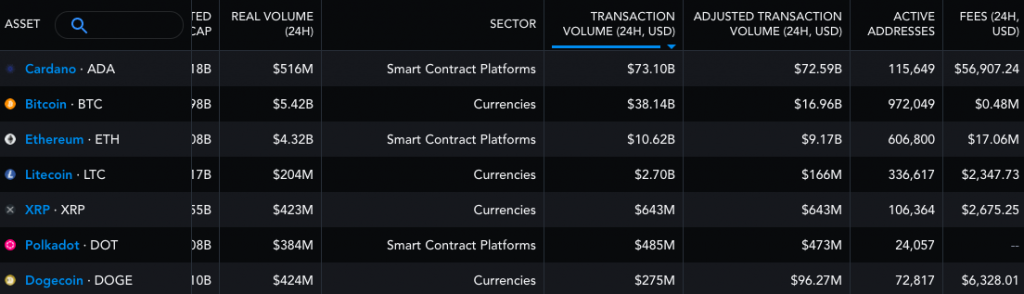

Dogecoin’s on-chain performance has been pretty decent of late. In the list of the most active blockchains, Dogecoin currently ranks 7, only below the likes of Cardano, Bitcoin, Ethereum, Litecoin, XRP, and Polkadot.

Over the past 24-hours, the on-chain transaction volume reflected many $275 million, for which it had earned a fee of $6.32k. Interestingly, the active addresses on Dogecoin flashed a cumulative figure of 72.8k, while for Polkadot, the same stood at merely 24k.

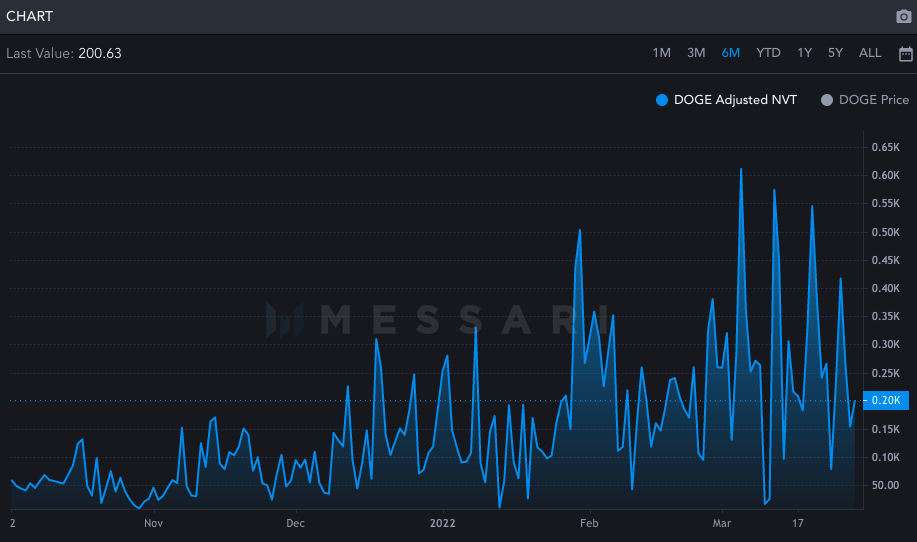

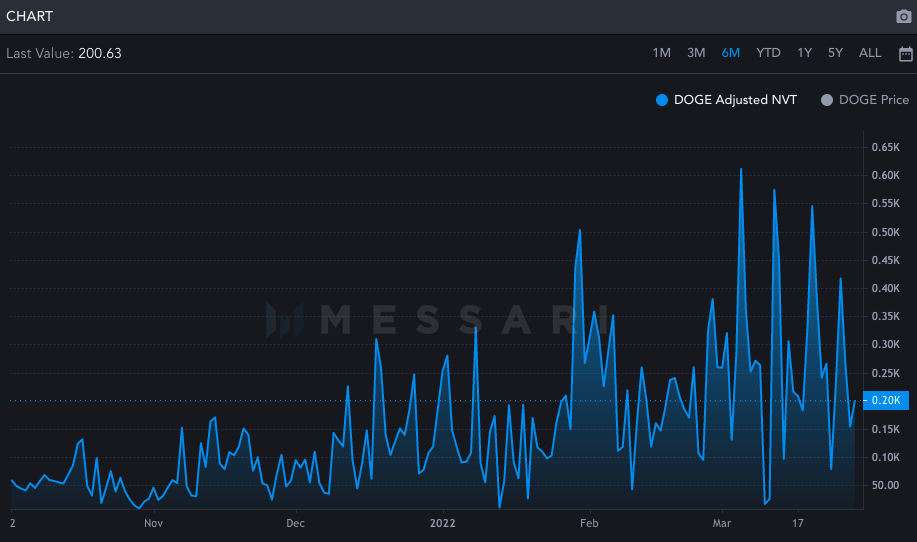

Dogecoin’s Network Value to Transaction [NVT] ratio has witnessed an incline in the macro frame. When compared to November’s 8.8 lows, the NVT went on to peak at 611 at the beginning of March.

However, it does have some short-term catching up to do. At press time, this metric was hovering midway, around 200. More often than not, Dogecoin’s price has peaked in and around the period when this metric has peaked.

Simply put, a rising NVT usually implies that the network value is being able to outpace the value being transferred on the network and this usually happens either during price bubbles or legitimate growth phases.

Dogecoin’s price front

Since May last year, DOGE has been registering lower highs and lower lows. As a result, it had been engulfed within a falling wedge on its weekly chart. However, right before the lines could converge, Dogecoin’s price broke above the upper trendline.

In fact, throughout last week Dogecoin exchanged hands above the same, confirming the bullish breakout, giving more weightage to the legitimate growth narrative than the price bubble one.

From the first swing high to the first swing low, the crypto asset’s price noted a 63.74% decline. Thus, per the technical thesis, Dogecoin’s price signed up for a hike of a similar magnitude post-breaking out. Theoretically, a 63.74% ascent from the breakout point would see DOGE knock the doors off $0.19379700.

However, the state of Dogecoin hasn’t been that great of late. It has declined by 3% over the past day, bringing its press time value to $0.144. As a result, the latest weekly candle had already flipped to red.

The RSI reading on the weekly chart remained to be under the neutral line, indicating that neither bulls nor bears were able to single-handedly dominate the market. Thus, the next couple of days would be quite crucial for bulls to seize the market, make their presence felt, and aid Dogecoin inch to $0.2.