Over the past month, Shiba Inu’s price has completed a parabolic recovery. From the highs of $0.00002817, SHIB went on to pay a visit to $0.00002139. From thereon, it gradually paved its way back up and created a local high of $0.00002904 in mid-March.

Over the past few days, nonetheless, the coin stepped into its consolidation mode, bringing down its weekly gains to merely 15%. On the daily front, the figures had already turned to red and reflected a negative value of 3.85% at the time of press.

Why did Shiba Inu apply brakes?

On 19 March, Shiba Inu shared a correlation of 0.24 with Bitcoin. Eleven days down the line and the same is already up to 0.82. This means that Shiba Inu’s price is more dependent on that of Bitcoin now than it was a fortnight back.

Bitcoin, for its part, has been quite inert and has been stuck around $47k since Tuesday. So, only when the king-coin heads up, Shiba Inu would be able to effortlessly carry on with its rally.

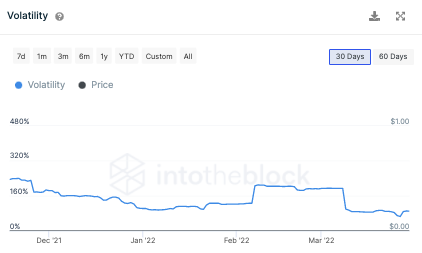

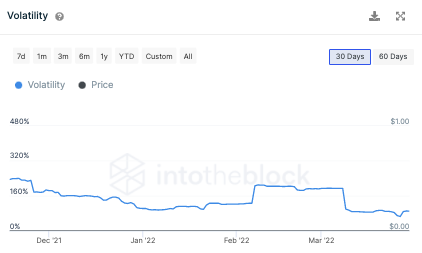

The evaporation of volatility from the Shiba Inu market has been another reason why the token’s performance has been lackluster. When compared to mid-March’s 193%, the volatility now merely stands at 89%, eliminating the odds of SHIB witnessing out-of-the-blue price swings.

Burning keeps SHIB’s tale wagging though

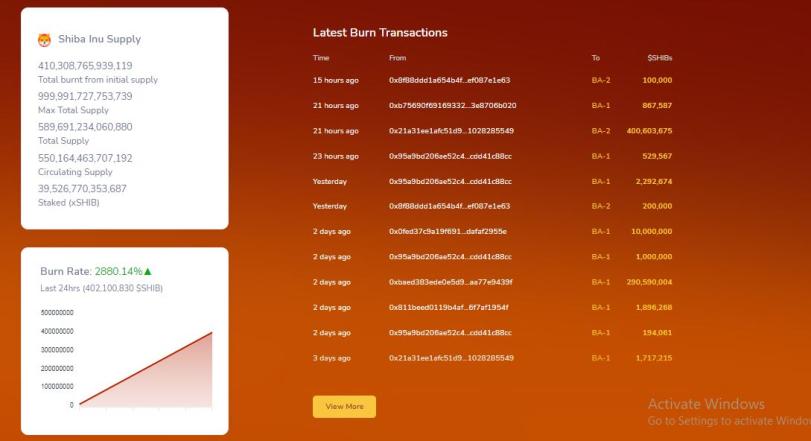

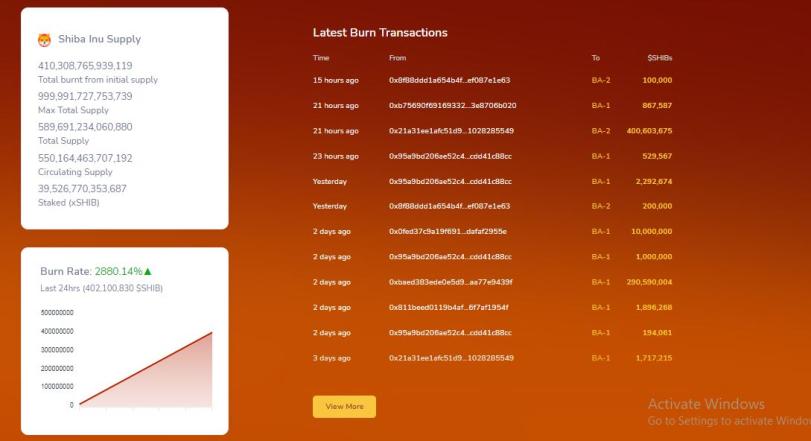

Over the past day, a total of 402 million SHIB tokens have been burned, bringing up the burn rate by over 2880%. Interestingly, the total number of burned tokens stands at 410.3 trillion at the moment.

The community has been indulgent in actively burning tokens to reduce Shiba Inu’s circulating supply, create a supply crunch, and elevate the price. Thus, if the same goes on in full fledge going forward, we may get to see SHIB’s price react positively.