XRP as America’s strategic asset has recently emerged as a compelling topic in the financial sector following a detailed proposal that was submitted to the SEC suggesting the cryptocurrency could serve as a strategic financial tool for the United States. The document, authored by financial advisor Maximilian Staudinger, has catalyzed discussions across various major cryptocurrency forums.

Also Read: Dogecoin Prediction: AI Sets DOGE Price For March 20, 2025

XRP as a Potential Reserve Currency Amid Regulatory and Adoption Challenges

The Staudinger Proposal on the SEC Website

The SEC recently published a document proposing XRP as America’s strategic asset. This generated considerable attention throughout the financial community and also crypto enthusiasts. The proposal outlines how integrating XRP into the U.S. banking system could unlock substantial capital currently tied up in global Nostro accounts.

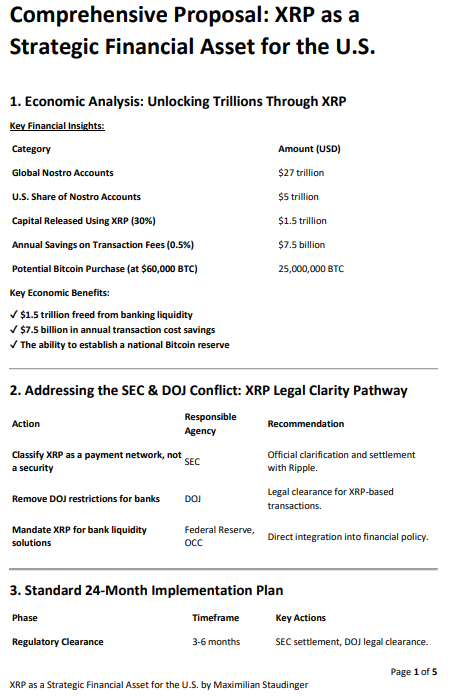

According to the detailed assessment provided in the document, an estimated $27 trillion is basically stored in such accounts worldwide. Approximately $5 trillion is held by the United States alone. Replacing traditional liquidity mechanisms with XRP technology should release around $1.5 trillion for economic flexibility and also strategic deployment in various sectors.

The Ripple XRP news has accelerated interest as the proposal claims that shifting financial transactions to XRP could generate approximately $7.5 billion in annual transaction savings through numerous significant efficiency improvements.

Also Read: Stellar’s 65% Price Surge: Is XLM the Next Crypto Goldmine?

Regulatory Changes Needed

To advance XRP adoption meaningfully, regulators must address several key hurdles as soon as possible. The proposal specifically urges the SEC to classify XRP as a payment asset rather than a security and to reach a comprehensive settlement in the ongoing Ripple SEC case update. Additionally, it calls for the Department of Justice to remove certain critical restrictions that are currently preventing financial institutions from utilizing XRP-based solutions at scale.

XRPL dUNL validator Vet stated:

While the proposal has gained attention after being published on the SEC’s website, it is important to clarify that this does not indicate any official SEC endorsement.

Questionable Elements in the Proposal

While the document highlights potential benefits of XRP adoption, it also includes some unrealistic suggestions. There is no wonder they’ve raised eyebrows among various major financial analysts and experts. One particularly problematic recommendation involves establishing a Bitcoin reserve by acquiring 25 million BTC. This is, at the time of writing, mathematically impossible given Bitcoin’s capped supply of 21 million coins.

The Ripple SEC case update continues to shape how regulators, investors, and financial institutions perceive and evaluate XRP as America’s strategic asset across multiple essential market segments. The proposal outlines both a standard two-year implementation timeline and an accelerated six to twelve-month plan requiring immediate regulatory approvals through executive orders, which is quite ambitious.

Presidential Connection

Interest in XRP reserve currency has actually intensified following President Donald Trump’s recent mention of XRP as part of a potential national crypto reserve strategy. This development has catalyzed various major market reactions across several key financial sectors. This development has, at the time of writing, also fueled robust discussions about cryptocurrency’s role in national finance and such economic policy frameworks.

The document proposes leveraging XRP for numerous significant government payment systems through multiple essential implementation pathways. This includes IRS tax refunds and also Social Security distributions, which would represent a transformative integration within federal financial infrastructure across various major operational domains.

Staudinger previously spearheaded advocacy initiatives for XRP reserve currency potential through several key public discussions with gold advocate Peter Schiff, such as strategic dialogues that engineered new perspectives. This followed President Trump’s statements about establishing a national crypto reserve, which have instituted a framework for numerous significant policy considerations.

The proposal, even if it appears on the SEC website right now, must not be interpreted as an official SEC position within multiple regulatory contexts. The SEC has actually implemented comprehensive mechanisms that enable individuals to submit public comments through various major participation channels. Regulatory transparency initiatives have catalyzed the online archiving of these submissions, transforming open governance protocols across several key institutional frameworks.

Also Read: Best 3 GARP Stocks with Over 50% Growth Potential in 2025