, Kon added,

“The Reserve Bank of India has always been thoughtful and undoubtedly, the future—as will be visible in how the Digital Rupee uplift the local economy—will justify the reasons why the trials were delayed up to this point.“

Selected merchants, as such, have already started offering customers to pay for their goods and services via the CBDC. In fact, in a recent interview with the Economic Times, the owner of the shop shortlisted for testing the CBDC opined that funds would remain “safe” in the digital wallet because of the Reserve Bank of India’s involvement.

Footnote

Keeping the progress made so far in mind, the ongoing research and pilot testing phases being conducted by different countries around the world would likely be followed by back-to-back launches going forward. Countries currently in the pre-launch stage can look back and take inspiration from the torch-bearers. Nevertheless, only time can ascertain whether all the different kinds of monetary variants will be able to thrive together or not.