Even amidst the presence of giants like Google Chrome, Safari, and Mozilla Firefox, Brave has been able to carve a separate niche for itself in the web browser space. Its user base continues to expand as millions of people keep using Brave on a daily basis.

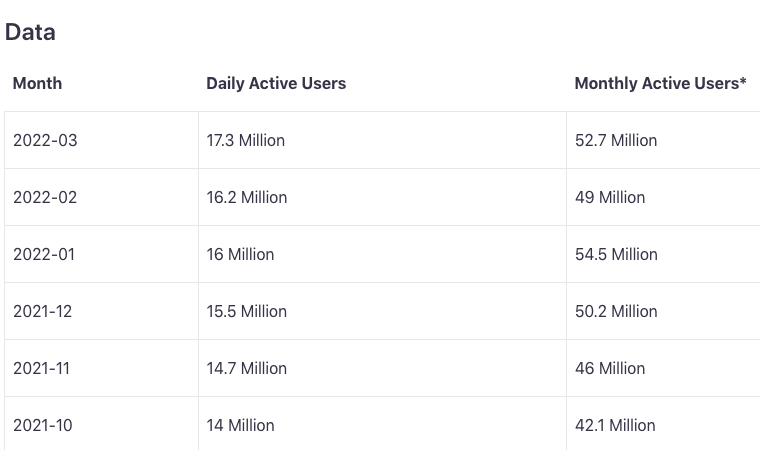

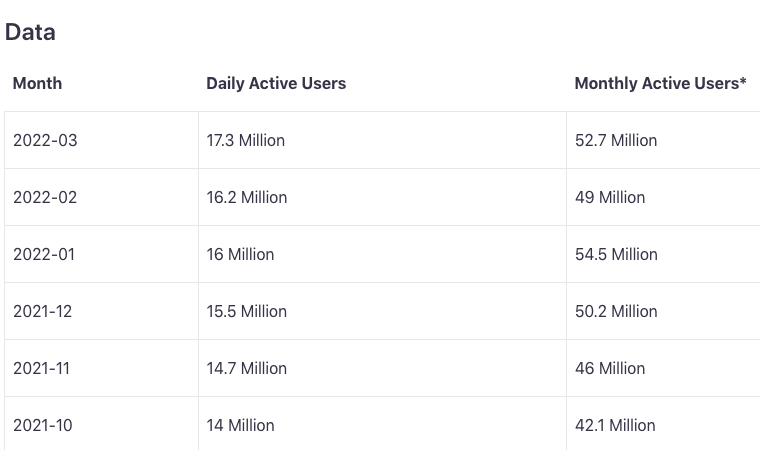

In fact, per the latest stats, the daily active users of this browser rose by more than a million in the month of March. As can be observed from the table attached below, the rise by such a magnitude has been noted for the first time in months.

The monthly numbers, on the other hand, had deteriorated in February but managed to soon rebound. In fact, it stood at a modest 52.7 million by the end of March.

Interestingly, BAT, the native token associated with the Brave ecosystem, broke above its monotonous downtrend in the month of March and registered a 36% uptick on its charts as of 3 April.

Over the last two days, however, the state of things has not been in favor of the token, with the price of the asset revisiting the $0.8 range after being at the brink of $1 during the weekend.

Will profit booking entice BAT HODLers?

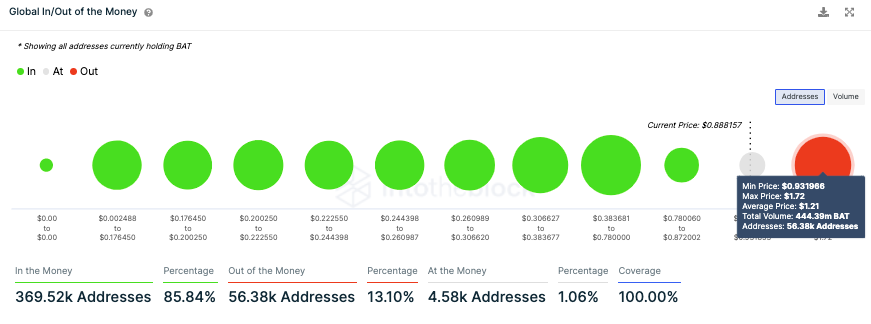

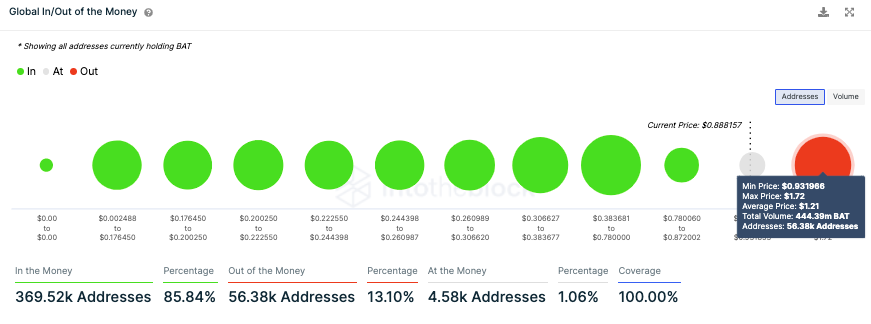

At this stage, it is quite crucial to note that close to 86% of BAT HODLers are “in the money” or in profit. Now, not considering other factors, simply remaining in profit usually triggers HODLers to realize the gains. At the end of the day, what good does only paper profit do?

However, ITB’s data brought to light that the number of profitable addresses has been >90% since the beginning of this year. This means, over the past quarter, all the weak hands have been filtered out and only hardcore HODLers, along with the ones in loss, continue to remain in the market. The same also points out that BAT does have slightly more room to glide up in the days to come.

Nonetheless, it should be borne in mind that the only major resistance zone for BAT extends from $0.931 to $1.72. Over here, 56.38k addresses have purchased around 444.4 million BAT.

Thus, when the price approaches the said range the next round of litmus test would begin, for participants who bought the token around its ATH in November would be in a profitable state after suffering losses for weeks.

Selling/profit-booking by participants belonging to the aforesaid cluster may definitely be on the cards and might hinder BAT’s bullish prospects over the short term, but once that’s done and dusted, the next bull cycle would likely materialize, provided the broader market fosters so.